-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

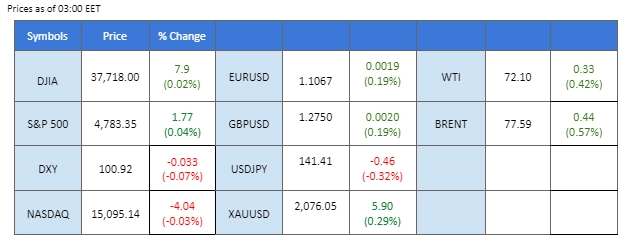

The U.S. Chicago Purchasing Managers’ Index (PMI) reading significantly dropped to 46.9, falling below both the previous reading and market consensus. This suggests a contrasting economic landscape in the U.S. However, the poor economic data did not prevent the U.S. dollar from extending its gains for the second consecutive session last Friday. Meanwhile, gold prices held steadfast above the $2060 level, maintaining their trajectory. Traders are vigilantly monitoring developments in Middle-East tensions, adding an additional layer of complexity to market dynamics. On the other hand, oil prices continue to encounter headwinds, trading lower as market sentiment maintains a pessimistic view on the outlook for oil demand in 2024. The challenging economic environment contributes to the ongoing struggle in the oil market.

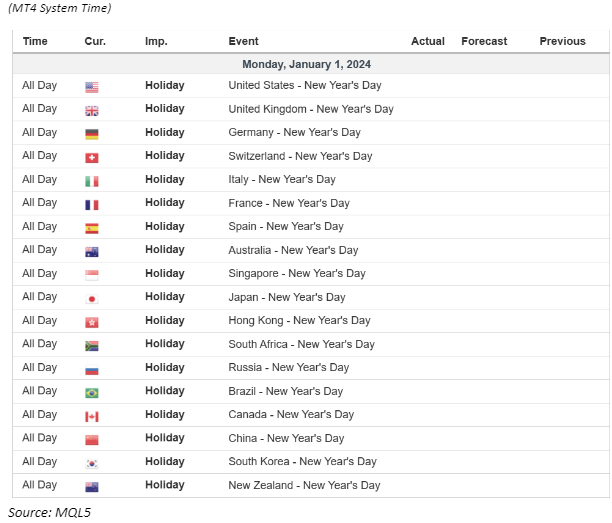

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (84.5%) VS -25 bps (15.5%)

In the closing session of 2023, the US Dollar managed marginal gains despite unfavourable economic data from the United States. The Chicago Purchasing Managers’ Index (PMI) fell short at 46.9, significantly below both the previous reading and market consensus. This unexpected decline in the PMI is anticipated to pose challenges for the dollar, particularly amid growing speculation of a Federal Reserve rate cut in the upcoming year, which may further impede the dollar’s strength.

The dollar index continues to gain while currently trading above its long-term downtrend resistance level, suggesting a potential trend reversal for the dollar. The RSI has gained sharply from the oversold zone while the MACD is moving toward the zero line from below, suggesting the bullish momentum is forming.

Resistance level: 101.75, 102.60

Support level: 100.80, 99.67

Gold prices remained resilient, poised above the $2060 level, and traded sideways on the last trading session of 2023. Despite a slight gain in the dollar, gold prices displayed strength, maintaining their position above the $2060 threshold. Traders are closely monitoring the evolving developments in the Middle-East tension, as it has the potential to influence gold prices in the near term.

Gold prices are traded below their uptrend channel, implying a potential trend reversal for gold. The RSI has dropped out of the overbought zone while the MACD has crossed above the zero line, suggesting the bullish momentum has decreased drastically.

Resistance level: 2069.40, 2088.00

Support level: 2052.00, 2028.50

The GBP/USD pair has successfully breached its downtrend resistance level and is currently trading sideways, anticipating a catalyst to dictate its next direction. Despite the UK’s Consumer Price Index (CPI) remaining below the targeted 2% rate, the Bank of England (BoE) maintains a rather hawkish stance in managing inflation. With these factors in play, the Cable will experience gains in 2024.

The GBP/USD had broken above the resistance level, suggesting the bullish trend remains. The bullish momentum is lacking as the RSI has declined to near 50 levels while the MACD is declining toward the zero line.

Resistance level: 1.2815, 1.2906

Support level: 1.2631, 1.2528

In the last trading session of 2023, the EUR/USD pair remains under downward pressure. The Eurozone’s Consumer Price Index (CPI) has consistently been below 3%, with the latest reading at 2.4%. This suggests that the European Central Bank (ECB) may reconsider its monetary tightening policy, potentially ending it. The shift in monetary policy outlook has had a constraining effect on the strength of the euro.

The EUR/USD is yet to find support from its bearish trend and is heading to its Fibonacci Retracement level of 61.8%; a break below such a level might be a bearish signal for the pair. The MACD is on the brink of breaking below the zero line while the RSI has declined to below the 50 level, suggesting the bearish momentum is strong.

Resistance level: 1.1140, 1.1225

Support level: 1.0954, 1.0866

The Japanese Yen maintains its strength against the U.S. dollar, with the USD/JPY pair continuing to trade lower. Despite a slight gain in the dollar index last Friday, the Yen’s resilience suggests a divergence in monetary policy expectations for 2024. The Bank of Japan (BoJ) is anticipated to raise its interest rates. At the same time, the Federal Reserve is expected to initiate rate cuts, contributing to the downward trend in the USD/JPY pair.

USD/JPY declined last Friday and remains below its resistance level, suggesting the bearish momentum is strong. The RSI kept at below 50 level while the MACD hovered at below zero line, suggesting the bearish momentum remains intact with the pair.

Resistance level: 141.65, 143.80

Support level: 138.88, 137.70

The Australian Dollar has been trading sideways while experiencing bearish momentum. This trend is occurring alongside continued gains in the dollar index. The Aussie dollar’s performance, however, has been hampered by discouraging data from China, specifically the poor Manufacturing Purchasing Managers’ Index (PMI) reading, which came in at 49. This reading suggests a contraction in the Chinese economy, potentially impacting the Australian dollar as a China-proxy currency.

After trading to its recent high, the AUD/USD pair has eased in bullish momentum. The RSI has declined to below 50 levels while the MACD is approaching the zero line from above.

Resistance level: 0.6894, 0.6985

Support level: 0.6712, 0.6617

Oil prices witnessed a downward trend for the third consecutive trading session, managing to close slightly above the $70 level. The outlook for oil prices remains uncertain, with market participants eagerly anticipating the repercussions of aggressive rate hikes since 2022 by major central banks globally. If the global economic performance takes a downturn in 2024, it is expected to lead to a decline in oil demand, potentially exerting negative pressure on oil prices.

Oil prices continued to drop and declined by nearly 1% in the last trading session of 2023. The RSI is declining while the MACD has broken below the zero line, suggesting the bearish momentum is gaining.

Resistance level: 73.80, 77.23

Support level: 68.50, 64.75

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!