-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

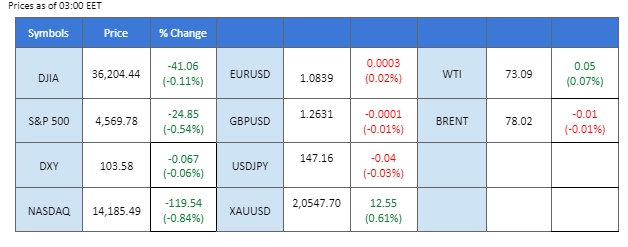

Wall Street’s bullish momentum showed signs of easing, coinciding with the U.S. dollar stabilising ahead of the eagerly anticipated U.S. job data (NFP) set for release this Friday. Market sentiment was impacted by a tempered view on the Federal Reserve’s unwinding of monetary tightening, with concerns that optimism might be premature. In the realm of commodities, gold prices experienced a more than 2% slide after reaching an all-time high at $2146.80 in the last session. Meanwhile, oil prices took a pause in their bearish trend, prompted by China’s PMI surpassing market expectations. The robust economic performance from the world’s largest oil importer suggests a more favourable outlook. On another front, the Japanese core CPI falling short at 2.3%, compared to the previous reading of 2.7%, impeded the strength of the Japanese Yen.

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.0%) VS 25 bps (5%)

The US Dollar sees a slight uptick, marking a modest correction after a three-week decline fueled by speculations of impending interest rate cuts by the Federal Reserve. Investors perceive this as a healthy technical correction, with attention shifting to the upcoming US Jobs report as a crucial factor influencing further market moves.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 104.05, 104.55

Support level: 103.25, 102.50

Gold prices reach unprecedented levels, breaching the psychological barrier at $2150, only to experience a sharp retracement as global investors engage in profit-taking. Despite the retreat, the fundamental bullish trend in gold remains intact, fueled by expectations that the Federal Reserve may opt to halt its tightening monetary policy. The spotlight now turns to the forthcoming US jobs data, a key catalyst for the gold market’s trajectory.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2050.00, 2085.00

Support level: 2030.00, 2010.00

The Cable experienced a modest decline of just over 0.6% against the U.S. dollar, with the dollar gaining strength in anticipation of the pivotal U.S. job data scheduled for release on Friday. Market apprehensions surrounding potentially over-optimistic bets on the Federal Reserve’s unwinding monetary tightening contributed to a slight upturn in the dollar’s strength yesterday. The focus now turns to Friday’s Non-Farm Payrolls (NFP) report, as market participants eagerly await insights into the Fed’s forthcoming monetary policy moves.

The Cable is traded sideways between 1.2615 to 1.2730 levels ahead of crucial economic data. The RSI is gradually moving downward while the MACD is approaching the zero line from above, suggesting a potential trend reversal may happen.

Resistance level: 1.2730 1.2815

Support level: 1.2528, 1.2437

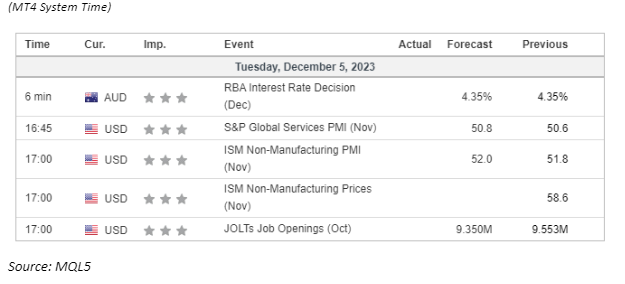

The Australian dollar is currently constrained below a strong resistance level at 0.6677 against the U.S. dollar, leading up to the highly anticipated Reserve Bank of Australia (RBA) interest rate decision. Market expectations suggest the RBA is likely to maintain its current interest rate, given the moderate economic performance and the uncertain global economic outlook. Simultaneously, the U.S. dollar has seen an uptick in strength ahead of the Non-Farm Payrolls (NFP) announcement this Friday, reflecting a shift in market sentiment, which now considers it premature to speculate on the possibility of the Federal Reserve initiating rate cuts next year.

The AUD/USD pair has formed a double-top price pattern, suggesting a potential trend reversal for the pair. The RSI has dropped to below the 50-level from the overbought zone while the MACD is on the brink of breaking below the zero line, suggesting that bearish momentum is forming.

Resistance level: 0.6677, 0.6744

Support level: 0.6560, 0.6500

US equities face a downward trend as investors adopt a cautious stance in anticipation of crucial employment data that could significantly impact Federal Reserve monetary policy decisions. To mitigate potential market volatility, investors opt for risk-off strategies, leading to a selloff in high-risk equity assets. Major indices, including the S&P 500, experience declines, with tech giants Microsoft, Apple, Nvidia, and Amazon facing notable pressure amid higher US Treasury yields.

The Dow is trading higher following the prior breakout above the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 80, suggesting the index might enter overbought territory.

Resistance level: 36490.00, 36955.00

Support level: 35930.00, 35465.00

The USD/JPY pair saw a slight gain yesterday as the strength of the Japanese Yen receded following the release of Japan’s Core CPI. The CPI reading fell short at 2.4%, indicating a moderation in inflation in Japan. Conversely, the U.S. dollar regained some strength as market sentiment shifted, with a growing sense that it might be premature to expect a dovish stance from the Federal Reserve in the coming year. All attention is now focused on this Friday’s Non-Farm Payrolls (NFP) reading, eagerly anticipated for insights into the Fed’s future monetary policy decisions.

The USD/JPY has rebounded slightly but still remains below its long-term resistance level, suggesting the bearish momentum is still intact. The RSI remains at the lower region, but the MACD has a higher value below the zero line, suggesting a potential trend reversal for the pair.

Resistance level: 147.40, 148.30

Support level: 146.23, 144.78

Concerns about declining demand and lingering uncertainty regarding the depth and duration of OPEC+ supply cuts contribute to the continued losses in oil prices. Despite Saudi Arabia’s announcement of voluntary production cuts, market scepticism prevails on the effectiveness of these measures, adding to the overall bearish sentiment in the oil market.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated diminishing bearish momentum, while RSI is at 35, suggesting the commodity might enter oversold territory.

Resistance level: 74.20, 78.30

Support level: 72.05, 69.90

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!