-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*Regional Bank Selloff: Shares in Western Alliance (-10.8%) and Zions Bank (-13.1%) tumbled after disclosing exposure to alleged borrower fraud, sparking concerns over U.S. regional bank credit quality.

*Credit Market Anxiety: The KBW Regional Banking Index plunged 6.3%, its sharpest one-day fall since April, reflecting heightened stress in smaller lenders.

*Policy and Macro Risks: The ongoing U.S. government shutdown and renewed U.S.–China trade tensions continued to cloud investor sentiment.

Market Summary:

TU.S. equity markets pulled back slightly but remained near all-time highs, as investors weighed a mix of bullish tech momentum against rising macro and credit concerns. The U.S. government shutdown and trade tensions with China continued to erode confidence, while a fresh wave of regional banking stress added downside pressure.

Shares in Western Alliance Bank and Zions Bank fell sharply after both disclosed potential exposure to borrower fraud — reigniting concerns over the health of smaller U.S. lenders. The KBW Regional Banking Index slumped 6.3%, marking its biggest daily loss in months. Analysts warn that broader contagion fears could dampen risk appetite if similar credit risks emerge.

Despite the caution, tech and AI-linked stocks remain the backbone of equity resilience. Companies like Nvidia, Apple, and Google continue to deliver robust earnings and innovation-driven optimism, helping to offset losses in cyclical and financial sectors.

Still, the balance of risks leans uncertain — with policy paralysis in Washington, a potential credit crunch, and slowing global demand all threatening to stall the current bull run. Investors are advised to stay vigilant as volatility could spike in the near term.

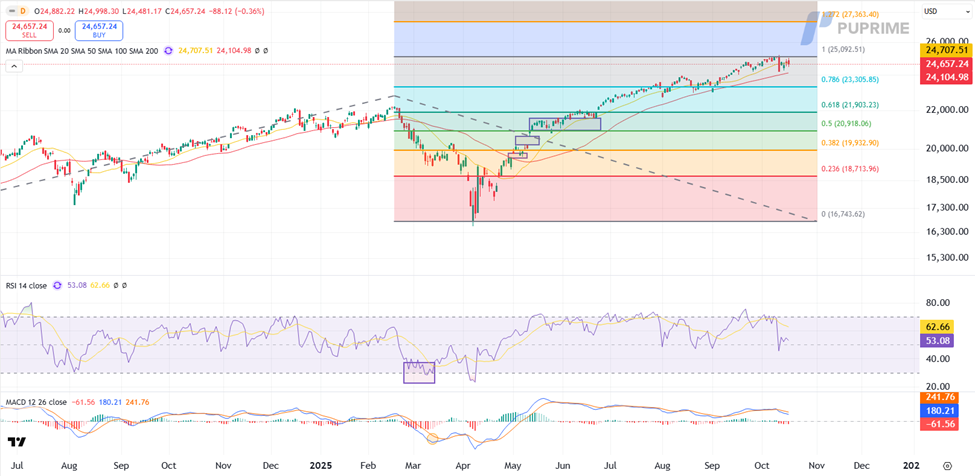

Technical Analysis

NASDAQ, H4:

The Nasdaq index remains near record highs but shows signs of short-term exhaustion. MACD has formed a bearish crossover, signaling waning upward momentum, while RSI at 53 has retreated from overbought levels.

A sustained break below the moving average line (red) could confirm a downside correction toward support at 23,305, with deeper pressure targeting 21,905. On the upside, resistance stands at 25,090, followed by 27,365, where renewed bullish momentum may re-emerge if tech optimism persists.

Resistance Levels: 25,090.00, 27,365.00

Support Levels: 23,305.00, 21,905.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!