-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

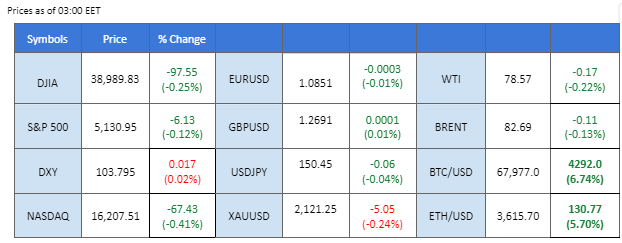

* Gold prices are on the brink to hit its all time high ahead of Powell’s testimony on Wednesday.

* Tokyo Core CPI came in line with the market expectation with an increase from the previous reading fuels hope for a rate hike from BoJ.

* BTC surged to above the $68000 mark for the first time since November 2021.

As the U.S. equity markets maintain a holding pattern ahead of Federal Reserve Chair Jerome Powell’s testimony before Congress on the nation’s monetary policy, Asian stock markets face pressure due to China’s ongoing People’s Congress meeting. The dollar index (DXY) has traded quietly since the start of the week, while gold prices have surged over 3.5% since the last Friday session, nearing their all-time high at $2146.80. This rally is fueled by speculation about a June rate hike from the Federal Reserve, coupled with heightened tensions in the Middle East.

In contrast, oil prices retraced following the boost from OPEC+’s announcement of an extension of its oil supply cuts. Additionally, the BTC ETF has seen significant inflows, bringing BTC prices close to their all-time high at $68,900. If the risk appetite in the market continues to grow, BTC prices may target the next psychological hurdle at $70,000.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar Index hovered within a remarkably tight range as investors braced for significant events in the week ahead. All eyes are on the Federal Reserve Chair, who is scheduled to testify before Congress. Market participants widely speculate that the Fed Chief will emphasise the central bank’s commitment to its monetary tightening stance. The expectation is that there will be no haste in adjusting rates downward until there’s clear evidence that inflation has sustainably settled below the 2% target.

The Dollar Index traded flat, giving no clues for the upcoming movement. The RSI remains flowing near the 50 level while the MACD hovers in between the zero line, with both indicators also given a neutral signal.

Resistance level: 104.50, 104.95

Support level: 103.70, 102.90

Gold prices have undergone a significant rally, approaching the historic high at $2146.80. The surge is fueled by market sentiment speculating on the potential for the Federal Reserve’s first rate cut in June. Investors eagerly await cues from both Wednesday’s testimony by Powell and Friday’s Non-Farm Payrolls report to assess the likelihood of a June rate cut. The precious metal has long been favoured during times of lower interest rates, and current market dynamics are reinforcing its appeal as a safe-haven asset.

Gold prices have broken above the uptrend channel and continue to gain, suggesting that gold is trading with an extremely strong bullish momentum. The RSI continues to surge in the overbought zone while the MACD is moving upward and diverging, suggesting the bullish momentum is gaining.

Resistance level: 2117.90, 2140.00

Support level: 2088.20, 2068.80

The Pound Sterling maintains a positive trajectory, supported by an optimistic economic outlook articulated by UK Prime Minister Rishi Sunak. Sunak emphasized that the UK economy is on the right track, hinting at potential tax cuts in the upcoming budget. Despite the lack of clarity on budget details, investors are advised to vigilantly monitor developments for nuanced trading signals.

GBP/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level:1.2710, 1.2785

Support level: 1.2635, 1.2530

The Euro remains in a holding pattern as investors await crucial monetary policy decisions from the European Central Bank later this week. Anticipated to maintain steady interest rates, the ECB faces the challenge of easing inflation. ECB Vice President Luis de Guindos emphasises the need for more data on Eurozone inflation, currently at 2.6%, before considering rate adjustments. Investors remain attentive to ECB decisions for potential trading signals.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1.0865, 1.0954

Support level: 1.0765, 1.0710

Bitcoin continues its ascent, reaching a more than two-year peak above $65,000, fueled by substantial flows into cryptocurrency exchange-traded funds, particularly in the United States. Analysts caution that while short-term gains are likely, a cooling-off period may ensue as unrealized profit margins approach extreme levels. Long-term investors express confidence in rising demand through new U.S. ETFs and anticipate tighter supply after the April halving event, potentially propelling Bitcoin to new all-time highs.

BTC/USD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 71, suggesting the crypto might enter overbought territory.

Resistance level: 69010.00, 70000.00

Support level: 62530.00, 57430.00

The USD/JPY pair continues to move within a broad sideways range as traders await a catalyst to determine the pair’s direction. The recently released Tokyo Core CPI reading, which came in at 2.5%, aligning with market expectations and marking an increase from the previous 1.8%, has sparked speculation of a potential rate hike from the Bank of Japan (BoJ). This development could lead to a strengthening of the Japanese Yen.

USD/JPY ticked up slightly but remains trading within its sideways range, given a neutral signal for the pair. The RSI flows near the 50 level while the MACD hovers near the zero line, with both indicators giving a neutral signal for the pair.

Resistance level: 150.80, 151.70

Support level: 149.40, 147.60

The US equity market experiences a mild retreat, influenced by a tech-driven slump led by Apple and a tempered outlook on imminent rate cuts. Federal Reserve members maintain a hawkish stance, warning against premature rate cuts that could jeopardise economic growth and inflation stabilisation. With bets on a June rate cut slightly diminishing, hovering at 49.5%, down from 57%, hawkish expectations contribute to increased US Treasury yields, placing downward pressure on the equity market. Investors navigate a complex landscape ahead of crucial economic data and Fed Chair Jerome Powell’s testimony.

The Dow is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 61, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 39420.00, 40000.00

Support level: 37925.00, 36745.00

In the latest session, oil prices saw a decline of over 1.3%, following a surge prompted by OPEC+’s announcement to extend its supply cut measures. The downturn is attributed to profit-taking activities among traders as oil prices neared their highest point since last November. Market participants are closely monitoring the ongoing developments from China’s People’s Congress meeting, with updates from the event anticipated to significantly influence oil price trends.

Oil prices have declined to their support level of 78.65 level, which is at a potential rebound level. The RSI has declined to near the 50 level while the MACD has crossed from the above suggesting the bullish momentum is easing,

Resistance level: 81.20, 84.10

Support level: 78.65, 75.20

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!