-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

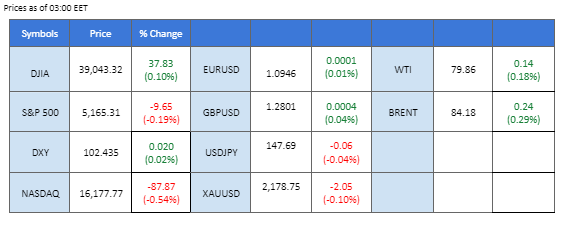

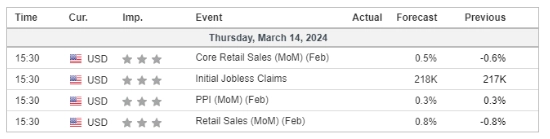

The Dollar Index retreated from resistance levels, as market participants applied profit-taking strategies ahead of crucial events. With attention shifting towards the pivotal Producer Price Index (PPI) and retail sales figures, investors seek insights into the economy’s trajectory and potential interest rate adjustments by the Federal Reserve. Meanwhile, US equity markets experienced a slight pullback driven by profit-taking activities, despite hovering near record highs. While the S&P 500 and NASDAQ Composite recorded marginal declines, the Dow Jones Industrial Average demonstrated resilience, buoyed by gains in industrial heavyweight 3M Company. Amidst prevailing market caution, gold prices rebounded from support levels, extending their bullish trajectory as investors sought refuge in safe-haven assets amidst lingering risk aversion. Crude oil prices surged higher on the back of better-than-expected inventory reports, with US Crude oil inventories declining more than anticipated according to Energy Information Administration (EIA) data.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar Index retreated from resistance levels as market participants absorbed higher-than-expected Consumer Price Inflation (CPI) data, prompting profit-taking strategies ahead of upcoming US economic releases. Attention now turns to pivotal Producer Price Index (PPI) and retail sales figures for insights into the economy’s trajectory and potential interest rate adjustments.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 40, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 103.05, 103.70

Support level:102.55, 102.10

Amidst prevailing market caution ahead of crucial US economic data releases, gold prices rebounded from support levels, extending their bullish trajectory. Lingering risk aversion prompted investors to seek refuge in safe-haven assets, contributing to heightened demand for gold.

Gold prices are trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the commodity might experience technical correction since the RSI entered overbought territory.

Resistance level: 2235.00, 2350.00

Support level:2150.00, 2080.00

Pound Sterling saw a modest rebound post UK GDP data release, which met market expectations. According to the Office for National Statistics, the UK economy returned to expansion in January, rising by 0.20% after contracting 0.10% in December, which aligned with the market expectations. Despite returning to growth in January, Pound Sterling remained relatively subdued amidst ongoing volatility. Market participants await additional catalysts before taking decisive positions.

GBP/USD is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 52, suggesting the pair might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 1.2865, 1.2940

Support level: 1.2770, 1.2710

EUR/USD experienced modest gains, supported by US Dollar depreciation. However, market sentiment remains mixed as investors weigh macroeconomic outlooks in the Eurozone and the United States. Anticipation builds ahead of potential borrowing cost adjustments by the European Central Bank (ECB) and the Federal Reserve (Fed) in June.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1.0960, 1.1095

Support level: 1.0865, 1.0765

AUD/USD edged higher as markets anticipated a potential Federal Reserve interest rate cut in June, despite sticky inflation data. Contrastingly, the Reserve Bank of Australia (RBA) hints at potential rate hikes amidst elevated inflammation levels, signalling divergent monetary policies between the two central banks.

AUD/USD is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 63, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 0.6645, 0.6680

Support level: 0.6585, 0.6535

Despite lingering near record highs, US equity markets experienced a slight pullback fueled by profit-taking activities following a robust rally driven by enthusiasm over artificial intelligence. The S&P 500 and NASDAQ Composite recorded marginal declines, while the Dow Jones Industrial Average maintained resilience, supported by gains in industrial heavyweight 3M Company.

The Dow is trading flat while currently testing the resistance level. MACD has illustrated increasing bullish momentum, whale RSI is at 57, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 39400.00, 40000.00

Support level: 37915.00, 36735.00

Crude oil prices climbed higher following better-than-expected inventory reports, with US Crude oil inventories declining more than anticipated according to Energy Information Administration (EIA) data. Investors await the International Energy Agency’s monthly report for further insights into supply and demand dynamics, following OPEC’s latest forecast.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 80.20, 84.10

Support level: 78.00, 75.95

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!