-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

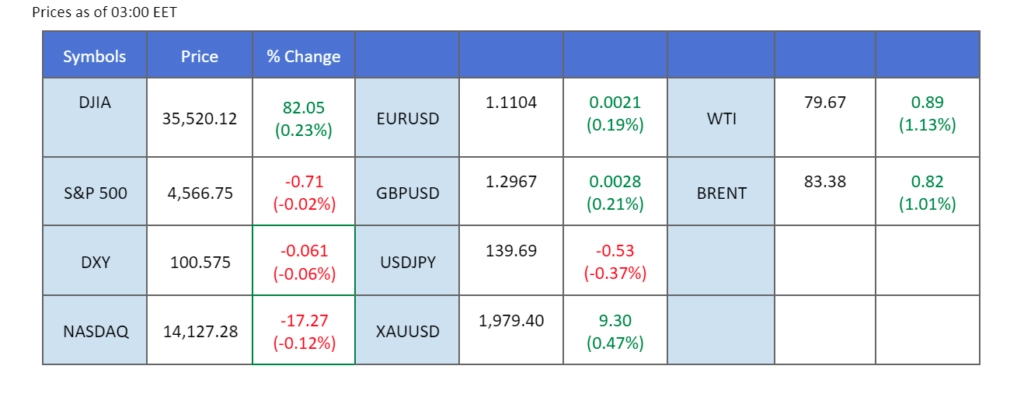

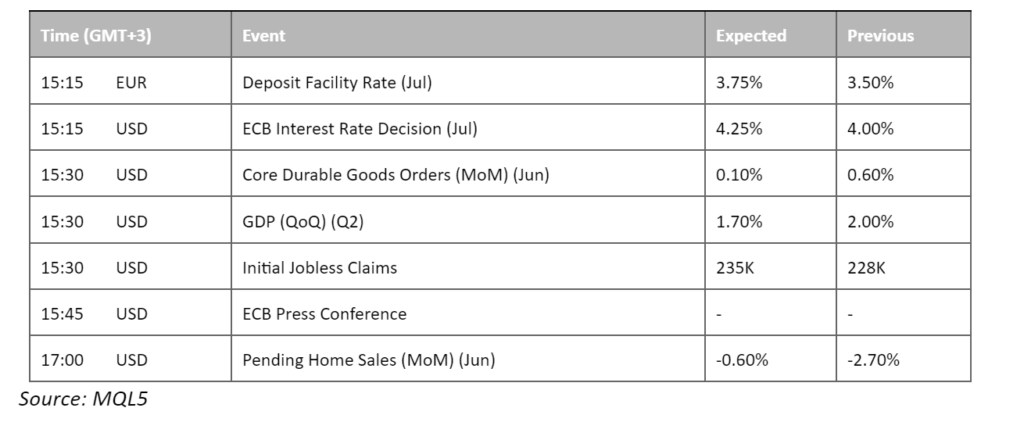

The Federal Reserve delivered as anticipated, implementing a 25 bps rate hike that propelled the interest rate to its highest level in 22 years. With the benchmark rate now residing within the range of 5.25% to 5.5%, the Fed’s chair reiterated the central bank’s ongoing pursuit of its 2% targeted inflation rate and expressed openness to additional rate hikes if necessary. Following the announcement, the strength of the U.S. dollar waned, prompting gold prices to climb as the dollar’s depreciation made the precious metal more attractive. Moreover, the surge in oil prices persisted, bolstered by the weakening dollar. Meanwhile, the unexpected drop in U.S. crude oil inventories served as a further catalyst, adding to the market’s enthusiasm.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar retreated amid lower bond yields after the FOMC decisions. Bond yields, including the two-year US yields, sensitive to imminent Fed moves, dropped to 4.84%. Overall, investor sentiment leans towards a more dovish outlook, despite the Fed’s rate hike announcement. The Federal Reserve raised its interest rates by a quarter point to a target range of 5.25% to 5.5%. However, policymakers highlighted that the prospects for September’s interest rate decisions remain uncertain. Federal Reserve Chairman Jerome Powell emphasised that future monetary policy will be data dependent. Investors will continue to eye on further data to receive further trading signals.

The dollar index is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 43, suggesting the index might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 101.50, 104.25

Support level: 98.70, 94.75

Despite the Federal Reserve’s 25 basis points interest rate hike, the gold market extended its gains while attempting to form a double top trend. The market sentiment for the Fed’s future policy remains tilted towards a more dovish stance, with a focus on dropping short-term US treasury yields. Powell’s mention of data-dependence reinforces the need for investors to closely monitor economic data, especially inflation and employment figures, for further trading signals.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 1970.00, 1985.00

Support level: 1950.00, 1930.45

As anticipated, the Federal Reserve raised its interest rate by 25 basis points, propelling the country’s benchmark rate to its highest level in 22 years. The market had already factored in the rate hike, leading to a weakening of the U.S. dollar. Investors now have to wait until September to see if the Fed continues its path of further tightening monetary policy. Taking advantage of the weakening dollar, the euro seized the opportunity to rebound from its monthly low at 1.1040, registering a gain of nearly 0.3% last night.

The pair has rebounded from its monthly low and is trading above the 100 SMA line suggesting a bullish trend is forming. The RSI and the MACD supported the view as the RSI has also rebounded before entering into the oversold zone while the MACD has crossed below.

Resistance level: 1.1157, 1.1237

Support level: 1.1031, 1.0951

The Pound Sterling continued its upward momentum for the third consecutive session, rallying from its recent low near the 1.2801 region. Investors are closely eyeing the upcoming Bank of England (BoE) interest rate announcement, scheduled for next week. Meanwhile, the Federal Reserve’s interest rate decision unfolded as expected, with the dollar displaying sluggish trading against the Sterling. Despite Jerome Powell, the Fed chair, affirming the central bank’s willingness for further rate hikes if necessary, the dollar failed to make significant gains against the Pound Sterling.

GBP/USD has rebounded and is trading out of the downtrend channel and is currently trading in bullish momentum. The RSI surge rapidly entering the overbought zone while the MACD has crossed above the zero line, suggests that the bullish momentum is strong.

Resistance level: 1.3062, 1.3137

Support level: 1.2820, 1.2665

Bond yields, including the two-year US yields, sensitive to imminent Fed moves, dropped to 4.84%. Overall, investor sentiment leans towards a more dovish outlook, despite the Fed’s rate hike announcement. The US equity market initially rallied during the press conference but later reversed gains. Investors will closely watch financial results from US companies for signals from the equity market. As for writing, the Dow Jones Industrial Average rose by 0.20%, or 82 points.

The Dow is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the index might enter overbought territory.

Resistance level: 35530.00, 36415.00

Support level: 34435.00, 33675.00

USD/JPY continues to extend its losses following the FOMC meeting, with investors showing scepticism despite the Federal Reserve’s decision to hike interest rates by 25 basis points and their commitment to maintaining tightening measures if inflation surges. As a result, US Treasury yields, a key indicator of future Fed interest rate expectations, begin to decline. Looking ahead, market attention turns to the Bank of Japan’s monetary decisions later this week, as investors seek further trading signals.

USD/JPY is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the pair might extend its losses in short-term since the RSI stays below the midline.

Resistance level: 141.25, 142.10

Support level: 140.35, 139.30

The oil market’s winning streak came to an end after disappointing US inventory draws. Government data revealed that US crude inventories fell by only 0.6 million barrels, falling short of market expectations of a 2.348-million-barrel decline. Despite the end of supply injections from the national reserve, the limited drawdown impacted market sentiment.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 61, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 79.90, 83.20

Support level: 77.30, 73.70

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!