-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Key Takeaways:

*The Japanese Yen remains weak ahead of the Bank of Japan’s policy decision, with markets expecting the central bank to maintain its ultra-loose stance under new Prime Minister Sanae Takaichi’s influence.

*Political optimism over Takaichi’s pro-growth policies and expectations of continued fiscal stimulus have driven the Nikkei 225 to a historic peak above 51,000.

*The BoJ’s policy statement and upcoming CPI release will be crucial in determining the next direction for both the Yen and Japanese equities.

Market Summary:

The Japanese Yen is poised for a period of heightened volatility as market participants await the Bank of Japan’s (BoJ) upcoming rate decision and, more importantly, the nuances within its monetary policy statement. This event takes place against a backdrop of sustained weakness in the Yen, which has faced significant downward pressure following the inauguration of the new Japanese Prime Minister, Sanae Takaichi. Her explicit calls for the central bank to align its policies with the government’s agenda have been perceived by the market as a strong dovish signal, reinforcing expectations that the BoJ will maintain its ultra-accommodative stance.

This political shift has had a divergent impact on domestic assets. While the Yen has softened, the country’s equity market, the Nikkei 225, has rallied to a historic peak above the 51,000 mark. This surge reflects investor optimism that Prime Minister Takaichi will continue the legacy of Shinzo Abe, championing expansive government spending and advocating for persistently loose monetary policy to fuel economic growth. Such speculation has been a key driver behind the stock market’s upward momentum.

In the immediate term, the trajectory for both the Japanese Yen and the Nikkei 225 will be critically determined by the BoJ’s rhetoric regarding its near-term policy path. Furthermore, tomorrow’s Consumer Price Index (CPI) reading will serve as another pivotal data point, offering a crucial gauge of domestic inflation pressures and potentially shaping the central bank’s future actions. All eyes are now on these key events to determine whether the current trends will solidify or reverse.

Technical Analysis

The USDJPY pair is now hovering near its highest levels of the year. The broader technical structure retains a bullish bias, as the pair has consistently charted a pattern of higher highs and remains firmly supported above its key uptrend line. This underlying momentum, however, is now being challenged by significant technical headwinds.

A formidable resistance barrier has emerged around the 153.15 level, where the pair has faced rejection on two separate occasions, forming a potential double-top pattern. This classic chart formation often signals a bearish reversal and indicates that selling pressure intensifies at this height. The market is now at a critical inflection point, making this resistance level the primary focal point for the next major move. A decisive breakout above 153.15 would invalidate the bearish pattern and serve as a solid bullish signal, potentially unlocking further gains. Conversely, another rejection from this level would constitute a strong selling signal, likely triggering a corrective move lower.

The RSI is hovering near its midline, offering a neutral reading that suggests a balance between buying and selling forces. Meanwhile, the MACD indicator is flashing a more cautionary signal; it has formed a lower high and is now flirting with the zero line. This divergence suggests that the underlying bullish momentum is waning and adds credence to the potential for a bearish reversal.

Resistance level: 153.16, 156.05

Support level: 149.70, 146.35

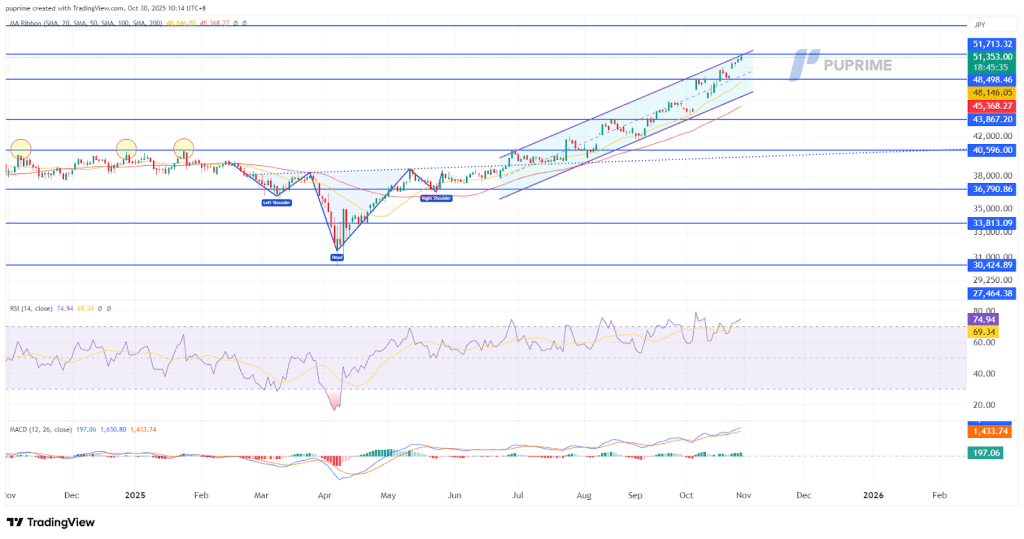

The Nikkei 225 has continued its powerful ascent, fueled by a confirmed breakout from a major inverse head-and-shoulders pattern — a classic bullish reversal signal. The index’s decisive surge above the key 40,800 resistance level, which had repeatedly capped gains in prior attempts, marked a pivotal technical shift. Since that breakout, the Nikkei has rallied approximately 27%, underscoring strong buying momentum that has now carried the benchmark past the psychological 50,000 mark.

Technical indicators continue to affirm the strength of the uptrend. The Relative Strength Index (RSI) has entered overbought territory, while the Moving Average Convergence Divergence (MACD) remains firmly on an upward trajectory. Together, these signals point to sustained bullish momentum and reinforce a constructive near-term outlook for the Nikkei 225.

Resistance level: 55,500.00, 60,945.00

Support level: 48,500.00, 43,870.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!