-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

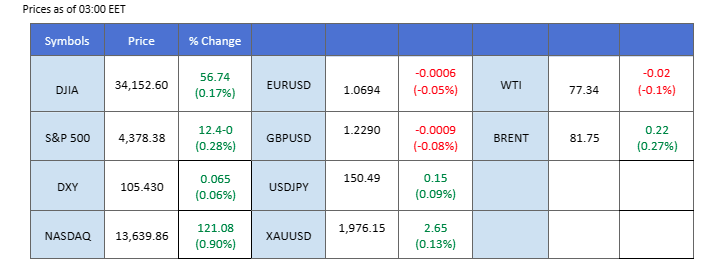

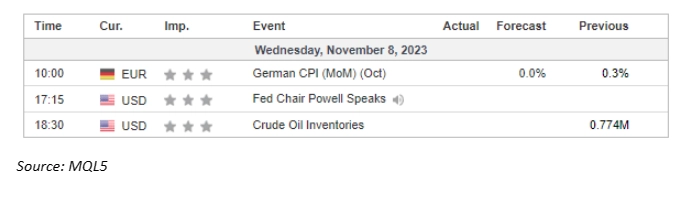

In a sharp turn, oil prices tumbled nearly 5% as the demand outlook dimmed, exacerbated by a substantial surge in U.S. crude stockpiles revealed in the API weekly data. This surge implied a significant cool-off in oil demand. Eyes are now fixed on China’s upcoming economic data, specifically CPI and PPI figures, set to be unveiled on Thursday, promising further fluctuations in oil prices. Contrastingly, gold prices found stability above the $1960 mark, with investors closely monitoring the unfolding tensions in the Middle East. Meanwhile, the dollar index continued its ascent, fueled by the Hawkish tone of Federal Reserve officials. Market participants eagerly anticipate Jerome Powell’s scheduled speech on Thursday, hoping for valuable insights into the Fed’s monetary policy outlook.

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.0%) VS 25 bps (2%)

The US Dollar made a rebound, primarily driven by technical corrections and bargain hunting. All eyes are on the Federal Reserve’s monetary statement as investors seek further trading cues. Expectations of a Fed pause have increased, following less hawkish signals and the release of downbeat job data last week.

The Dollar Index is trading higher while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 49, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 105.65, 106.15

Support level: 104.95, 104.50

Gold’s downturn continues as investors embrace a risk-on sentiment, driven by the easing of Middle East tensions and positive developments in US-China relations. High-level meetings between the two nations have contributed to the improved relationship, with expectations rising ahead of an anticipated meeting between leaders Xi Jinping and Joe Biden next week.

Gold is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 56, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2005.00, 2050.00

Support level: 1965.00, 1915.00

After a recent dip triggered by soft job data last Friday, the Dollar staged a robust comeback over two consecutive days, galvanised by a series of hawkish remarks from Federal Reserve officials. Market sentiment now hinges on the highly anticipated speech by Fed Chair Jerome Powell slated for Thursday, eagerly seeking cues on the Fed’s monetary policy trajectory. In Europe, concerns loomed as Germany, a key economic player, experienced a contraction in industrial production for September. Investors are now eagerly awaiting Germany’s CPI data, scheduled for release later today, as a gauge of the Euro’s resilience amid challenging economic headwinds.

EUR/USD trades lower and has suppressed below its uptrend resistance level, but it is still trading within the uptrend channel. The MACD crossed and moved downward while the RSI flowed lower, suggesting the bullish momentum was diminishing.

Resistance level: 1.0700, 1.0775

Support level: 1.0630, 1.0560

The British Pound faced a retracement as the Dollar regained its vigour following a dip triggered by soft job data. Rate hike speculation resurfaced amid a hawkish tone from multiple Federal Reserve officials, signalling that the Fed’s monetary tightening campaign might not be over, especially as the targeted inflation rate remains unmet. In contrast, the focus turns to the UK’s GDP data slated for release on Friday, expected to bring fluctuations to the Pound. Investors are closely monitoring these developments for potential market impact.

The Cable retraced at a strong resistance level at 1.2420 but has found support at above Fibonacci’s 61.8% level, suggesting the bullish momentum is still intact. The RSI and the MACD both declined, suggesting the bullish momentum has diminished significantly.

Resistance level: 1.2300, 1.2410

Support level: 1.2060, 1.1830

The US equity market witnessed a surge, with both the S&P 500 and Nasdaq posting their lengthiest streak of gains in two years. The decline in US Treasury yields, coupled with the positive outlook for US-China relations, has bolstered risk-on sentiment in global financial markets. Investors have been reallocating their portfolios towards the high-risk US equity market.

Nasdaq is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 74, suggesting the index might enter overbought territory.

Resistance level: 15330.00, 15930.00

Support level: 14600.00, 14010.00

The AUD/USD pair experienced a decline following the RBA’s decision to raise interest rates by 25 basis points, signalling a more cautious approach to further policy tightening despite the hike. This shift in stance was influenced by easing inflationary pressures, even though the disparity between the current rate and the targeted level remains significant. Investors are now turning their attention to upcoming crucial economic data from China, slated for tomorrow, which is anticipated to influence the strength of the Aussie dollar in the market. Market participants closely monitor these developments for potential trading opportunities and impacts on currency movements.

The AUD/USD retraced sharply at its strong resistance level of 0.6510 but has found support at a level near 0.6417 level. The RSI and the MACD continue to slide, suggesting the bullish momentum diminish drastically.

Resistance level: 0.6510, 0.6620

Support level: 0.6400, 0.6300

Oil prices plunged to seven-month lows due to disappointing trade data from China, raising concerns about the world’s largest crude importer’s economic health. Recent data revealed that China’s exports contracted more than anticipated in October, resulting in the country’s trade surplus reaching its weakest point in 17 months.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 81.65, 89.80

Support level: 73.55, 67.05

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!