-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

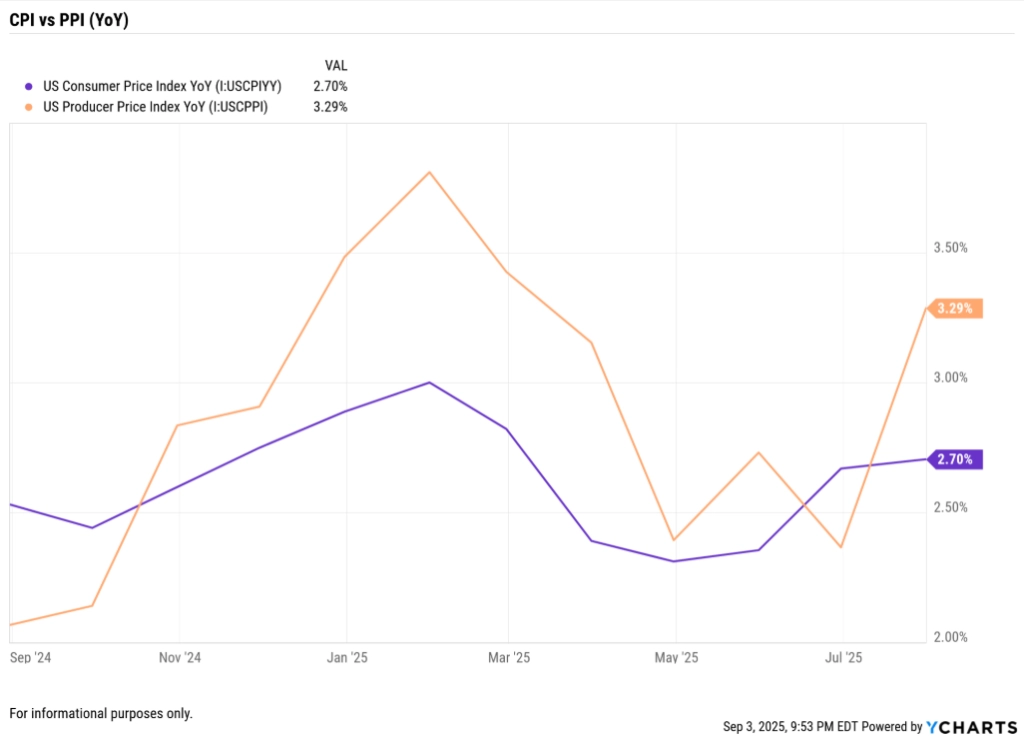

Producer Price Index (PPI) tracks prices received by producers, while Consumer Price Index (CPI) tracks prices paid by consumers. Because producer costs can flow through supply chains to retail prices, PPI can provide an early read on CPI. Pass-through means the extent to which changes in producer costs show up in consumer prices. It can be partial, delayed, or absorbed in company margins, and it varies by sector and economy.

Traders who understand this relationship can better interpret inflation momentum, potential policy signals, and how markets may react to new data.

Inflation data plays a central role in shaping financial markets. From guiding central bank decisions to driving price movements in currencies, commodities, and equities, understanding inflation trends is essential for informed trading. Among the most closely watched inflation metrics are the CPI and the PPI. Bureau of Labor Statistics

While both indicators provide insight into price dynamics, they do so from different perspectives. CPI reflects the changing cost of goods and services paid by consumers, while PPI measures price changes received by producers. This relationship offers a potential forecasting advantage. Federal Reserve Bank of Richmond

Traders using platforms like PU Prime often monitor PPI data as an early signal of where consumer inflation might be headed. Since producer costs can influence retail prices, understanding how PPI movements may lead CPI figures can help traders anticipate policy shifts and price reactions across multiple markets.

Central banks, such as the Federal Reserve (Fed), the European Central Bank (ECB), and the Reserve Bank of Australia (RBA), monitor these reports when assessing inflationary pressures and setting policy. For market participants, interpreting this data with precision is key to navigating volatility and identifying potential trading opportunities.

The Consumer Price Index (CPI) is a key measure of inflation, widely used by governments, economists, and traders around the world. It tracks the average change in prices paid by consumers for a representative set of goods and services over time, offering a snapshot of cost-of-living trends in a given economy.

The CPI is based on a representative “market basket” that is periodically updated to reflect common household spending patterns. Typical categories include:

The weighting of these categories may vary across countries, as national statistics agencies tailor the basket to match local consumption patterns.

