-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

What is copy trading and how does it work?

Copy trading is a platform feature that mirrors another trader’s new positions in your account.

You select a trader, set an allocation, and the platform’s automation executes proportional trades on your behalf when that trader opens or closes a position.

You retain full control at all times, with the ability to pause copying, adjust allocation, or close individual positions.

The role of automation and passive participation

Automation handles order execution and sizing according to your settings.

This supports a more passive approach to market participation while still allowing you to apply safeguards such as equity stops, per-trade limits, and instrument filters where available.

Compliance note: With CFDs, you speculate on price movements and do not own the underlying assets. Trading with leverage can magnify gains and losses.

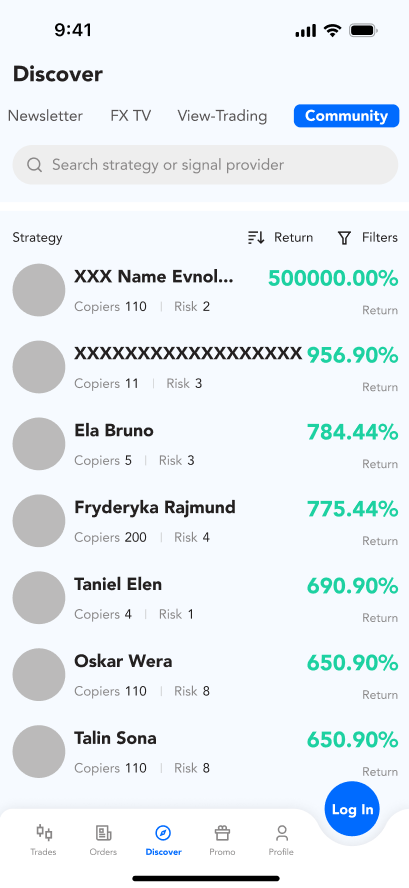

PU Prime provides a copy trading interface that lets you browse trader profiles, review performance data, set allocation, and apply risk controls within the platform’s ecosystem.

For a deeper primer on core concepts, see What Is Copy Trading: Complete Beginner’s Guide.

Step-by-step setup

Further Reading

How to Identify the Best Traders to Copy.

Evaluating a lead trader starts with objective metrics rather than headline returns.

The goal is to understand how results were produced, the risks taken, and whether the approach aligns with your tolerance for drawdowns and volatility.

In this context, a trading signal is the event generated when the lead trader opens, modifies, or closes a position.

The platform uses that signal to replicate the action in your account according to your allocation and settings.

Signals typically include instrument, direction, size parameters, and protective orders.

Depending on your configuration, copying applies to new trades only or can include open positions if you enable that option.

Further Reading

How to Copy Traders: Essential Metrics and Red Flags.

Costs shape long-term outcomes, so it is important to identify every line item before allocating capital.

For Example: If a copied strategy earns $120 in gross P&L in a week, and your combined spreads, commissions, swaps, and provider fees total $35, the indicative net would be $85 for that period.

Actual results vary with execution and market conditions.

Key reminders

Copy trading involves CFDs. You speculate on price movements and do not own the underlying assets. Fees and charges differ by account type, instrument, and region.

Always verify current terms in your account documents.

Further Reading

What Is Cost Per Order in Copy Trading.

Short answer: Profitability is possible, but never guaranteed. Results depend on market conditions, the trader you copy, your allocation and risk controls, and the total cost of trading.

Significant announcements can drive rapid price moves, wider spreads, and gaps. For example, a major Swiss National Bank decision can cause sudden volatility in CHF pairs.

In such moments, copy trading outcomes may diverge from a trader’s historical pattern due to faster price changes, increased slippage, and partial or missed fills.

Copy trading can be one component of a diversified approach alongside other strategies and asset classes.

Many users review the correlation between the traders they follow, spread allocation across multiple profiles, and periodically rebalance to keep risk aligned with personal tolerance.

Further Reading

Is Copy Trading Profitable? Weighing the Pros and Cons.

Automation handles execution, yet risk management remains essential.

Clear limits, diversified allocations, and routine reviews help keep outcomes aligned with your tolerance for loss and volatility.

Copy trading exposes your account to the decisions and execution of another trader.

Market swings, strategy changes, and liquidity conditions can all affect results, so guardrails are important even when copying experienced profiles.

