-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Enter the dynamic world of CFD trading, where market volatility can turn the tides in your favour. As traders scrutinise the constantly shifting landscape, an understanding of volatile currency pairs becomes essential. The key to unlocking financial growth and resilience dwells within the knowledge of how to trade volatile currency pairs effectively. This comprehensive guide dives into the mechanics of forex market volatility and approaches to leverage it through a dependable online forex trading platform. By grappling with the intricacies of these financial instruments, one can navigate online trading seas with precision, making volatility less intimidating and more rewarding.

* Grasp the fundamental concepts of volatile currency pairs and their role in forex trading.

* Learn to harness market volatility to amplify profits and execute strategic trades.

* Discover the features and benefits of prominent online forex trading platforms like PU Prime.

* Understand why trading volatile currency pairs can present enhanced profit potential.

* Embrace the intricacies of market volatility to strengthen trading methodology and risk management.

Understanding volatile markets is crucial for traders navigating the forex market. Volatile markets are characterized by swift price movements that can occur in very short time spans. Market volatility often reflects a high degree of investor anxiety, spurred by a variety of catalysts including economic indicators and geopolitical events. While these conditions can present risks, they also may create opportunities for substantial profits through astute trading strategies and solid risk management.

Factors such as interest rate changes, fiscal policies, and unpredictable occurrences reshape the landscape of the forex market. When high-impact news breaks, such as an election result or economic sanctions, the forex market often experiences heightened volatility. Professional traders monitor these indicators closely to adjust their trading strategies accordingly, often employing technical analysis tools to forecast market movements and identify potential entry and exit points.

Understanding how to read currency pairs is an essential skill for any trader engaging in the forex market. Grasping the significance of the base currency and quote currency is the first step. The base currency represents the first currency in the pair, indicating the currency being bought or sold, while the quote currency is the second one and shows how much of the quote currency is needed to purchase one unit of the base currency.

Understand More About Base And Quote Currency In Forex Trading

Start reading

When traders read currency pairs, they are essentially interpreting the exchange rate. This exchange rate fluctuates based on supply and demand in the market, economic data, and geopolitical events. It reflects the amount of the quote currency that one would exchange for one unit of the base currency.

For instance, if the EUR/USD pair is trading at 1.2000, it means that 1 euro (the base currency) is equivalent to 1.20 US dollars (the quote currency).

Analyzing currency pair charts is also a critical component. It involves scrutinizing past market behavior to forecast future price movements. Technical indicators, which can be as simple as moving averages or as complex as Fibonacci retracements, provide additional insights into market trends and potential reversal points. Below is an illustration of commonly traded currency pairs and their corresponding symbols:

| Currency Pair | Symbol |

| US Dollar / Euro | EUR/USD |

| Great British Pound / US Dollar | GBP/USD |

| US Dollar / Japanese Yen | USD/JPY |

| Australian Dollar / US Dollar | AUD/USD |

| US Dollar / Canadian Dollar | USD/CAD |

This table demonstrates a selection of currency pairs, which ambitious traders will regularly read, interpret, and analyze to make well-informed trading decisions within the vibrant forex market.

Identifying volatile currency pairs is crucial for traders seeking dynamic trading environments and opportunities for significant profit. The forex market is replete with a spectrum of currencies that display different levels of volatility, often categorized as major currency pairs and exotic currency pairs. When you aim to trade volatile currency pairs, understanding their behavior becomes critical.

Typically, major currency pairs such as EUR/USD, GBP/USD, and USD/JPY experience substantial movements due to the economic stature and the volume of trades executed involving these currencies. Conversely, exotic currency pairs, although less liquid, can exhibit even greater volatility. This can be attributed to economic factors specific to emerging markets, which when coupled with lower liquidity, result in sharper and more unpredictable price movements.

| Currency Pair | Average Range | Daily Liquidity |

| EUR/USD | 70-100 pips | High |

| GBP/USD | 100-120 pips | High |

| USD/JPY | 50-70 pips | High |

| USD/ZAR | 1000-1500 pips | Lower |

Many traders are keen to trade volatile currency pairs because they offer the potential to gain substantially in a short period. However, this comes with substantial risks. Economic factors play a key role in this volatility, with interest rate decisions, inflation reports, and political instability bearing considerable influence over currency movements. Furthermore, market sentiment is an essential driver of price fluctuations, particularly for exotic currency pairs.

Traders need to exercise caution and embrace comprehensive risk management strategies when engaging with the most volatile currency pairs. These pairs provide exciting trading opportunities but also pose significant risks that must be skillfully navigated for successful forex trading.