CPI plays a central role in shaping inflation expectations and monetary policy decisions. When consumer prices rise more quickly than expected, central banks may respond by raising interest rates to cool inflationary pressure. A lower-than-expected CPI can support looser policy.

Many countries release CPI data monthly, and these announcements often lead to sharp movements in financial markets. Traders monitor CPI figures to assess potential impacts on currency values, interest rates, and broader market sentiment. Understanding what is driving the headline and core CPI figures can help reveal where inflation pressures are building and what that might mean for market positioning.

Key Takeaways

CPI measures the average change in consumer prices for a basket of goods and services. It reflects the cost of living and consumer purchasing power. CPI composition and weighting vary by country to reflect local spending habits. Central banks monitor CPI to guide monetary policy decisions. CPI releases are closely watched by traders for their impact on market volatility.

The Producer Price Index (PPI) tracks the average change in prices received by domestic producers for their goods and services. It reflects inflation at an earlier stage in the economic cycle, before costs reach the consumer. Because of this upstream perspective, PPI is often considered an early signal of potential changes in consumer inflation.

PPI focuses on prices at the point of first commercial sale. This includes goods sold to wholesalers, retailers, or other businesses. Unlike CPI, which covers final consumer prices, PPI captures pricing dynamics within the production and supply chain.

PPI is usually reported in three stages:

By examining price shifts at each level, traders and analysts can better understand how inflation pressures might develop over time.

The PPI primarily covers goods-producing sectors such as manufacturing, mining, and agriculture. In most economies, it does not include service industries or imported goods, which can limit its scope compared to CPI. However, this narrower focus is also what makes PPI a useful tool for identifying price trends before they reach consumers.

PPI data is typically released monthly by national statistical agencies. While methodologies differ between countries, the general structure and interpretation are consistent across global markets.

Key Takeaways

PPI measures average price changes received by producers for their output. It captures early-stage inflation, often before it reaches consumers. The index includes raw materials, intermediate goods, and finished products. PPI focuses on domestic production and usually excludes services and imports. Traders view PPI as a potential leading indicator for broader inflation trends.

While both the Producer Price Index (PPI) and Consumer Price Index (CPI) measure inflation, they do so from different points in the supply chain. Understanding their distinctions helps traders interpret how inflation builds over time and where it is most likely to impact markets.

Although methodologies vary by country, CPI and PPI are usually compiled through different surveys, with CPI based on retail outlets and PPI based on business-to-business transactions.

| Feature | CPI | PPI |

| Perspective | Consumer (buyer) | Producer (seller) |

| Focus | Final goods and services | Goods at production/wholesale level |

| Includes Services | Yes | Rarely |

| Includes Imports | Yes | No |

| Includes Taxes | Yes (sales/excise) | No (usually excludes end-use taxes) |

| Timing of Inflation | Reflects current consumer cost | Indicates potential future consumer cost |

Key Takeaways

CPI and PPI measure inflation at different stages of the economic cycle. CPI includes services, import prices, and consumer-level taxes. PPI reflects wholesale price trends and excludes imports and most services. Understanding both helps traders interpret the timing and source of inflationary pressures.

One of the most valuable applications of the Producer Price Index (PPI) in trading is its ability to serve as a leading indicator for the Consumer Price Index (CPI). Since PPI reflects the prices producers receive for goods and services before they reach end consumers, changes in PPI often signal future shifts in consumer-level inflation.

When input costs rise for manufacturers (such as raw materials, fuel, or packaging) those costs may eventually be passed on to retailers and then to consumers. For example:

However, the speed and extent of this pass-through can vary based on market conditions, supply chain efficiency, competition, and profit margin pressures.

In some cases, PPI and CPI may move in different directions or show a time lag between peaks and troughs. Traders and analysts look for these gaps to:

By monitoring PPI trends ahead of CPI releases, traders can develop expectations around inflation momentum, central bank responses, and sector-specific price dynamics.

Key Takeaways

PPI often moves before CPI, offering an early view of inflation trends. Wholesale price increases can signal future consumer price changes. Delays in pass-through depend on market conditions and cost absorption. Divergences between PPI and CPI may reveal pressure on margins or structural shifts. Traders use this relationship to build inflation expectations and monitor potential policy reactions.

For active traders, the relationship between PPI and CPI offers a valuable framework for interpreting inflation developments and anticipating how markets may react. By assessing whether producer costs are rising and if those increases are feeding into consumer prices, traders can form views on potential impacts across asset classes.

