-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

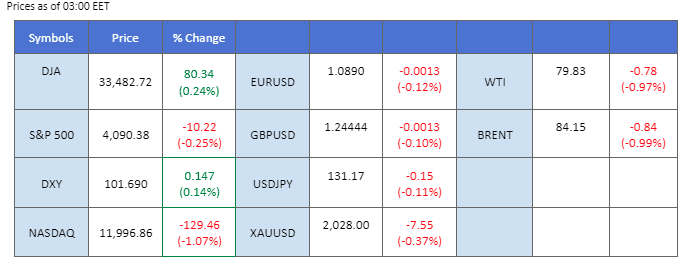

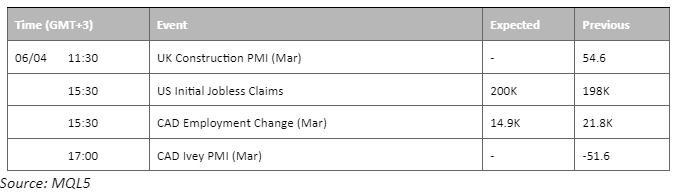

Recession fears have escalated in the markets, especially after the ADP Nonfarm payroll was released yesterday. The dollar index traded higher, and gold prices poised at a yearly high as safe-haven assets are being sought after by investors amid a recession looming with a lower-than-expected U.S. job report. On top of that, the U.S. ISM non-manufacturing PMI reading was much lower than the previous reading as well as the forecasted number, deepening the belief that a recession will be coming. On the other hand, the equity markets traded sideways as investors are waiting for the Nonfarm Payroll release on Friday for a clearer indication of the U.S. job market performance. Elsewhere, oil prices could sustain above $80 while U.S. crude oil inventories report showed the crude inventories dropped more than expected.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (56.1%) VS 25 bps (43.9%)

The Dollar Index has bounced back from a two-month low, as traders have taken profits and lightened their short positions ahead of the eagerly awaited US Nonfarm Payrolls report due on Friday. Despite this temporary uptick, the underlying trend for the US Dollar remains bearish, and Wednesday’s release of US ADP sector job numbers only reaffirmed this sentiment. According to the latest Automatic Data Processing (ADP) report, US ADP Nonfarm Employment Change has taken a significant dip, dropping from the previous reading of 261K to 145K, falling short of market expectations of 200K.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 44, suggesting the index might extend its gains after successfully breakout since the RSI rebounded sharply from its oversold territory.

Resistance level: 102.90, 103.50

Support level: 100.85, 100.15

Gold prices remained relatively unchanged in yesterday’s trading session, hovering close to their record highs. Investors are closely monitoring key US employment data, including Nonfarm Payroll and Unemployment Rate, before making any significant moves in the market. The current market sentiment is characterised by caution and a preference for safe-haven assets, such as gold. The release of yesterday’s US economic data has further reinforced the pessimistic outlook for the US economy. The US ADP Nonfarm Employment Change data was particularly concerning, as it dropped significantly from the previous reading of 261K to 145K, missing market expectations of 200K.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2025.00, 2045.00

Support level: 2000.00, 1970.00

The euro closed lower as the U.S. dollar index experienced a technical rebound at around $101.5. Despite a technical rebound, the market perceived the Fed might no longer need to raise rates given recent poor economic data. This may weaken the dollar if the Fed pauses its monetary tightening program or even starts cutting rates. On the other hand, the eurozone economy is relatively promising with the PMI still climbing and CPI remaining high; the ECB might be more Hawkish in May to meet the 2% targeted inflation rate. Investors may refer to this Friday’s Nonfarm payroll to gauge the movement of the U.S. dollar and EUR/USD price movement.

The indicators show a reduction in bullish momentum for the pair with the RSI fallen to 48 as of writing and the MACD converging.

Resistance level: 1.917, 1.965

Support level: 1.0867, 1.0796

The Nasdaq Index dropped 1.07% to 11996 points on Wednesday as economic data fuels recession jitters. A batch of economic data increases investors’ worries that the restrictive central bank policies could push the global economy into recession. It was mainly dragged down by Nvidia Corp (NVDA.O) dropped 2.1% and was followed by Alphabet Inc (GOOGL.O) said the supercomputers it used to train its artificial intelligence models were faster and more power efficient than comparable components made by Nvidia. Along with recession sentiment, the ADP data showed that U.S. private employers hired fewer workers than expected in March. And the ISM showed the services sectors slowed more than expected last month on cooling demand.

Hence, fear of a recession is the dominant theme in the market now. MACD has illustrated bullish momentum. However, RSI is at 54, indicating a neutral-bullish momentum.

Resistance level: 12278,13013

Support level: 11993,10778

The pound eased 0.60% to $1.2441 on Wednesday but remained close to its 10-month high against the dollar hit the day before. Improving economic circumstances has helped the pound become one of the biggest beneficiaries of the softening U.S. currency. Moreover, the pound rallied about 2% against the dollar in the first quarter of the year as the U.K.’s economic data has primarily come in slightly better than feared. The U.K.’s services PMI data showed a better-than-expected reading of 52.9, higher than the market forecast of 52.8, indicating a strong service sector activity that drives market expectations of more interest rate hikes from the BoE to rein in inflation.

The U.K. rate expectations have repriced in recent weeks on the support of renewed hawkishness from the BoE officials. Therefore, the overall outlook for the pound remains strong. A decline in the price can consider a technical retrace. MACD remains above the zero line, which indicates bullish momentum. RSI is at 53, indicating a neutral-bullish momentum ahead.

Resistance level: 1.2613, 1.2740

Support level: 1.2425, 1.2298

The Dow saw a modest uptick, with healthcare stocks leading the charge. However, concerns surrounding the uncertain economic outlook persist, as downbeat economic data has triggered risk-off sentiment across the global financial market. According to the latest data, private payrolls in March rose by a mere 145,000, representing a stark decline from the previous reading of 261,000, and falling well short of the economists’ forecast of 200,000. Additionally, the services ISM slipped to 50.6, missing market expectations of 53.8. In light of these developments, investors are eagerly awaiting Friday’s Nonfarm Payrolls report for March, with economists predicting the addition of roughly 240,000 new jobs.

The Dow is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum while RSI is at 68, suggesting the index might enter overbought territory.

Resistance level: 34310.00, 35640.00

Support level: 32875.00, 31600.00

Oil prices have edged lower as investors opt to take profits after the recent surge, while bearish economic data suggests a cooling economic climate that may dampen demand. Market volatility remains high as traders eagerly await the release of the US Nonfarm Payrolls reports, which has led to a sell-off of risky assets such as crude oil. Despite this, concerns over potential supply disruptions have supported the overall bullish momentum in the oil market. The Energy Information Administration (EIA) reported that US crude oil inventories declined by 3.739M, a figure that surpassed market expectations of -2.329M.

Crude oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 66, suggesting the commodity might enter overbought territory.

Resistance level: 81.05, 85.45

Support level: 77.25, 73.80

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!