-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

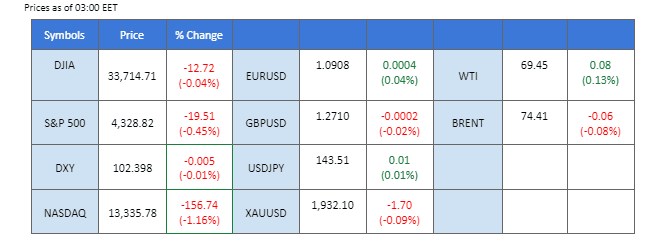

Stock markets were rattled as the events over the weekend in Russia heightened geopolitical uncertainty. In a late-night televised speech, the Russian president condemned the leaders of the Wagner mercenaries as traitors, further exacerbating the instability within the country. While concerns over supply disruption from Russia overshadowed the pessimistic outlook for oil demand, oil prices managed to stabilise. Simultaneously, gold prices saw a slight increase as investors sought a safe haven. On the other hand, the strength of the dollar persisted, and U.S. government bond yields stabilised as the market speculated on the possibility of an interest rate cut by the Federal Reserve later this year.

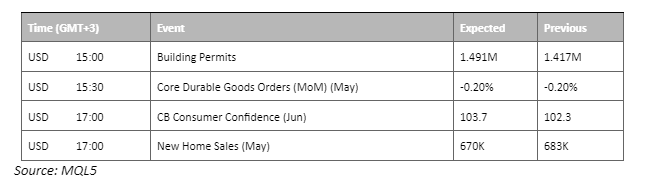

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (26%) VS 25 bps (74%)

Investors have adopted a wait-and-see approach in the US dollar markets, remaining cautious amidst the ongoing geopolitical uncertainties. The Dollar Index traded flat as market participants focused on upcoming US economic data, including indicators such as new orders for durable goods, GDP, and Personal Consumption. These data points are expected to provide further trading signals and potentially influence investor sentiment in the near term.

The dollar index is trading flat while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 54, suggesting the index might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 103.35, 103.90

Support level: 102.75, 102.00

Gold prices experienced a slight retreat as investors seized the opportunity to take profits after the commodity encountered a crucial resistance level. The gold market has been caught in a phase of consolidation, oscillating between support and resistance levels amid mixed market sentiment. On one hand, the escalating geopolitical tensions in Russia have bolstered demand for the safe-haven asset. However, the allure of the gold market has been dampened by the decisions of several major central banks to raise interest rates, which has diminished its appeal.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 44, suggesting the commodity might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 1930.00, 1955.00

Support level: 1895.00, 1865.00

Euro rebounded against the USD last night after it tumbled when investors rushed in for safe-haven assets due to Russia’s political uncertainty. However, the USD has eased in strength along with the US government bond yield following the unwinding bets that the Fed will cut interest rates this year. On the other hand, the inflation rate in the euro region is still high and the ECB is expected to remain hawkish in its monetary policy which will provide support to the euro.

The EUR/USD rebounded after it was hammered by the strong USD last Friday. The RSI has rebounded to near the 50-level while the MACD histogram is narrowed and provides a sign of trend reversal for the pair.

Resistance level: 1.0951, 1.1030

Support level: 1.0892, 1.0848

The yen’s significant slip can be attributed to the monetary policy divergence between the Bank of Japan (BoJ) and several major central banks. This depreciation poses a threat to consumers as it could lead to a spike in import costs. The widening gap between the BoJ’s policy stance and that of other central banks has weighed on the yen’s value, warranting investors’ attention and awareness of potential trading implications.

USD/JPY is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 71, suggesting the pair might enter overbought territory.

Resistance level: 145.25, 150.00

Support level: 141.55, 138.90

Pound Sterling is supported at the level around 1.2700 after it declined from its highest level since last April. The sterling has an anomalous price movement which declined after BoE delivered a bigger-than-expected rate hike last week. Worsening the situation, the Fed’s semi-annual monetary policy reports hinted the Fed has a high possibility of continuing its rate hike cycle next month, which will bolster the dollar’s strength. Investors may focus on the UK’s GDP data released on coming Friday (30th June) to gauge the price movement of the Sterling.

The cable is supported at Fibonacci 68.2% level and provides a trend reversal signal for the cable. The view is also supported by RSI, where it has to stop dropping and hover near the 50-level while MACD flows flat near the zero line.

Resistance level: 1.2775, 1.2840

Support level: 1.2700, 1.2630

The Dow faced additional headwinds due to the geopolitical issues in Russia, exacerbating existing concerns related to the Federal Reserve’s rate hike expectations. These uncertainties have dampened demand for equities, leading to a further decline in the high-risk US equity market. Market participants are closely monitoring the developments surrounding the geopolitical situation, as well as the probability of a July rate hike, which currently stands at 76.9%, according to CME’s FedWatch tool.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 34460.00, 35485.00

Support level: 33715.00, 32695.00

Speculation surrounding the political instability in Moscow has driven oil prices higher, as investors anticipate potential disruptions in oil supply. Despite this upward pressure, oil prices have struggled to break above the psychological level of $70. Pessimistic demand outlook, coupled with aggressive interest rate hikes by several central banks, has dampened expectations for economic growth, putting a cap on oil price gains.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 45, suggesting the commodity might extend its gains after successfully breakout above the resistance level as RSI rebounded sharply from oversold territory.

Resistance level: 70.00, 73.90

Support level: 67.25, 64.90

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!