-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*Crude oil remains rangebound as traders weigh tightening supply risks against weakening demand.

*U.K. sanctions and Trump’s comments on India phasing out Russian oil raise supply concerns, but markets doubt near-term disruption.

*U.S. and China growth softness continues to cap demand, overshadowing geopolitical risks.

Market Summary:

Crude oil prices are struggling to find equilibrium, trading within a tight range as investors weigh conflicting signals from geopolitics and fundamentals. On one hand, supply-side risks are intensifying following fresh U.K. sanctions targeting Russia’s oil majors and shadow tanker fleet, alongside President Trump’s claim that India will phase out Russian oil imports. These developments threaten to disrupt Russian export flows and potentially tighten global supplies. However, traders remain skeptical of the immediate impact given Moscow’s history of rerouting exports through alternative buyers and networks.

On the demand side, economic softness in the U.S. and China continues to overshadow supply disruptions. The Fed’s acknowledgment of downside risks to growth, coupled with the lingering effects of the trade war, has dampened industrial and freight activity, curbing energy consumption. The International Energy Agency’s warning of a record supply surplus in 2026, alongside OPEC+’s gradual restoration of production, has reinforced bearish sentiment. Structural indicators such as the WTI timespread flipping into contango point to a market already grappling with physical oversupply.

Although periodic geopolitical flare-ups may spark temporary rallies, the overarching narrative remains cautious. Without a meaningful rebound in demand or concrete proof that sanctions will significantly curb Russian exports, oil is likely to remain under pressure, with upside moves limited by an increasingly heavy supply backdrop and fragile global growth prospects.

Technical Analysis

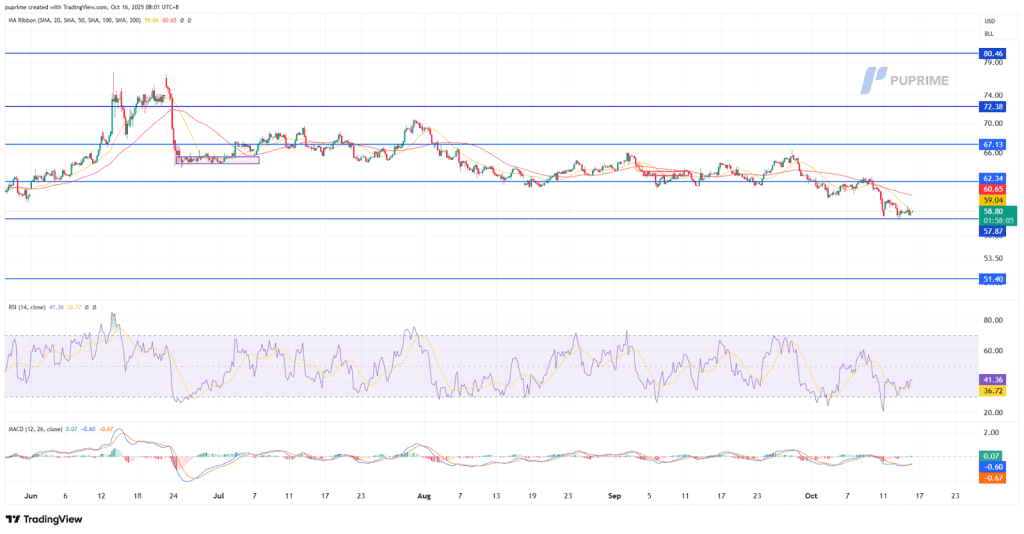

USOIL, H4:

Crude oil remains under sustained pressure, extending its decline for a second week as sellers maintain control below the key $60.00 handle. The broader downtrend remains intact, with price action capped by the 20- and 50-period moving averages, both sloping downward signaling persistent bearish momentum.

On the momentum front, RSI hovers around 41, suggesting weak recovery attempts after a deeply oversold stretch. Meanwhile, the MACD remains below the zero line, though showing early signs of a potential bullish crossover, hinting at possible short-term stabilization.

Overall, the technical bias remains bearish unless oil can hold above $60.00 with follow-through buying. Failing that, momentum indicators point to further downside risk toward $57.90, in line with a broader risk-off tone across commodities.

Resistance Levels: 62.35, 67.15

Support Levels: 57.90, 51.40

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!