Embarking on forex trading can be a daunting experience for new traders. Recognizing the right currency pairs is crucial, which is why this guide focuses on beginner-friendly currency pairs. These pairs are known for their lower volatility, higher liquidity, and more predictable market movements, making them ideal for those just starting their forex trading journey.

For beginners, stepping into the forex market can be met with trepidations about volatility and complexities. Hence, trading beginner-friendly currency pairs becomes a practical starting point, introducing novices to the mechanics of forex without overwhelming them with excessive fluctuation and risk.

These currency pairs present a more stable introduction to forex trading for beginners due to their widespread popularity and substantial amount of market information available, which can be leveraged for informed decision-making. However, it’s still critical for new traders to understand the factors that can impact these pairs, including economic data releases, political events, and central bank decisions.

Starting with pairs like the EUR/USD and USD/JPY allows for a smoother educational curve in interpreting forex signals, engaging in technical analysis, and understanding economic fundamentals.

Despite their appeal for newcomers, it is also essential for beginners to recognize the potential drawbacks when they trade beginner-friendly currency pairs. While typically less volatile, these pairs can still be influenced by unexpected global financial events, leading to sudden market shifts. Moreover, higher liquidity may not always equate to profitable opportunities, particularly if the market is in a sideways trend.

To trade these currency pairs effectively, beginners should employ strategic planning and sound trade management. Beginning with a clear trading plan, setting realistic goals, and learning how to use stop-loss orders can help in mitigating risks. Additionally, traders should not overlook the importance of ongoing education and staying current on global economic trends.

Forex trading for beginners need not be an overwhelming experience. By starting with beginner-friendly currency pairs and approaching the market with patience, research, and a solid strategy, new traders can gradually build competency and confidence in their trading abilities.

When it comes to the forex market, volatility can be as much an opportunity as it is a challenge. For those adept at navigating these waters, the decision to trade volatile currency pairs using a CFD (contract for difference) trading account can be particularly rewarding. CFD trading is a method that allows individuals to speculate on currency pair price movements without the need for ownership of the underlying foreign currencies.

In CFD trading, leverage is a powerful tool that allows traders to gain a large exposure to a financial market while only tying up a relatively small amount of their capital. Essentially, trading on leverage means that you can put up a small amount of money to control a much larger position. This can amplify profits when the market moves in your favor, though it’s important to remember it can also amplify losses. To manage this, traders must be savvy with their risk management strategies and understand the importance of margin—the deposit required to maintain an open leveraged position.

