-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

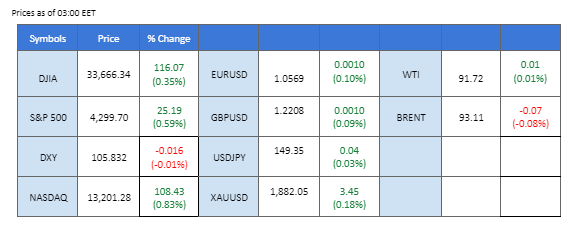

The U.S. dollar, which had reached its peak since December, experienced a decline following yesterday’s release of U.S. economic data that failed to meet projections. Disappointing figures in the U.S. GDP price index, falling short of both prior readings and market expectations, coupled with signs of deceleration in U.S. home sales, put downward pressure on the dollar, nullifying its gains from the previous day. Conversely, Australia saw a dip in retail sales data, causing the Aussie dollar to drop to its lowest point since last November. However, a robust recovery prior to the Reserve Bank of Australia’s upcoming interest rate decision, fueled by the possibility of the RBA continuing its monetary tightening cycle, added a layer of complexity to the currency market dynamics.

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (78.0%) VS 25 bps (22%)

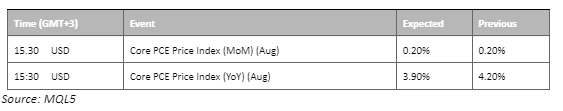

Despite rising US Treasury yields, the US Dollar retreated as investors seized the opportunity to book profits and reallocate their portfolios toward undervalued currencies. Nevertheless, the fundamentals underlying the Dollar remain robust, particularly in the wake of the solid jobs report. Investors’ focus now shifts to the eagerly awaited release of the PCE Price Index to gauge the inflation landscape in the United States.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 106.95, 108.65

Support level: 105.25, 103.15

Gold prices have descended to levels not seen in seven months, primarily driven by the relentless rise in US Treasury yields and heightened expectations of rate hikes. Even as the US Dollar retreated from its November highs, the bond market selloff continued to exert downward pressure on non-yielding assets, including gold and silver.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 28, suggesting the commodity might enter oversold territory.

Resistance level: 1890.00, 1950.00

Support level: 1840.00, 1790.00

Indications of potential easing in Eurozone inflation pushed the euro to its lowest point of the year against the USD, while the dollar maintained its robust performance. Both Spanish and German Consumer Price Indices (CPI) fell below market expectations, with the German CPI hitting its lowest level since May. These signs of economic softening across Eurozone member states restrained the euro’s ability to strengthen against the strong USD.

The Euro is able to defend against the strong USD at above 1.05000, a crucial psychological support level for the pair. The MACD has crossed while the RSI has rebounded strongly from the oversold zone suggesting the bearish momentum is diminishing.

Resistance level: 1.0617, 1.0705

Support level: 1.0548, 1.04730

The Pound Sterling rebounded from its earlier losses in anticipation of the pivotal UK GDP data set to be released later today. Weaker-than-anticipated U.S. economic indicators, including the GDP price index and New Home Sales, tempered the dollar’s strength, creating a favourable environment for the Sterling. Additionally, the alleviation of concerns regarding a U.S. government shutdown further softened the dollar’s position during the same period

The Cable rebounded by more than 0.5% yesterday and has formed a solid bullish engulfing candlestick pattern, signalling for a trend reversal for the pair. The RSI has rebounded sharply from the oversold zone while the MACD has crossed and is approaching the zero line, echoing the trend reversal signal as well.

Resistance level: 1.2360, 1.2530

Support level: 1.2040, 1.1935

The Australian dollar (AUD) neared its annual low before staging a sharp recovery ahead of the impending RBA interest rate announcement scheduled for the upcoming Monday. Weaker-than-expected U.S. economic data and the easing of U.S. government shutdown concerns have subdued the dollar’s strength from its 2023 peak. Despite retail sales falling below market consensus, Australia’s monthly private sector credit saw a rise of 0.4%, leading the market to speculate that the RBA might resume its interest rate hikes after a three-month pause.

The AUD/USD has rebounded sharply from its lowest region of the year and the pair is currently trading in a broad sideways range. The RSI is approaching the overbought zone while the MACD is on the brink of breaking above the zero line, suggesting the bullish momentum has formed.

Resistance level: 0.6500, 0.6610

Support level: 0.6390, 0.6280

US equity markets rebounded after a recent downturn, as investors engaged in bargain buying. This resurgence in equities occurred despite the backdrop of surging Treasury yields, which had cast a shadow over stock markets. The recent ascent in yields, reaching levels not seen in 16 years, has dominated the investment landscape.

The Dow is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 33, suggesting the index might enter oversold territory.

Resistance level: 34355.00, 34900.00

Support level: 33590.00, 32745.00

The Japanese yen experienced a mild rebound, with USD/JPY hovering around the critical 150 benchmark. Market sentiment suggests that the Bank of Japan may intervene if the yen crosses the 150 thresholds, prompting many traders to opt for profit-taking.

USD/JPY is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 62, suggesting the pair might be traded lower since the RSI retraced from its overbought territory.

Resistance level: 150.25, 151.45

Support level: 148.50, 146.25

Despite strong fundamentals driven by aggressive oil production cuts by Saudi Arabia and Russia, the oil market witnessed a dip, with signs of potential overbought conditions. Investor caution prevails ahead of the release of the high-impact US PCE Price Index, which holds indirect implications for oil prices. Some investors chose to lock in profits to mitigate market volatility.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the commodity might enter overbought territory.

Resistance level: 94.40, 101.00

Support level: 87.80, 79.65

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!