For practical tactics, see [Copy Trading Risk Strategies: How to Protect Your Investment].

On platforms like PU Prime, common controls include:

You can copy multiple traders at the same time.

Spreading allocation across traders who focus on different instruments and styles can reduce reliance on a single approach.

Set allocation caps per trader, check for overlap in symbols, and rebalance on a schedule to keep concentration in check.

Some traders refer to guidelines like a “2% per trade” risk limit or tiered exposure, such as “3-5-7”, based on confidence.

Treat these as examples rather than prescriptive rules, and size allocations according to your own tolerance and account terms.

Further reading

Copy Trading Risk Strategies: How to Protect Your Investment

Advanced configuration can help you align copy trading outcomes with your goals.

The ideas below describe how experienced users set up, monitor, and refine their approach without promising results or recommending a specific method.

Build a diversified roster of traders

Allocate across traders who focus on different instruments and styles, and cap exposure per trader.

Periodically review overlap and correlation, then rebalance on a schedule so one approach does not dominate your risk.

See [How to Maximize Returns by Mirroring Trades] for a focused walkthrough.

Use platform risk tools proactively

Apply equity stops, per-trade size caps, and take-profit or stop-loss levels where supported.

These settings can limit single-trade impact and help manage variability over time.

Adapt allocations to market conditions

Some users adjust their allocation or pause copying during major events and periods of higher volatility.

Reviewing a trader’s history across different market backdrops can help you decide when to scale exposure or step back.

Choose the right copy scope

Decide whether to copy new trades only or include open trades when you begin copying.

Copying only new positions can reduce mismatch with the trader’s existing book, while including open trades attempts to align more closely with the trader’s current exposure.

Platform rules vary, so check how each option is implemented.

Apply measured risk scaling

Multipliers increase or decrease the size of mirrored orders relative to your equity.

If you use a multiplier, pair it with per-trade caps, margin buffers, and an equity stop so sizing remains within your tolerance.

Set a review cadence and rebalance plan

Create a calendar to check drawdown, payoff ratio, concentration, and costs.

Document your rationale for each trader and adjust allocation based on evidence rather than short-term swings.

Mirror trading vs. copy trading

These terms are often used together but refer to slightly different mechanisms.

Regulatory guidance describes mirror trading as implementing fixed strategies based on predefined preferences, while copy trading typically means allocating a proportion of your funds to execute the trades of a specific trader.

Platform features and controls can differ, so confirm how each is handled in your account.

Important reminder

CFD Copy Trading involves risk.

You speculate on price movements and do not own the underlying assets. Leverage can magnify losses as well as gains.

Further reading

How to Maximize Returns by Mirroring Trades

What is the difference?

| How social trading works | How copy trading works |

| View community posts, trade rationales, and strategy updates | Select a lead trader and set your allocation |

| Follow traders to monitor activity without mirroring orders | Platform automation mirrors that trader’s new orders in proportion to your settings |

| Learn by comparing approaches, metrics, and risk notes | Apply risk controls such as equity stop, per-trade caps, and instrument filters |

| Engage with educational content and platform analytics | Monitor results and adjust or pause copying at any time |

Choosing based on your goal

Platform note

On PU Prime, copy trading is accessed via [the PU Prime Trading App], while social features are available via PU Social.

For a side-by-side explainer, see Copy Trading vs Social Trading: Understanding the Differences.

Do I need trading experience to start copy trading?

No prior experience is required to enable copying.

It is important to understand core concepts like leverage, drawdown, and costs before allocating funds.

Is it possible to lose money with copy trading?

Yes. All trading involves market risk. Past performance does not guarantee future results, and leverage can magnify losses as well as gains.

CFD Copy trading means you speculate on price movements and do not own the underlying assets.

Can I use a demo account to test copy trading?

You can use a demo to practice platform navigation, order types, and risk concepts without real capital.

On PU Prime, the copy trading feature is not available on demo accounts. You can review trader profiles on demo, then enable copying on a live account when you are ready.

What are the most important metrics for choosing a trader?

Focus on a small set of evidence-based indicators:

How much control do I have over my account?

You retain full control. You can set allocation limits, apply equity stops, cap per-trade size, close individual positions, pause copying, or stop copying at any time.

When you stop copying, no new trades are mirrored; open copied positions remain until you close them or use any platform option provided to close on stop.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!