-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Key Takeaways:

*Markets remain volatile as shifting U.S.-China trade rhetoric—from tariff threats to potential export curbs—keeps investors on edge.

*The U.S. dollar faces renewed pressure amid dovish Fed expectations, while gold holds firm above $4,000 as safe-haven demand steadies.

*The upcoming U.S. CPI release and next week’s APEC summit in Korea are set to define market direction and global risk sentiment.

Market Summary:

Financial markets are navigating a period of heightened uncertainty, balancing volatile shifts in U.S.-China trade policy against pivotal upcoming economic data and diplomatic engagements. The dominant theme remains the erratic trajectory from the White House, which has left investors in a cautious “wait-and-see” mode. The cycle began with a sharp escalation as former President Trump threatened 100% tariffs on China, citing restrictive rare earth exports, only for him to pivot to a more conciliatory tone days later, soothing frayed nerves. This reprieve proved short-lived, however, as his administration is now reportedly considering new curbs on exports of U.S. software and high-technology products, reigniting fears of a prolonged trade war.

This policy whiplash has created clear undercurrents in key asset classes. The U.S. dollar is encountering sustained downside pressure, weighed down by the dual headwinds of renewed trade tensions and market expectations for a dovish Federal Reserve. Conversely, safe-haven gold has discovered a firm support base above the critical psychological level of $4,000, though its upward momentum has been tempered by hopes for diplomatic de-escalation.

The market’s holding pattern is expected to be broken by two imminent catalysts. First, the release of the U.S. Consumer Price Index data tomorrow will be crucial for recalibrating interest rate expectations. The inflation print could pivot the Fed’s upcoming policy decision, directly impacting the dollar’s yield appeal and gold’s non-interest-bearing allure. Subsequently, all eyes will turn to the APEC summit in Korea next week, where the U.S. and Chinese leaders are scheduled to meet face-to-face for the first time since the administration change. This meeting is widely perceived as a critical opportunity to resolve lingering issues on tariffs and export controls, with its outcome likely to set the tone for global risk sentiment and capital flows in the weeks to come.

Technical Analysis

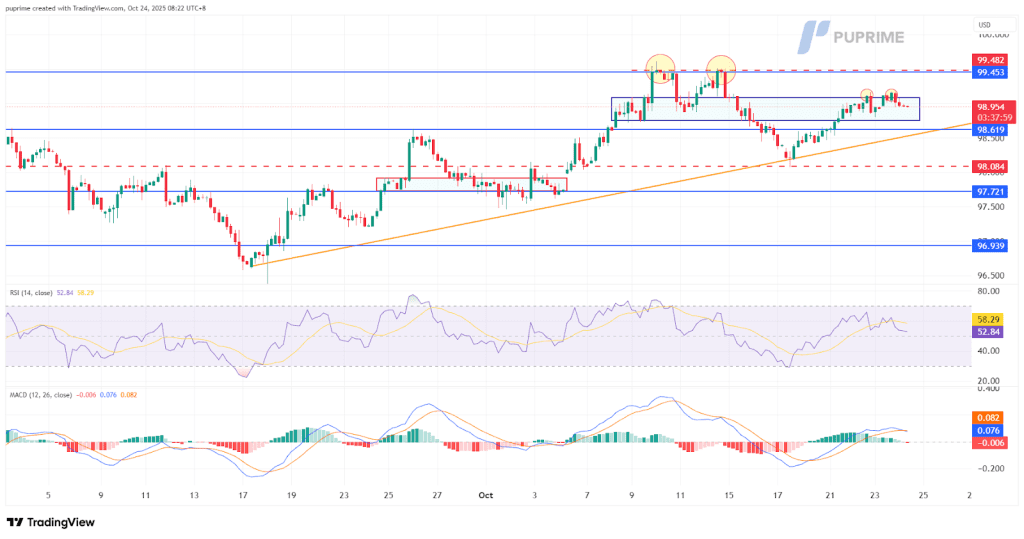

The U.S. Dollar Index is exhibiting signs of a potential bearish reversal, having formed a distinct double-top price pattern following a recent decline of over 1.3%. The latest price action shows the index was once again rejected near the 99.15 resistance level, reinforcing this level as a significant barrier and signaling a high probability of a resumption of the downtrend in the upcoming sessions.

This bearish technical structure is further supported by underlying momentum, which suggests the bullish drive is faltering. The Relative Strength Index (RSI), while holding above its mid-point, lacks upward conviction. More notably, the Moving Average Convergence Divergence (MACD) is tracing a pattern of lower highs, indicating that buying momentum is steadily easing and that sellers may be regaining control.

The convergence of the double-top reversal pattern at a key resistance level and the waning bullish momentum paints a compelling bearish picture. A confirmed break below the recent swing low would validate this outlook and likely trigger a move toward lower support levels. The index’s ability to hold above the 99.15 mark remains the critical test for the bulls.

Resistance level: 99.45, 100.40

Support level: 98.60, 97.70

Gold prices have entered a phase of consolidation, trading within a narrow range following a significant recent sell-off that saw the metal decline by over 8%. Despite this downward pressure, a strong layer of support has emerged above the $4,070 level, as evidenced by the repeated formation of lower wicks and consistent daily closes above this threshold, indicating sustained buying interest at these lower levels.

The immediate technical outlook hinges on the metal’s ability to address the nearby Fair Value Gap (FVG) residing below $4,166. A decisive and sustained break above this $4,166 level would signal a potent bullish trend reversal, suggesting that the prior sell-off has been fully absorbed. Conversely, a clear rejection from this FVG would imply that bearish forces remain in control, likely leading to a re-test of the $4,070 support base.

The momentum landscape presents a nuanced picture. While the Relative Strength Index (RSI) remains subdued below its mid-point, and the Moving Average Convergence Divergence (MACD) flirts with a bearish crossover below its zero line, the intensity of the bearish momentum appears to be easing. This creates a tension between the constructive price action at support and the still-cautious momentum readings. The resolution of this stalemate at the $4,166 FVG will be critical in determining gold’s next directional move.

Resistance level: 4200.00, 4294.00

Support level: 4018.70, 3947.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!