Start CFD Trading With A Live Account

Create an account

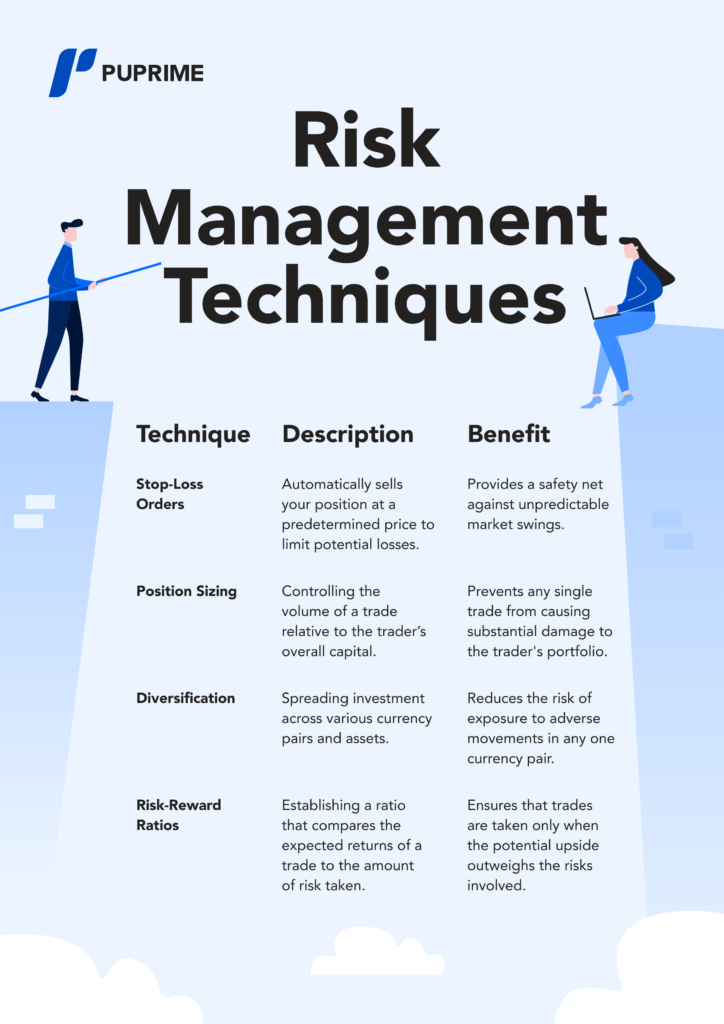

To trade volatile currency pairs successfully, employing robust risk management techniques is imperative. This involves setting appropriate stop-loss orders to protect capital, using position sizing to control risk, and always keeping an eye on margin requirements to avoid liquidation. Traders should have a clear understanding of the potential volatility and risks before entering the market and adjust their strategies accordingly.

Below, we’ll review some critical trading strategies that can be deployed to handle market volatility effectively:

The following table showcases common risk management techniques applied in volatile forex markets:

Embarking on CFD trading can be a thrilling venture, especially when dealing with volatile currency pairs. For those looking to enhance their trading skills and strategize effectively, a forex demo account is the perfect starting point. A demo account provides a risk-free trading environment, offering a hands-on experience without any actual financial risk.

Whether you are a novice or an established trader, using a demo account to practice trading is a powerful way to familiarize yourself with the nuances of the forex market. The simulation of real-market conditions will prepare traders for the realities of live trading, where proficiency could result in increased profits.

Here are some tips for maximizing your experience with a CFD demo account:

* Approach your demo account as if it were real capital; this instills disciplined trading habits.

* Experiment with different trading strategies to discover which works best for your trading style.

* Utilize the risk-free setting to understand and apply various risk management tools.

* Assess your emotional responses to wins and losses, as managing psychology is critical in trading.

Start CFD Trading With A Demo Account

Create a demo account

When delving into the dynamic realm of trading volatile currency pairs, securing the right CFD broker can make all the difference. A well-reputed online broker not only provides a robust trading platform but also supplements your trading journey with essential trading tools and dependable customer support. These elements are critical to navigating the complexities of market fluctuations with confidence and precision.

Choosing a reliable CFD broker entails a thorough evaluation of several facets including regulatory compliance, the sophistication of trading platforms, and the availability of educational resources. A reputable broker’s dedication to transparency and customer service is manifest in the ease with which traders can engage with its platform and the quality of support provided.

Trading with PU Prime, traders benefit from a comprehensive selection of financial assets, state-of-the-art trading tools, and detailed market analysis. PU Prime’s commitment to excellence is evident in their round-the-clock customer service, ensuring that every trader’s query and concern is addressed promptly. The nuances of each trading tool are tailored to optimize your trading strategies, whether you are a novice trader or a seasoned professional.

Learn Qualities Of The Best CFD Brokers

Find out more

To commence trading with PU Prime, here’s a step-by-step guide on setting up your forex trading account:

By meticulously following these steps and leveraging the tools and services provided by PU Prime, you position yourself to navigate the volatile waters of forex trading with an enhanced sense of control and potential for success.

Trading volatile currency pairs offers the potential for significant profits, but it also entails heightened risk and requires a strategic approach. By understanding the factors influencing currency pair volatility, employing appropriate trading strategies, implementing effective risk management techniques, and maintaining psychological discipline, traders can navigate high-octane forex markets with confidence and increase their chances of success.

Start CFD Trading With A Live Account

Create an account

Both forex trading and CFDs (contracts for difference) offer unique advantages and considerations. Forex trading involves buying and selling currencies on the foreign exchange market, while CFD trading allows investors to speculate on the price movements of various financial instruments without owning the underlying asset.

The potential profits from CFD trading vary depending on factors such as market conditions, trading strategy, risk management practices, and the trader’s skill and experience level. CFD trading offers the opportunity to profit from both rising and falling prices in various financial markets, including stocks, commodities, indices, and currencies.

CFD trading can be suitable for beginners who are willing to learn and understand the intricacies of financial markets, as well as the risks and complexities associated with leveraged trading. However, it is essential for beginners to approach CFD trading cautiously and take steps to educate themselves before engaging in live trading.

CFD trading can be challenging due to various factors, including market volatility, leverage amplification, complex pricing mechanisms, and psychological factors affecting trader behavior. Successful CFD trading requires discipline, patience, continuous learning, and the ability to adapt to changing market conditions. Traders should develop a robust trading plan, employ effective risk management strategies, and maintain emotional resilience to navigate the challenges of CFD trading successfully.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!