-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*Oil prices plunged to fresh multi-month lows below $56 as supply risks eased and demand concerns deepened.

*The Israel–Hamas ceasefire and hostage releases reduced fears of regional supply disruptions, removing a key support for prices.

*Slowing global growth and renewed U.S.–China trade tensions cloud consumption prospects, keeping oil’s near-term bias tilted to the downside.

Oil markets faced substantial selling pressure last week, with West Texas Intermediate (WTI) crude sliding to a fresh low since May, breaching the $56.14 mark. The downturn reflects a fundamental shift in market dynamics, driven by a confluence of easing supply fears and a deteriorating demand outlook.

On the supply side, the risk premium associated with Middle East disruptions has notably diminished. The ceasefire agreement between Israel and Hamas and the subsequent release of hostages have alleviated immediate concerns over potential supply shocks from one of the world’s most critical oil-producing regions.

However, the more persistent bearish pressure stems from a gloomy demand forecast. Economic growth in key consuming nations—including China, the Eurozone, and the United States—is showing signs of deceleration, which is expected to suppress energy consumption. This outlook is further darkened by renewed trade tensions between Washington and Beijing, which threaten to slow global economic activity and, by extension, dampen oil demand.

All eyes are now on the delayed U.S. Consumer Price Index (CPI) reading due this Friday. As a crucial gauge of inflation and economic health, the data will heavily influence the Federal Reserve’s policy path and the U.S. dollar’s strength, making it a pivotal catalyst for oil prices in the near term. The prevailing market sentiment suggests that without a significant improvement in demand fundamentals or a fresh supply disruption, the path of least resistance for oil remains downward.

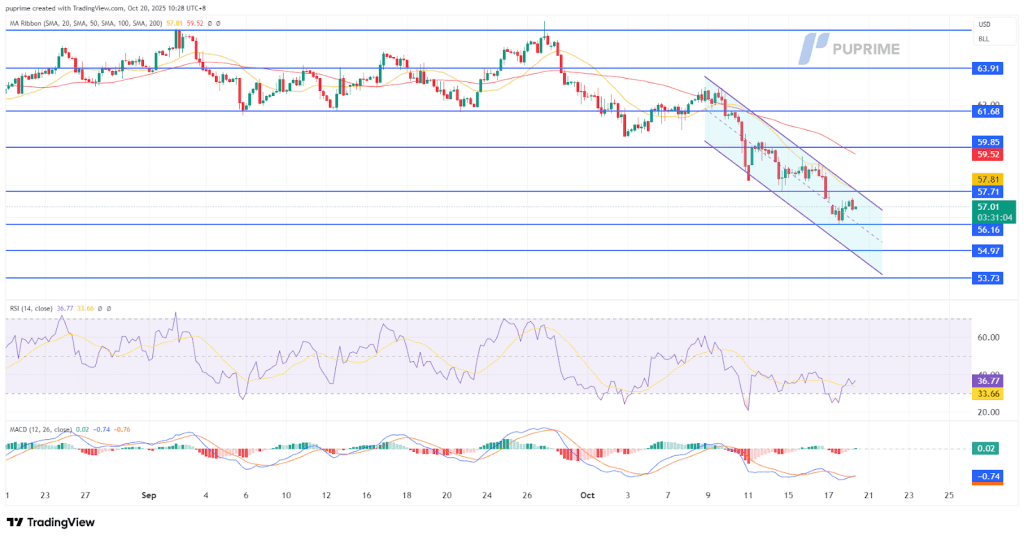

Oil prices remain entrenched within a steep downtrend channel, having registered a 1.73% decline last week. The market structure is decidedly bearish, with the immediate focus on the critical support level at the $56.20 mark. A decisive break below this threshold would signal a continuation of the sell-off, opening a path toward lower technical targets.

The bearish price action is supported by deteriorating momentum indicators. The Relative Strength Index (RSI) is poised to breach into oversold territory, reflecting intensifying selling pressure. Concurrently, the Moving Average Convergence Divergence (MACD) continues to edge lower after having already crossed below its zero line. This technical confluence indicates that bearish momentum is not only present but is actively gaining strength, aligning with the prevailing negative market bias. The path of least resistance remains firmly to the downside.

Resistance Levels: 57.70, 59.85

Support Levels: 56.15, 54.95

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!