-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Key Takeaways:

*Softer inflation data (headline CPI at 3.8%, core 3.5%) triggered aggressive market bets on BoE rate cuts by year-end, eroding Sterling’s yield advantage.

*Chancellor Reeves faces a £25B budget shortfall ahead of the Autumn Budget, raising fears of fiscal slippage and renewed credibility concerns.

*Business and consumer data point to stagnating demand, with manufacturing and retail indicators signaling economic softness.

Market Summary:

Financial markets experienced a significant reprice in the last session, driven by the delayed U.S. Consumer Price Index report for September. The data confirmed a discernible easing of inflationary pressures, with the year-on-year reading coming in at 3.0%, below the 3.1% consensus. This softer print immediately bolstered the market’s dovish outlook for the Federal Reserve, with investors now pricing in a greater than 90% probability of an interest rate cut at the upcoming FOMC meeting this week.

The reaction was most pronounced in currency and equity markets. The U.S. dollar index faced substantial selling pressure, plummeting to the $98.25 level, while Wall Street staged a robust rally. The Dow Jones and Nasdaq both advanced more than 1% as the prospect of lower borrowing costs provided a fresh catalyst for risk assets.

Conversely, the environment proved challenging for safe-haven gold. Despite the weaker dollar, which typically supports dollar-priced bullion, the metal remained fragile near its weekly low around $4,080. Its inability to rally underscores how its dynamics are being overshadowed by a sharp reduction in safe-haven demand. This shift is attributed to positive developments in U.S.-China trade relations, following another round of negotiations in Malaysia over the weekend. The high likelihood of a face-to-face meeting between President Trump and China’s President Xi at the APEC summit in Korea this week has further bolstered optimism, mitigating a key geopolitical risk. Should this diplomatic engagement yield a mutual trade agreement, the resulting decline in global uncertainty could continue to exert downside pressure on gold while potentially allowing the greenback to appreciate on improved fundamentals.

Technical Analysis

The U.S. Dollar Index is exhibiting clear signs of fading bullish momentum, underscored by the formation of a second distinct double-top price pattern. The index is now struggling to maintain support above the critical pivotal level at the 98.60 mark, a zone that has repeatedly served as both support and resistance. A sustained break below this key level would serve as a strong bearish signal, confirming the reversal pattern and likely triggering a deeper corrective move.

The weakening technical structure is further validated by a deteriorating momentum backdrop. While the Relative Strength Index (RSI) hovers neutrally near its mid-point, the Moving Average Convergence Divergence (MACD) is conveying a more definitive message. It is tracing a pattern of lower highs and is poised for a bearish crossover below its zero line. This divergence suggests that the underlying bullish drive is vanishing, giving way to building bearish pressure.

The convergence of the double-top reversal pattern at a key support level and the MACD’s rollover below its zero line presents a compelling bearish case for the index. The immediate outlook now hinges on the battle at the 98.60 level; a decisive break below it would signal that sellers have gained firm control.

Resistance Levels: 99.45, 100.40

Support Levels: 98.60, 97,70

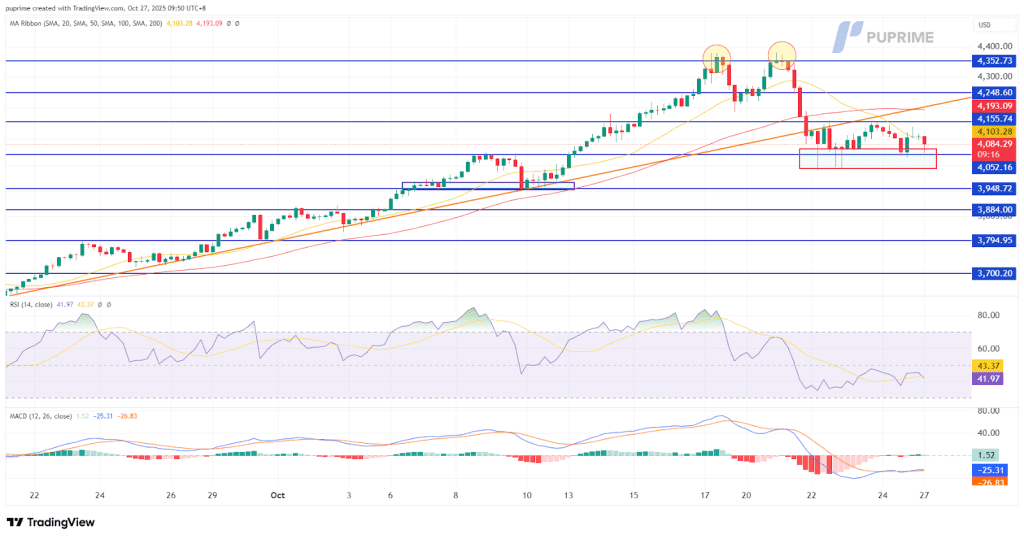

Gold has undergone a significant shift in momentum, having established a clear double-top reversal pattern at its all-time peak near the $4,360 mark. The subsequent decline of over 6% has brought the metal to a critical juncture, where it has found temporary support above the $4,080 level and entered a phase of sideways consolidation.

However, the structure of this consolidation suggests underlying weakness. The formation of a lower-high price pattern indicates that buying pressure is waning at progressively lower levels. The immediate focus is the crucial psychological support at $4,000. A sustained break below this level would constitute a strong bearish signal, likely confirming the resumption of the downtrend and opening a path toward deeper technical support.

This bearish technical structure is reinforced by momentum indicators, which remain squarely in negative territory. The Relative Strength Index (RSI) is persistently capped below its mid-point, reflecting a lack of bullish impetus. Simultaneously, the Moving Average Convergence Divergence (MACD) is hovering flatly beneath its zero line, confirming that bearish momentum continues to dominate the near-term trend. The convergence of these factors points to a high risk of a breakdown, with the $4,000 level serving as the definitive line between continued consolidation and a further bearish leg.

Resistance Levels: 4155.75, 4248.60

Support Levels: 4053.75, 3950.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!