Monitoring PPI trends ahead of CPI releases helps traders anticipate how inflation might evolve in the short term. A sharp rise in producer prices may suggest upward pressure on consumer inflation, particularly if the trend is broad-based and sustained across sectors.

This insight can influence trading decisions in markets that tend to react to inflation indicators, such as:

These instruments are accessible as Contracts for Difference (CFDs) on platforms like PU Prime, allowing traders to speculate on inflation-related price movements without taking ownership of the underlying assets.

Central banks emphasize consumer inflation measures when assessing policy, but early movement in producer prices can alert traders to upstream pressures that may later influence inflation assessments.

Euro area, early 2022:

Industrial producer prices recorded historic increases in early 2022, driven in large part by energy. On March 3, 2022, Eurostat reported that euro area industrial producer prices were up sharply year over year. The European Central Bank then began its tightening cycle with its first interest rate increase in 11 years on July 21, 2022. These developments illustrate how pronounced upstream price pressures can coincide with a reassessment of the inflation outlook and a shift toward policy normalization. European Commission European Central Bank

Understanding this sequence helps traders interpret the tone of central bank commentary and assess the probability of upcoming policy changes.

Trading CFDs involves speculation and carries significant risk. Traders do not own the underlying instruments, and past performance does not indicate future results. Market movements around inflation data releases can be volatile, and trading should be approached with proper risk management.

Key Takeaways

Traders monitor PPI as a potential lead-in to CPI movements. Inflation data influences currency, commodity, and equity markets. PU Prime offers access to inflation-sensitive instruments via CFDs. Expectations around CPI and PPI trends can inform views on central bank policy. All trading involves risk and should be guided by careful analysis and risk controls.

Inflation is a key driver of market behaviour, influencing everything from interest rates to corporate earnings. When inflation trends shift, traders often see significant movements across currencies, bonds, equities, and commodities. Understanding how CPI and PPI figures shape inflation expectations helps explain why these data points matter across asset classes.

Central banks typically raise interest rates to control high inflation. As rate expectations rise, the local currency often strengthens due to increased capital inflows and higher yield potential. For example, a stronger-than-expected CPI reading may lead traders to anticipate a rate hike, increasing demand for that country’s currency.

Inflation erodes the real return on fixed-interest investments like government bonds. Rising inflation usually causes bond prices to fall and yields to rise, as investors demand higher compensation for purchasing fixed-income assets in an inflationary environment.

Inflation’s impact on equities depends on several factors:

Many traders view commodities as a potential hedge against inflation. Rising prices for energy, metals, and agricultural goods often reflect broader cost pressures in the economy. Strong CPI and PPI figures can therefore support demand in commodity markets, especially when driven by supply-side constraints or robust demand growth.

Inflation data is a central input in monetary policy decision-making. Institutions such as the Federal Reserve, European Central Bank, and Reserve Bank of Australia assess CPI and PPI trends when evaluating interest rate adjustments, forward guidance, or other policy tools. These decisions often have broad market implications and are closely watched by traders.

Key Takeaways

Inflation affects currencies, bonds, stocks, and commodities in different ways. Strong inflation data can lead to higher interest rates and currency appreciation. Bonds often fall in value when inflation rises, due to weaker real returns. Equities may respond based on sector sensitivity and pricing power. Commodities are often used as inflation hedges and may rise on strong CPI or PPI data.

While inflation data can vary significantly across economies and time periods, the interaction between PPI and CPI often follows observable patterns. Traders who track these developments can gain a deeper understanding of how upstream cost changes affect consumer pricing and broader market sentiment.

Items such as energy and food tend to show high price volatility and can drive large short-term shifts in both PPI and CPI. For example, a sharp rise in crude oil prices may first appear in the PPI as higher transportation or manufacturing costs. In the following months, the CPI may reflect these pressures through increased fuel and consumer goods prices.

Conversely, a drop in wholesale agricultural prices could lower PPI, which might later contribute to slower food price growth at the consumer level.

In some inflation cycles, traders have observed a clear pass-through from PPI to CPI:

These examples show how sector-level shifts can provide early signals for broader inflation trends.

There are also periods when PPI and CPI diverge. This may occur if producers choose to absorb cost increases to remain competitive, limiting pass-through to consumers. Alternatively, service-sector inflation (reflected in CPI but not captured in many PPI indices) may rise independently of producer-level costs.

