-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

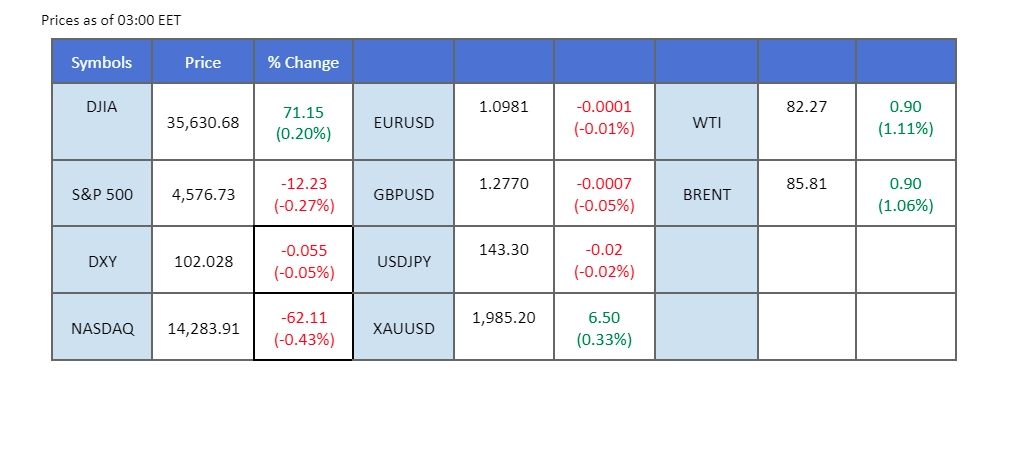

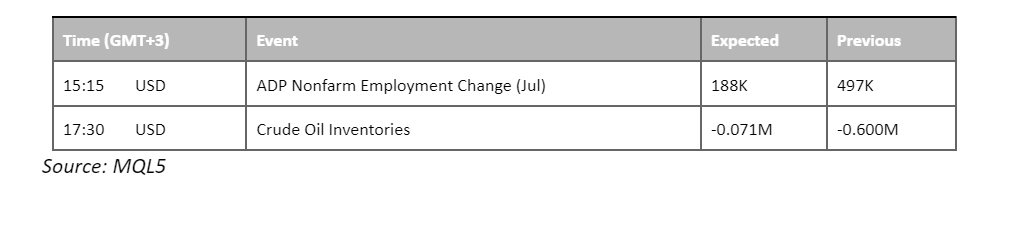

Fitch, the U.S. credit rating agency, has downgraded U.S. treasuries from their pristine AAA rating to AA+. The implications for the dollar remain to be seen, but the announcement immediately affected gold prices, which quickly surged by nearly 0.3%. In Asian markets, the rating cut caused a gap-down opening, and sentiment suggests that U.S. equity markets may follow suit later today. In a separate scenario, the Australian Dollar experienced a sharp decline as the Reserve Bank of Australia (RBA) once again paused its rate hikes this month. The decision was influenced by inflation data that revealed signs of easing in the country’s inflation. Elsewhere, prices continue to be bullish, buoyed by speculation that U.S. crude stockpiles will experience a significant drawdown.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar slumped amid pessimistic economic outlook. The US bond market experiences substantial turbulence after Fitch Ratings downgrades the nation’s credit from AAA to AA. This unprecedented shift, lasting since at least 1994, reflects concerns over expected fiscal deterioration, mounting government debt burden, and governance erosion. The downgrade amplifies volatilities and raises questions about its potential impact on bond yields and spread. Investors are advised to continue monitoring further US economic data for further trading signals.

The dollar index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the index might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 102.60, 103.45

Support level: 102.05, 101.45

The gold market experienced a rapid rebound as investors sought safe-haven assets amidst the heightened uncertainties after the US rating was downgraded. In a historic move, Fitch Ratings downgraded the US credit from AAA to AA, sparking substantial turbulence in the US bond market. The unprecedented shift, with concerns over fiscal deterioration, rising government debt burden, and governance erosion, amplified volatilities and raised questions about bond yields and spread.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 46, suggesting the commodity might extend its gains since the RSI rebounded from its oversold territory.

Resistance level: 1970.00, 1985.00

Support level: 1945.00, 1930.00

The U.S. dollar exhibited a powerful bullish trend against most of its currency counterparts. Surprisingly, even though the U.S. jobs opening data revealed a softer number than expected, the dollar only experienced a brief decline before swiftly recovering the lost ground. Meanwhile, notable credit rating agency Fitch has downgraded the U.S. treasuries rating. However, the impact of this development on the U.S. dollar is yet to unfold, and market participants eagerly anticipate the implications that may arise later in the day.

EUR/USD is trading in a bearish momentum but has successfully rebounded above its uptrend support line yesterday. However, the RSI continues to hover in the lower region while the MACD flows flat below the zero line suggesting the bearish momentum is intact with the pair.

Resistance level: 1.1092, 1.1150

Support level: 1.0927, 1.0845

The Australian Dollar faced a significant decline as the Reserve Bank of Australia (RBA) chose to maintain its interest rates at 4.10% during the August monetary policy meeting. RBA Governor Philip Lowe highlighted the need for additional time to assess the economic outlook, considering weak household consumption growth and the gradual return of inflation to the target range of 2-3% over the forecast horizon. While future monetary decisions will remain data-dependent, there is a possibility of tightening measures should inflation data unexpectedly spike. The market closely monitors these developments for further cues on the Australian Dollar’s trajectory.

The Aussie dollar is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 32, suggesting the pair might enter oversold territory.

Resistance level: 0.6725, 0.6815

Support level: 0.6600, 0.6545

The British Pound is displaying relative weakness compared to its currency peers as investors await the crucial interest rate decision by the Bank of England (BoE), scheduled for the upcoming Thursday. Market sentiment has shifted, leading to a downgrade in expectations for BoE’s future rate hikes from 50 bps to 25 bps. This expectation change is attributed to recent UK economic data, which indicates that the country’s economy is performing below expectations. The data suggests that the UK’s economic condition does not support an aggressive monetary policy stance by the BoE, as it could risk further undermining the already fragile economy.

Sterling is suppressed by its previous support level and current resistance level at 1.2780. The RSI showed the selling power is prevailing while the MACD moving flat below the zero line suggests the momentum with the Sterling is weak.

Resistance level: 1.2888, 1.3020

Support level: 1.2760, 1.2655

The Dow Jones Industrial Average experienced a volatile session, oscillating around a crucial resistance level, against the backdrop of impending crucial economic data. US stocks displayed a wavering trend as investors meticulously analysed mega-cap earnings reports, eagerly seeking insights into the Federal Reserve’s monetary outlook. Market sentiment remains uncertain, further exacerbated by Fitch’s downgrade of the US bond rating, potentially heightening borrowing costs for American corporations. Amidst these complex dynamics, market participants closely monitor data releases and the evolving economic landscape for vital trading cues.

The Dow is trading flat while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 69, suggesting the pair might enter overbought territory.

Resistance level: 35640.00, 36415.00

Support level: 34575.00, 33675.00

Oil market extends gains as recent data reveals OPEC’s crude production plummeted by the most in three years. Saudi Arabia’s deeper cutback contributed to the significant reduction in output, with the organisation’s average daily production dropping to 27.79 million barrels a day, the largest cut since the pandemic-induced supply slashes in 2020.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 73, suggesting the commodity might enter overbought territory.

Resistance level: 83.20, 86.10

Support level: 80.55, 77.30

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!