-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

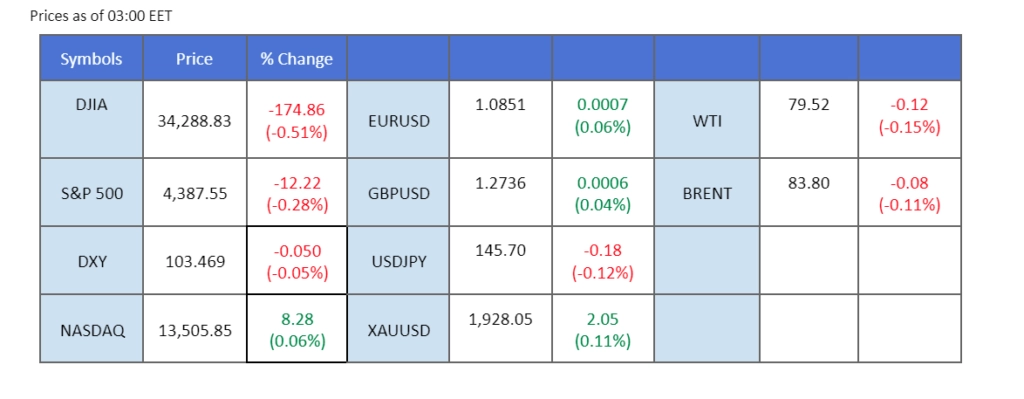

Investor enthusiasm for risk-taking experienced a swift decline following a day of technology-driven gains on Monday in the U.S. stock market. Investors are now eagerly awaiting Nvidia Corp’s results, hoping for a surge in excitement around artificial intelligence. As the Jackson Hole Economic Symposium approaches, the dollar is showing a slight increase in value. The prevailing sentiment in the markets appears to acknowledge the possibility that the Federal Reserve might maintain higher interest rates for an extended period. Concurrently, New Zealand pleasantly surprised observers with a Retail Sales reading that exceeded expectations, propelling the Kiwi currency to gain over 0.5% against the dollar.

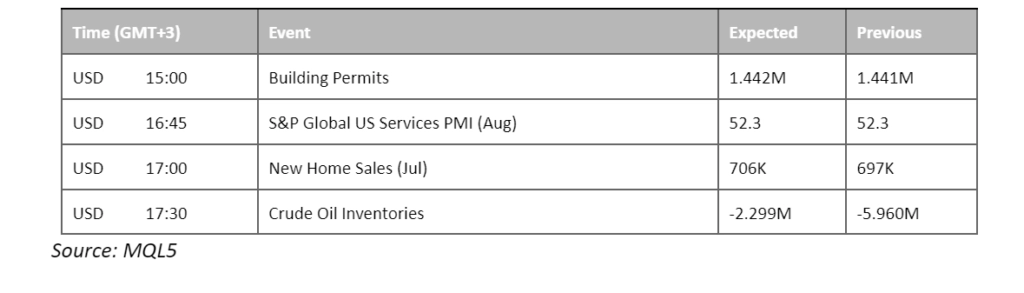

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US dollar maintains its subdued stance, hovering around the elevated levels reached last week, with investors keeping a close watch on the impending Jackson Hole Symposium. A surge in US Treasury yields to levels not seen in nearly 16 years underscores market expectations of an extended period of elevated US interest rates. As the symposium approaches, market participants are attuned to this event for potential trading cues.

The dollar index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 103.85, 104.30

Support level: 103.30, 102.55

Gold rekindles a marginal rebound amid the emergence of risk-off sentiment. The convergence of a less sanguine economic outlook and the recent downgrade of the US banking sector fosters a shift in sentiment toward the safe-haven allure of gold. Nevertheless, gold’s overarching trajectory remains intricate, ensnared by the interplay of investors speculating on the Federal Reserve’s potential aggressive rate hikes.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 1910.00, 1930.00

Support level: 1890.00, 1860.00

The euro displayed a decline in strength against the USD, struggling to maintain its psychological support level at 1.0900. Market sentiment leans towards the expectation that the Federal Reserve might prolong its elevated interest rates and potentially deliver assertive statements during the upcoming three-day Jackson Hole Economic Symposium. This sentiment has prompted the dollar to gain traction against other currencies. However, the investment community is currently anticipating the release of the eurozone’s Purchasing Managers’ Index (PMI) later today. This release is seen as a gauge of the euro’s resilience and potential strength.

