-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

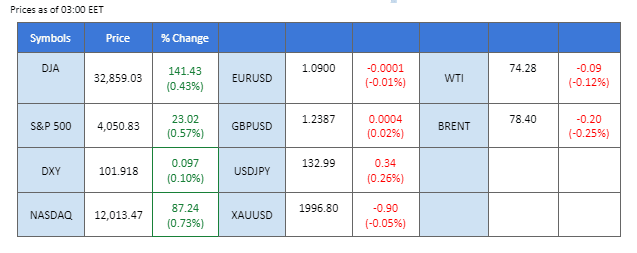

China’s economic performance continues to astound global markets as the latest Purchasing Managers’ Index (PMI) data revealed that the service sector activity in the country surged to its fastest pace in 12 years in March. Such sentiment has sparked optimism for the antipodean currencies, which are closely linked to China’s economy. The Euro remains resilient as the inflation data surpassed expectations, fueling hopes of further rate hikes from ECB. Global equity markets continue to rise, driven by easing fears of a banking crisis and declining US Treasury yields. All eyes in the financial world are currently fixed on the US personal consumption expenditures (PCE) index, which serves as the Federal Reserve’s barometer for inflation. This highly anticipated data is expected to offer key insights into the current state of the US economy and provide valuable clues regarding the Fed’s future monetary policy decisions.

Current rate hike bets on 3rd May Fed interest rate decision:

0 bps (46.9%) VS 25 bps (53.1%)

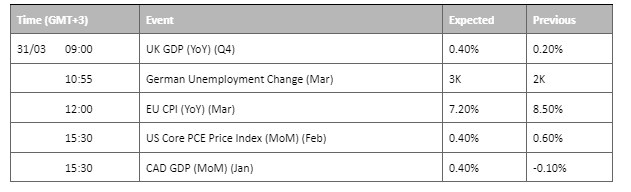

The US Dollar traded steadily yesterday amid mixed market sentiment, as investors weighed positive news from the US pending Home Sales report against a risk-on sentiment that fuelled bullish momentum in high-risk assets like the US equity market. The pending Home Sales report for last month came in at 0.80%, beating market expectations of -2.3% and indicating that the US housing market remains strong. Despite the positive news, the safe-haven dollar was held back by risk-on sentiment in the financial market. Moving forward, investors will be closely monitoring the release of the PCE index and US Initial Jobless Claims report, as they will provide important insights into the health of the US economy and the direction of future monetary policy.

The Dollar Index is trading flat while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 47, suggesting the index might extend its gains after breakout.

Resistance level: 102.85, 103.15

Support level: 101.95, 100.85

Gold prices continued to decline amid the prevailing risk-on sentiment in the market, as investors opt for high-risk assets instead of safe-haven commodities. The surge in bank stocks and easing concerns in the banking sector further fuelled the bullish momentum in the global financial market, leading to a decrease in the demand for safe-haven assets such as gold. While some investors may view gold as a hedge against inflation or market turbulence, the current upbeat market sentiment suggests a preference for high-risk assets.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 47, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 1975.00, 2000.00

Support level: 1955.00, 1925.00

The euro is consolidating above the 1.075 level as the forex market is quiet amid higher risk tolerance in the risky assets market. While investors further weighed down the financial system risk, the focus shifted away from the forex market, especially the safe-haven dollar, which has been muted lately. The euro has a stronger strength against the dollar as the economic bloc expects an acceleration in inflation as the euro central bank is determined to take the inflation rate down to a favourable range with a tighter monetary policy. On the other hand, the market is uncertain about the Fed’s next move as the concern over market recession is higher after the banking crisis left the dollar’s price movement lacking direction. the U.S. PCE data perhaps, maybe a catalyst for the dollar to fluctuate.

The indicators have a neutral signal as the pair consolidates in a smaller price range. The RSI hovers above the 50-level while the MACD stays flat above the zero line.

Resistance level: 1.0867, 1.0917

Support level: 1.0698, 1.0613

The Nasdaq rose 1.79% to 11,926 points on Wednesday as investors’ worries about the economy’s health continued to ease. Micron (MU.O) shares lifted the rally by 7.2%, leading gains in the PHLX semiconductor index, which closed 3.3% higher. The memory chip maker is forecasting a drop in third-quarter revenue in line with Wall Street expectations, while it gave a bright outlook for 2025 with artificial intelligence boosting sales. Adding to the optimism, Lululemon Athletica Inc (LULU.O) spiked 12.7% after an upbeat annual result forecast. Investors are awaiting PCE data on Friday for further clues on inflation.

As we can see, the overall trend remains positive, and the index has been moving toward its resistance level of 11993 as of writing. Investors are waiting for the break above to clear the path of the upcoming bullish trend. MACD has illustrated bullish momentum ahead. RSI is at 61, indicating a bullish momentum in the near term.

Resistance level: 11993, 13013

Support level: 10778, 9816

The pound has hit its eight-week high of $1.2361 at one time, and now it retraces to $1.2298 against the dollar as of writing. The pair traded in a bullish bias as worries about the health of the global financial system continued to ease. The pound’s movement was supported by the rebound in risk appetite amidst cooling concerns about the banking sector turmoil. Markets have been volatile in March following the collapse of U.S. tech lender Silicon Valley Bank (SVB) and the emergency takeover of Credit Suisse by banking rival UBS, raising fears of systemic stress that could lead to more bank failures. On Tuesday, the BoE Governor Andrew Bailey said that the central bank was on alert amid global turmoil in the banking sector. He added U.K. was not experiencing stress linked to the problems at SVB and Credit Suisse. In addition, investors can keep an eye on the upcoming UK GDP data, which will be released on Friday, for further trading signals.

The pound remains stand firm above $1.2298, and we could expect the trend to continue bullish. MACD has illustrated bullish momentum ahead. RSI is at 51, indicating the pound is trading in a bullish momentum in the short term.

Resistance level: 1.2425, 1.2613

Support level: 1.2298, 1.2190

US stocks soared on Tuesday, extending their bullish run, as investors grew more confident about the health of the banking sector and were buoyed by better-than-expected financial reports. The Dow Jones Industrial Average rose by 1%, or 323 points. The chip stocks and the broader tech market were among the top performers, with Micron Technology Inc, a semiconductor design consulting company, jumping more than 7% following its impressive financial results. The upbeat mood in the market was fueled by further signs of easing concerns in the banking sector. Bank stocks were in high demand, as investors welcomed the news that contagion fears were abating.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the Dow might extend its gains after successfully breakout.

Resistance level: 32720.00, 34310.00

Support level: 30945.00, 28760.00

Oil prices experienced a choppy day of trading, as investors engaged in profit-taking following two straight days of significant gains. Despite several upbeat news, including an unexpected draw in US oil stockpiles and a halt to some Iraqi Kurdistan oil exports, oil prices edged lower overall. However, the long-term trend for the oil market remained positive, as concerns over supply disruptions continue to dominate market sentiment. According to the Energy Information Administration (EIA), the unexpected draw in US oil stockpiles last week was particularly notable, with crude oil inventories notching down from the previous reading of 1.117M to -7.489M, missing market expectations of 0.092M.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 59, suggesting the commodity might extend its losses toward support level.

Resistance level: 73.80, 77.25

Support level: 68.60, 64.75

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!