-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*A sharp shift in sentiment saw gold retreat after its October surge, while the Dow Jones hit a record high of 46,926 amid renewed risk appetite.

*Markets rallied on softer trade rhetoric from former President Trump, echoing the “Trump Always Chickens Out” pattern of buying dips on tariff threats.

*The upcoming U.S. inflation report on Friday will test the rally’s durability and guide expectations for the Fed’s next policy move.

Market Summary:

A dramatic sentiment shift swept through financial markets in the last session, characterized by a significant plunge in safe-haven gold and a powerful rally in risk assets. The yellow metal, which had jumped over 9% in October, reversed course as investors pivoted toward equities, sending the Dow Jones Industrial Average to a fresh all-time high of 46,926.

This risk-on surge was largely fueled by a perceived softening in trade rhetoric from former President Trump, despite earlier tariff threats against China. The market’s reaction exemplifies a pattern now colloquially termed the “TACO” trade—an acronym for “Trump Always Chickens Out.” This strategy involves buying assets on dips caused by aggressive tariff announcements, anticipating that the threats will be delayed or walked back, ultimately leading to a profitable rebound. Wall Street’s current price action is a textbook manifestation of this pattern, with the bullish momentum expected to persist in the near term, potentially pushing other major indices to challenge their own record highs.

However, the sustainability of this rally faces a critical test with the upcoming release of the September U.S. CPI report on Friday. The inflation print will be a pivotal factor in shaping the Federal Reserve’s monetary policy trajectory, with the potential to either reinforce the current risk-on sentiment or trigger a reassessment of the interest rate outlook. While the “TACO” trade provides a short-term narrative, fundamental economic data remains the ultimate driver for market direction.

Technical Analysis

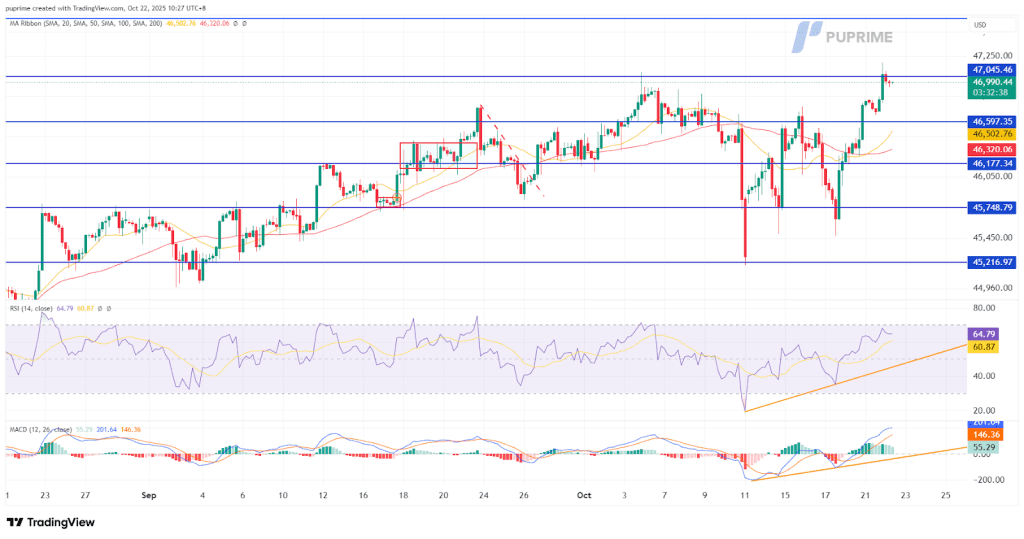

The Dow Jones Industrial Average has demonstrated formidable strength, decisively breaking its previous structure by not only recouping all of last Friday’s losses but also catapulting to a fresh all-time high, decisively surpassing the 47,000 milestone. This powerful price action signals that the index is trading with strong underlying bullish momentum and confirms a resumption of its primary uptrend.

While a minor technical pullback is a common occurrence following a record-breaking rally, the key level to watch for sustained bullish health is the 46,800 mark. Should the index find support above this level, it would indicate that the breakout is being respected and that the bullish trajectory remains firmly intact.

The bullish bias is strongly corroborated by momentum indicators. The Relative Strength Index (RSI) is gaining and is poised to test overbought territory, reflecting intense buying pressure. Simultaneously, the Moving Average Convergence Divergence (MACD) has confirmed its bullish stance by crossing above its zero line and continues to trend higher. This confluence of a record-high breakout, a defined support level, and strengthening momentum indicators paints a convincingly bullish picture for the index in the near term.

Resistance level: 47,640.00, 48,225.00

Support level: 46,600.00, 46,200.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!