-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

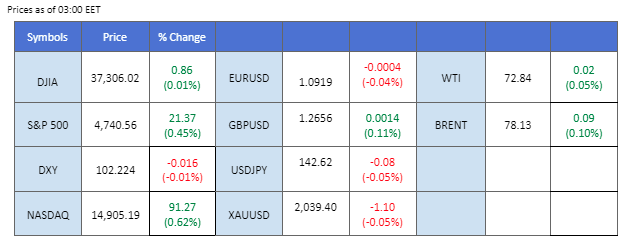

The Japanese Yen has taken centre stage as it gains ahead of the Bank of Japan’s (BoJ) interest rate decision. The market widely believed that the Japanese central bank is likely to maintain its current interest rate policy but anticipates a potential shift from its ultra-loose policy very soon. Simultaneously, the Australian dollar is finding support from the recently released Reserve Bank of Australia (RBA) meeting minutes. Despite the RBA keeping its interest rate level unchanged earlier, the meeting minutes indicate that Australian authorities remain focused on battling inflation while keeping the possibility of further rate hikes open. Furthermore, oil prices continue to be buoyed by the vessel attacks in the Red Sea, disrupting oil supplies and contributing to ongoing market dynamics.

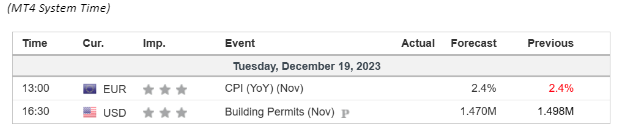

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (89.0%) VS 25 bps (11%)

The US Dollar held its ground with a lack of defining catalysts, leaving the overall trend flat. Investors keenly anticipate the forthcoming Core PCE Index release, expected to unveil crucial insights. While market speculation swirls around potential Fed rate cuts in March and throughout the year, the dovish sentiment from the Fed may already be fully absorbed. Traders are advised to exercise patience and await future economic data and Fed statements for a clearer picture of the Dollar’s likely trajectory.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 42, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 102.60, 103.50

Support level: 101.80, 101.30

Gold prices exhibited resilience, maintaining a steady position around the resistance level of 2030.00. The absence of significant market catalysts from the US contributed to this flat movement. Despite the current stagnation, the long-term outlook for gold remains positive, fueled by the potential for Federal Reserve rate cuts. If the Fed aligns with economists’ expectations, signalling further interest rate reductions, gold is poised to benefit from the ensuing diminished appeal of the US Dollar, making non-yielding assets like gold more attractive.

Gold prices are trading flat while currently testing the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the commodity might trade lower in short-term as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 2030.00, 2055.00

Support level: 2010.00, 1980.00

The GBP/USD pair is struggling to gather momentum for a potential trend reversal as the U.S. dollar maintains its strength. The dollar received support from a hawkish statement from the Federal Reserve, with the Cleveland Fed president moderating market optimism regarding potential rate cuts. The upcoming UK Consumer Price Index (CPI) data, scheduled for tomorrow, is expected to have an impact on the movement of the Cable (GBP/USD) pair.

GBP/USD is supported at near 1.2630 while the bullish momentum is drastically eased. The RSI is declining to near the 50- level from the overbought zone while the MACD has crossed the above and is approaching the zero line, suggesting that the bullish momentum has vanished.

Resistance level: 1.2729, 1.2815

Support level: 1.2630, 1.2528

The Euro has undergone a technical retracement from its recent bullish run but has maintained a generally bullish trajectory overall. Currently, the market is anticipating, waiting for the Euro’s Consumer Price Index (CPI) data to act as a catalyst for the pair to pick a clear direction. The pair appears to be trading sideways as traders await crucial economic data that could influence the Euro’s strength and guide future price movements.

The bearish momentum eases, and the pair moves upward, suggesting a potential trend reversal for the pair. The MACD is declining and is approaching the zero line while the RSI is flowing above the 50 level, suggesting the bullish momentum is softening.

Resistance level: 1.0954, 1.1041

Support level: 1.0866, 1.0775

The Japanese Yen has weakened, leading to an upward movement in the USD/JPY pair after consolidating at its recent low. On Tuesday, the Bank of Japan (BoJ) announced its interest rate decision, aligning with market expectations by maintaining its current interest rate level. Following the announcement, the Japanese Yen softened, contributing to the upward movement in the USD/JPY pair.

USD/JPY has broken above from its price consolidation range, suggesting a trend reversal for the pair. The RSI has picked up from the oversold zone while the MACD has crossed at the bottom and is moving upward, which suggests the bullish momentum is gaining.

Resistance level: 143.70, 145.20

Support level: 141.55, 140.00

The Australian dollar is presently trading at recent highs against the U.S. dollar and has broken above the ascending triangle price pattern. The Reserve Bank of Australia (RBA) meeting minutes have been unveiled, revealing a relatively hawkish stance. The minutes emphasise that battling inflation will remain the central bank’s priority, leaving the door open for future rate hikes. This hawkish tone in the meeting minutes has provided buoyancy for the AUD/USD pair, allowing it to maintain its current level and even experience upward momentum.

AUD/USD is trading at an elevated level and tends to break above from its ascending triangle price pattern, suggesting a bullish bias for the pair. The RSI flowing at the elevated level while the MACD flowing flat above the zero line suggests the bullish momentum is still intact with the pair.

Resistance level: 0.6744, 0.6800

Support level: 0.6677, 0.6614

The US equity market continued its bullish trajectory, propelled by declining US Treasury yields and expectations of impending Federal Reserve rate cuts. Notably, United States Steel Corporation took centre stage, experiencing a remarkable 26% surge following Nippon Steel’s announcement of a $14.9 billion deal, including debt, to acquire its rival. Energy stocks also enjoyed a nearly 1% rise, supported by surging oil prices amid fears of supply disruptions in the Red Sea.

The Dow is trading higher following the prior breakout above the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 87, suggesting the index might enter oversold territory.

Resistance level: 37645.00, 39000.00

Support level: 35735.00, 35075.00

Oil prices extended their gains, buoyed by geopolitical uncertainties and potential supply disruptions. Yemen’s Houthi militants’ attacks on ships in the Red Sea triggered disruptions in maritime trade, leading major corporations such as BP to temporarily pause transits. The rising tensions prompted discussions among the US and its allies about forming a task force to protect Red Sea routes, emphasising the geopolitical complexity that is now integral to the oil market’s dynamics.

Oil prices are trading higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 60, suggesting the commodity might enter overbought territory.

Resistance level: 74.85, 78.30

Support level: 72.15, 69.25

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!