Understanding these dynamics helps traders assess whether inflationary pressures are temporary or building more broadly across the economy.

Key Takeaways

Energy and food prices often lead to sharp movements in both PPI and CPI. Price increases at the production level can take time to affect consumer prices. Sector-specific data can help identify early inflation signals. Divergences between PPI and CPI may reflect cost absorption, policy effects, or structural market differences.

While the relationship between PPI and CPI can offer valuable insights, traders should be aware that it is not always straightforward. Several economic, structural, and behavioural factors can influence how and when producer-level price changes affect consumer prices.

One of the key limitations in using PPI as a predictor for CPI is the timing of the pass-through. Some producers may absorb cost increases due to competitive pressures, contractual pricing, or temporary subsidies. Others may delay price adjustments until consumer demand supports the change.

This lag means that rising PPI does not automatically lead to rising CPI in the next release. The effect can be delayed, uneven across sectors, or partially offset by other economic forces.

PPI and CPI are constructed differently and serve distinct purposes. PPI usually excludes:

CPI, on the other hand, focuses on urban consumer expenditures and may not fully capture rural or non-household inflation. As a result, both indexes provide only a partial view of overall inflation and should be interpreted alongside other macroeconomic data.

Inflation data releases often generate short-term market volatility, particularly if results deviate from expectations. Traders positioning around these events face risks including:

These considerations reinforce the need for a well-rounded view when interpreting inflation data in trading strategies.

Key Takeaways

The link between PPI and CPI is influenced by timing, market structure, and cost absorption. PPI excludes services and imports, while CPI focuses on urban consumer spending. Not all producer price changes are passed on to consumers. Traders face volatility and uncertainty around inflation data releases. Inflation indicators should be analysed in context with other economic signals.

The relationship between the Producer Price Index (PPI) and Consumer Price Index (CPI) can provide early insight into inflation developments and the broader direction of the economy. While CPI reflects consumer price trends, movements in PPI often appear earlier in the inflation cycle, offering traders a useful signal for anticipating potential shifts.

By studying how producer-level pricing changes filter through to retail markets, traders gain a deeper understanding of market dynamics. Whether assessing potential monetary policy reactions, watching for margin pressures across sectors, or gauging the outlook for key asset classes, inflation indicators are a valuable part of any macro-informed trading approach.

On platforms like PU Prime, traders can access CFDs on forex, commodities, and indices—all of which can be influenced by inflation expectations. This makes the ability to interpret economic data not only informative, but also practical.

Access to real-time economic data, advanced charting tools, and a wide range of instruments makes PU Prime a powerful platform for traders who want to stay ahead of the market. Whether you’re responding to inflation releases or planning your next position, equip yourself with the insight and tools to trade with clarity.

PPI measures the average change in prices received by domestic producers for their output, while CPI tracks the average change in prices paid by consumers for goods and services. PPI focuses on early-stage transactions in the production process, whereas CPI reflects final consumer-level pricing.

Because producer prices often move before retail prices, increases in PPI can signal that consumer prices may rise in the future. However, the pass-through is not always immediate or guaranteed.

Central banks monitor both indexes to assess inflationary pressures. CPI is often the primary measure used in policy decisions, while PPI helps identify upstream cost trends that could influence future CPI readings.

Not always. While the two are often correlated, several factors can weaken or delay the connection, including competition, productivity gains, subsidies, and changing demand conditions.

Inflation data releases can trigger sharp price movements. Risks include increased market volatility, unexpected outcomes, and potential data revisions. Traders should also consider the broader economic context and manage risk carefully when positioning around these events.

Both PPI and CPI are usually published monthly by national statistical agencies. Exact release dates vary by country, but traders often track them closely in economic calendars due to their impact on markets.

CPI data often has the strongest influence on currency and bond markets, as central banks use it to guide monetary policy. PPI can influence commodities and equities earlier in the cycle, especially when input costs are rising sharply.

Core CPI excludes volatile items such as food and energy to provide a clearer picture of underlying inflation trends. Many central banks focus on core measures when assessing long-term inflation pressures.

Yes. For example, declining producer prices may not immediately translate to lower consumer prices if service-sector inflation or other consumer costs remain high.

Traders often monitor forecasts, compare them against actual results, and watch for deviations from expectations. Many also use economic calendars and trading platforms like PU Prime to plan around potential volatility.

Because the two indexes complement each other: PPI offers early signals, while CPI provides confirmation of how inflation is affecting households and guiding central bank policy.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!