-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

PU Prime, a world-leading brokerage firm, is making big changes. In an effort to improve how customers manage risks and boost their trading opportunities, PU Prime has decided to set the highest leverage at 1:1000 and lower the stop-out level to 20%, starting from 17th June 2024. This helps traders better meet the new demands in leverage trading and margin rules, providing them with a safer platform for their trading adventures.

With a 1:1000 leverage ratio, traders can now do more with less investment. They can handle bigger deals and potentially earn more. However, it’s important to note that big leverage also means big risks. Careful risk management is crucial when using such high leverage.

To mitigate the dangers of high leverage, PU Prime has reduced the stop-out level to 20%. This means that if your account’s equity drops below 20% of the required margin, your positions will automatically close. This safety measure is designed to keep losses in check and encourage wise risk management, allowing traders to navigate the market with more peace of mind.

* PU Prime now allows for a 1:1000 leverage, opening up more trading chances.

* They’ve also set the stop-out level at 20% to make risk management better.

* These new settings help with leverage trading and how margins are handled.

* More leverage can mean higher earnings but also risks more loss.

* Being smart about risk is key when using high leverage.

Leverage trading lets traders control bigger deals with less money upfront. It can boost your profits, but it also makes losses bigger. This is why knowing how to handle risks is key. With leverage, traders can use their broker’s money to make even bigger wins or losses.

Understanding the leverage ratio helps grasp how leverage works. For example, if $1000 buys need a 10% margin, you get a leverage ratio of 10:1. This turns a $1000 investment into a $10,000 position.

For a $1000 trade, different leverage ratios give various exposures:

Margin requirements let traders handle bigger trades. For example, with $10,000 and a 50% margin, you can trade with $20,000. Leverage can boost profits, but it can also mean big losses if not managed well, especially by new traders. Risks in leveraged trading include emotional trading and big losses because your deals get bigger. It’s crucial to manage risks well. Trade at levels that feel comfortable and keep your risk per deal within 1%.

The stop-out level is key in risk management for brokers in leverage trading. It protects traders from big losses. When a trader’s open deals risk too much, the broker can close them to stop more loss.

PU Prime is making a significant change to their margin requirements, where the adjustment will tighten risk management for traders by lowering the stop-out level from 50% to a more aggressive 20%. This means that if the value of your account equity falls below 20% of the total position value, your broker will automatically begin selling off your positions to prevent further losses. Previously, this threshold was set at a more forgiving 50%, giving traders more breathing room before facing forced liquidation.

It’s important to keep your equity above the stop-out level. Try not to risk more than 15% of your deposit. Also, use tools like stop-loss to trade forex wisely, even with leverage.

