-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Key Takeaways:

*The Dollar Index slid to 98.57, as markets fully price in a 25-basis-point rate cut and anticipate another by year-end.

*Gold fell below $3,900, weighed by improving risk sentiment and reduced safe-haven demand amid market optimism.

*Investors eye the Trump–Xi meeting at the APEC summit, which could either ease trade tensions or reignite market volatility depending on the outcome.

Market Summary:

TThe U.S. dollar remained under pressure this week as traders positioned ahead of the Federal Reserve’s highly anticipated policy decision due later today. Market participants have largely priced in a 25-basis-point rate cut, with expectations building for another reduction before year-end. The dovish outlook has weighed on the greenback, sending the Dollar Index to a weekly low of 98.57 in the previous session.

Attention now turns to Fed Chair Jerome Powell’s post-decision remarks for any shift in rhetoric that could trigger heightened market volatility. Any deviation from the current dovish stance could prompt sharp moves across major currencies.

Meanwhile, gold extended its decline as improving risk sentiment curbed demand for safe-haven assets. The precious metal slipped below the psychological $3,900 level in the last session, pressured by fading market uncertainties and optimism in broader financial markets.

Traders are also bracing for a key geopolitical event later this week, as U.S. President Donald Trump and Chinese President Xi Jinping are set to meet on the sidelines of the APEC summit in Korea. Market optimism remains high that the talks could ease trade tensions between the world’s two largest economies. However, any setback or shift in tone from either side could quickly reignite market jitters, potentially fueling renewed demand for gold.

Technical Analysis

The U.S. Dollar Index extended its decline, slipping below a critical support zone before testing its uptrend support line near the 98.65 level — a move that leans toward a bearish bias for the gauge. The index is struggling to regain traction and continues to hover around this pivotal point, with a decisive break below likely signaling further downside momentum.

Technical indicators paint a mixed picture. The Relative Strength Index (RSI) is hovering near the midline, suggesting a neutral stance, while the Moving Average Convergence Divergence (MACD) remains close to the zero level, offering little directional clarity at this stage.

Resistance level: 99.45, 100.40

Support level: 97.70, 96.90

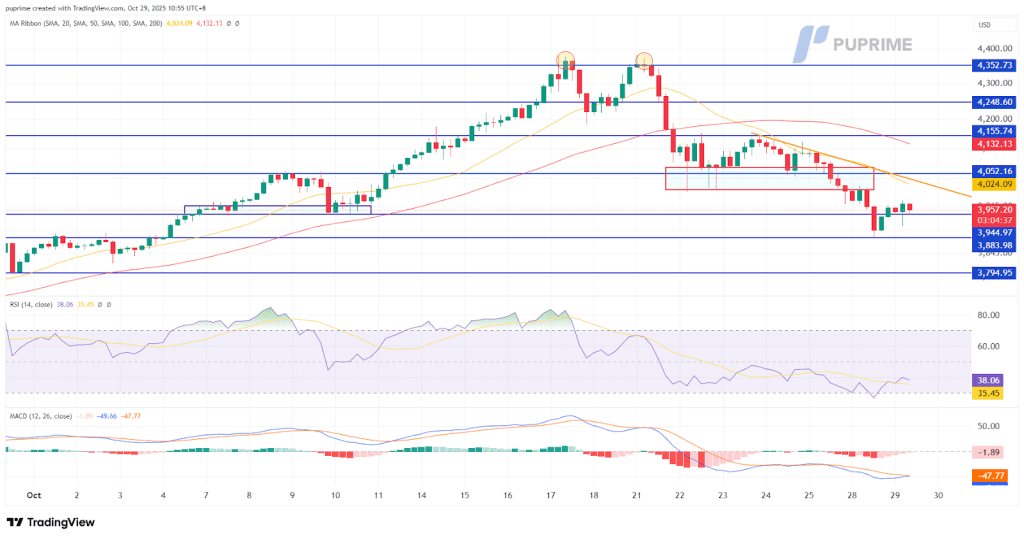

Gold has decisively broken its prior bullish structure, with prices sliding into a key liquidity zone near the $3,950 level before breaching the psychological $3,900 mark in the previous session — reinforcing a strong bearish bias for the metal. Although a brief technical rebound followed, gold remains under heavy downside pressure and is likely to trade below its downtrend resistance line in the near term.

Technical indicators continue to point to sustained weakness. The Relative Strength Index (RSI) hovers near oversold territory, while the Moving Average Convergence Divergence (MACD) continues to trend lower, signaling that bearish momentum is intensifying and aligning with the broader negative outlook for gold.

Resistance level: 4050.00, 4155.70

Support level: 3883.00, 3795.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!