-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

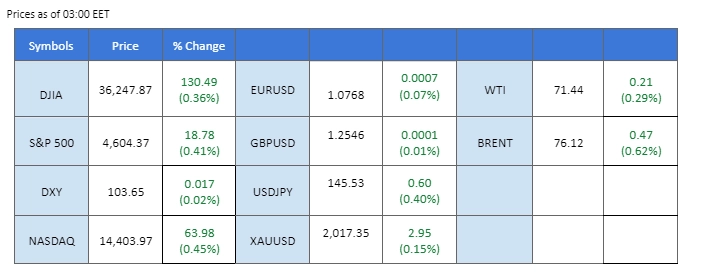

The US Dollar staged a robust rebound on stellar employment figures, with Nonfarm Payrolls exceeding expectations at 199K and the unemployment rate declining to 3.70%. This unexpected strength sparked optimism about the economic trajectory and fueled uncertainties regarding future Federal Reserve decisions. Gold prices dipped below $2,000 amid the Dollar’s resurgence, while crude oil experienced a modest rebound on positive US economic data. The US equity market remained resilient, buoyed by declining Treasury yields and a positive outlook for technology stocks. As market participants scrutinise these dynamics, attention turns to the upcoming inflation report for further trading signals.

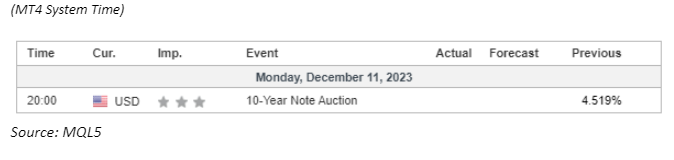

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.0%) VS 25 bps (2%)

The Dollar Index experienced a robust rebound against major currencies, propelled by stellar US employment figures that surpassed expectations. The Department of Labor reported a significant increase in US Nonfarm Payrolls, reaching 199K, outperforming the anticipated 180K. Concurrently, the US unemployment rate witnessed a notable decline from 3.90% to 3.70%, exceeding market projections. The better-than-expected job data fueled market optimism regarding the economic trajectory in the United States, injecting uncertainty into future monetary policy decisions by the Federal Reserve.

The Dollar Index is trading higher while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 57, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 104.30, 105.40

Support level: 103.40, 102.50

Gold prices dipped below $2,000 as unexpectedly favourable jobs data increased the attractiveness of the US Dollar. Despite this slip, gold market uncertainties persist, with focus shifting to the impending US inflation data release, specifically the Consumer Price Index (CPI), expected to decrease from 3.20% to 3.10%. Investors are keenly watching this data for potential trading signals and further clarity on the precious metal’s direction.

Gold prices are trading lower following the prior breakout below the support level. MACD has illustrated increasing bearish momentum, while RSI is at 36, suggesting the commodity might enter oversold territory.

Resistance level: 2010.00, 2030.00

Support level: 1980.00, 1935.00

GBP/USD maintained a flat trajectory as investors adopted a wait-and-see approach, anticipating significant market volatilities triggered by upcoming events, notably the FOMC and Bank of England meetings later in the week. Bank of England Governor Andrew Bailey’s cautious stance on rate cuts, coupled with stabilising inflation rates and dwindling economic optimism, sets the stage for a pivotal Bank of England meeting. With expectations leaning towards the Bank of England maintaining its interest rates at a 15-year high, Pound traders eagerly await monetary policy statements as the focal point for potential market shifts.

GBP/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 36, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1.2630, 1.2730

Support level: 1.2530, 1.2435

The EUR/USD pair faces sustained bearish momentum, propelled by the strengthening of the US Dollar in the wake of an upbeat jobs report. Last Friday’s surge in the US Dollar underscored the currency’s resilience, impacting the Euro negatively. Looking ahead, investors closely monitor potential market drivers, with a keen focus on the US Consumer Price Index (CPI) as a pivotal indicator that could provide further insights and trading signals.

EUR/USD is trading lower while currently testing the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 39, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.0835, 1.0955

Support level: 1.0750, 1.0665

The Chinese economy continues to grapple with a lack of positive catalysts, manifesting in persistent downward pressure on Chinese-related stocks. The Hang Seng Index (HK50) extends its losses, nearing a 13-month low, with Chinese banks and insurers experiencing declines following Moody’s downward revision of the outlook on top industry players. Despite ongoing efforts by Chinese authorities to alleviate liquidity crises faced by property developers, market sentiment remains tinged with pessimism, reflecting persistent concerns about the broader Chinese economic landscape.

Hang Seng Index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 27, suggesting the index might enter oversold territory.

Resistance level: 16450.00, 17020.00

Support level: 15885.00, 15290.00

The Japanese yen retreated from its initial strong bullish stance against the US Dollar, succumbing to the sway of better-than-expected job figures from the United States. The robust employment report bolstered the US Dollar, prompting a strategic shift among investors who redirected their portfolios from the yen to the greenback, resulting in an increase in the USD/JPY pair. As market participants navigate this shift, all eyes turn to upcoming events, particularly the US Consumer Price Index (CPI) and the impending FOMC decision this week.

USD/JPY is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 49, suggesting the pair might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 146.30, 147.55

Support level: 144.60, 143.20

The US equity market demonstrated resilience, buoyed by declining US Treasury yields and the promising outlook for technology stocks. Analysts anticipate that softening inflation and employment data could prompt the Federal Reserve to consider pausing its tightening monetary policy cycle, with some even speculating on rate cuts in the coming months. The potential for interest rate reductions is seen as a stimulant for business expansion and economic growth, enhancing the allure of stocks for investors.

The Dow is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 74, suggesting the index might enter overbought territory.

Resistance level: 36490.00, 36955.00

Support level: 35930.00, 35465.00

Crude oil prices experienced a modest rebound on Friday following supportive US economic data, indicating healthier demand growth and defying expectations of a more severe economic downturn. The US Labor Department’s release, revealing stronger-than-expected job growth, instilled confidence in the oil market regarding sustained fuel demand. However, investors remain cautious, closely monitoring additional economic data to better understand the global economic outlook and potential impacts on oil demand.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 48, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 72.15, 74.85

Support level: 68.90, 64.85

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!