The EUR/USD is testing its crucial support level at near 1.0850 level, a break below will serve as a strong bearish signal for the pair. The RSI continues to flow in the lower region while the MACD fails to break above the zero line suggesting the bearish momentum is intact with the pair.

Resistance level: 1.0924, 1.0990

Support level: 1.0848, 1.0760

The Sterling is demonstrating notable resilience against the recently fortified dollar. This is in the backdrop of the prevailing market sentiment that aligns with the expectation that the Federal Reserve will maintain higher interest rates over an extended period, contributing to a potent dollar. The British pound has displayed considerable strength against the US dollar in this context. Furthermore, the BoE is anticipated to uphold its policy of monetary tightening, driven by the persistently elevated inflation levels within the UK. Meanwhile, investors are eagerly anticipating the release of the UK’s PMI later today. A positive PMI reading from the UK might serve as a catalyst, potentially bolstering Sterling’s position and allowing it to trade higher against the US dollar.

The Sterling has broken above its downtrend resistance level, suggesting a bullish momentum is forming. Meanwhile, the RSI and the MACD are flowing flat, suggesting the momentum is not strong for the Cable.

Resistance level: 1.2780, 1.2870

Support level: 1.2640, 1.2550

The Kiwi experienced a modest upswing against the dollar, taking advantage of the recent relaxation of the dollar’s strength since yesterday. The Kiwi’s momentum was further propelled by a positive outcome in Retail Sales, resulting in a gain of nearly 0.5% throughout the past two trading sessions. However, investors are currently focused on the impending speech by Jerome Powell at the Jackson Hole Economic Symposium, scheduled for the upcoming Thursday. Should the Federal Reserve Chair deliver a hawkish statement, it has the potential to invigorate the dollar and apply pressure on the NZD/USD currency pair to overcome its robust resistance level that has been constraining its upward movement.

The pair is currently suppressed below the downtrend resistance level. Meanwhile, the RSI is moving toward the overbought zone while the MACD is about to cross above the zero line suggesting a trend reversal for the pair.

Resistance level: 0.5980, 0.6050

Support level: 0.5900, 0.5800

The Dow Jones experienced a modest retreat in recent sessions, compelled by the reverberations of credit rating downgrades. S&P Global’s decision to follow Moody’s in trimming credit ratings of select regional banks, particularly those heavily exposed to commercial real estate, further echoes the ongoing challenges stemming from the Chinese property crisis and the prevailing environment of rising rates. This downshift impacted prominent financial institutions, including JPMorgan Chase and Bank of America, as their shares both registered declines of nearly 2%.

Dow Jones is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 28, suggesting the index might enter oversold territory.

Resistance level: 35605.00, 36520.00

Support level: 34260.00, 33720.00

Antipodean currencies, notably AUD and NZD, staged a modest recovery after Chinese President Xi Jinping asserted the resilience of China’s economy. Addressing the BRICS group, Xi underscored the unwavering fundamentals of China’s long-term growth. This affirmation contributes to the uptick in Chinese-proxy currencies, highlighting their sensitivity to developments emanating from China’s economic landscape.

AUD/USD is trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the pair might continue to consolidate between a range between support and resistance since the RSI stays near the midline.

Resistance level: 0.6465, 0.6600

Support level: 0.6385, 0.6285

Oil prices experience a retracement as Iraqi and Turkish oil ministers announce discussions concerning the resumption of oil flows after pipeline maintenance finalisation. This development has the potential to bolster global oil supply dynamics. Prior to this, Turkey suspended Iraq’s exports via the northern Iraq-Turkey pipeline, representing around 0.50% of global supply, following an International Chamber of Commerce arbitration decision earlier this year.

Oil prices are trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the commodity might extend its losses after breakout below the support level since the RSI stays below the midline.

Resistance level: 83.25, 87.25

Support level: 79.00, 76.90

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!