Learn More About Leverage Ratio And Stop Out Levels

Find out more here

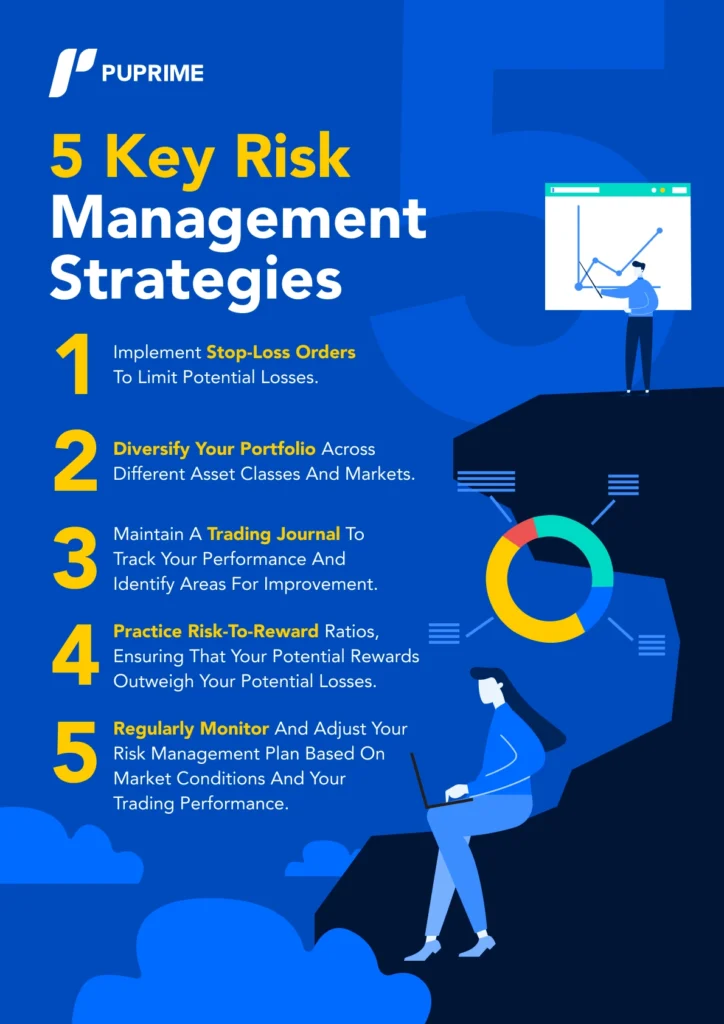

Risk management is key for trading success, especially with high leverage. A trader should set clear goals and know how much risk they can take. It’s important to use tools like stop-loss and take-profit orders to control losses. Also, diversifying, keeping a journal, and looking at risk-to-reward ratios are good strategies. Always check and adjust your risk plans. This way, traders can feel more secure, even with high leverage.

PU Prime offers a leverage of 1:1000 and stop-out level at 20%. This means traders can make big trades, but it also increases the risk. Remember, both gains and losses can be much larger with leverage trading. It’s important to be careful and stick to your plan to avoid big losses.

Choosing the right leverage ratio is crucial. It should fit your risk tolerance and trading strategy. Leverage ratios like 1:100 to 1:1000 can greatly change your trading risk. So, pick one that matches your goals and comfort level.

Understanding margin calls is also vital. Margin lets you trade with more money than you have. It can boost your profits, but also your losses. Being cautious with these tools is key to smart trading.

Sticking to these strategies helps traders feel more in control, even with high leverage. PU Prime advises using good risk management with leveraged trading to reduce losses. They also protect against account balances going negative.

PU Prime’s choice to increase leverage limit to 1:1000 and reduce stop out level to 20% is a big move. It changes the forex and CFD trading leverage world. This change helps traders gain more from their investments. Yet, it focuses on doing so carefully by managing risks well. By providing trade support through high leverage ratios and a smaller stop out level, PU Prime helps traders boost gains safely.

Traders must understand that big earnings can bring big risks. They should keep their eyes open and use smart risk management strategies. This includes things like stop-loss orders, spreading out where they invest, and keeping detailed records of their trades. Trading smart with PU Prime’s new leverage limit and stop out level calls for careful, thoughtful moves.

Open A Live Account And Start Trading

Create Live Account

Leverage in trading means using money from a broker to increase possible gains. You can trade bigger with less money at first. Yet, it also increases the risk of losing more money. So, handling risk well is very important.

PU Prime now lets traders use leverage up to 1:1000. This means you can make much larger trades than before.

The stop-out level is a limit where the broker closes your trades to stop losses. It triggers when your account is below a certain percentage.

PU Prime’s new stop-out level is 20%. This means if your account hits below 20% of the margin needed, your trades will close. It’s a move to stop traders from losing too much and to keep their risk management smart.

Good risk management with leverage includes using stop-loss orders and diversifying your trades. Keep a journal, watch your risk-to-reward ratios, and always adjust your plans. Understanding your own risk comfort level is also key.

PU Prime’s new 1:1000 leverage limit means bigger trade possibilities with less upfront. But the 20% stop-out level adds safety, cutting losses and encouraging smart risk management.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!