-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

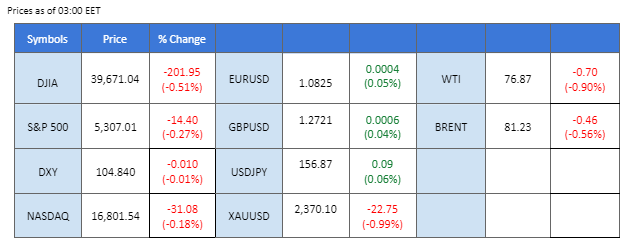

The U.S. dollar has strengthened, with the Dollar Index (DXY) climbing to its highest level this week, fueled by hawkish FOMC meeting minutes released in the last session. The minutes revealed that some members doubted whether the current interest rate level is sufficient to bring inflation down to the 2% target, leading to a jump in both U.S. Treasury yields and the dollar’s strength.

The strengthening dollar has pushed the Japanese yen back above the 156.50 level. In contrast, the sterling was buoyed by an upbeat CPI reading, keeping it trading at monthly high levels against the dollar.

In the commodity market, gold prices were hit by the stronger dollar, sliding nearly 2% in the last session. Oil prices were also hammered by the strengthened dollar and are trading at their lowest levels since March; traders in oil and the market await the outcome of the OPEC+ meeting scheduled for June 1.

Additionally, both the UK and Eurozone PMI readings will be unveiled later today. Traders will be closely monitoring these readings to gauge the strength of the respective currencies.

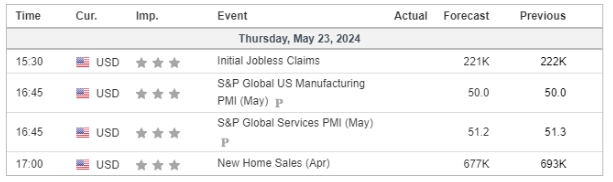

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (91.1%) VS -25 bps (8.9%)

Market Overview

(MT4 System Time)

Source: MQL5

The Dollar Index, which measures the greenback against a basket of six major currencies, extended its gains following the release of the FOMC meeting minutes. The minutes revealed that Federal Reserve officials remain concerned about persistent inflation, with the Monetary Policy Committee expressing a lack of confidence in moving forward with interest rate cuts. Key officials, including Chair Jerome Powell and Governor Christopher Waller, indicated scepticism about further rate hikes. This hawkish stance has shifted market expectations away from near-term rate cuts.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the index might extend gains toward resistance level since the RSI stays above the midline.

Resistance level: 105.25, 105.70

Support level: 104.65, 103.90

Hawkish comments from Federal Reserve officials, as detailed in the latest FOMC meeting minutes, have driven investors to sell dollar-denominated gold, leading to a stronger US Dollar. Fed officials noted several upside risks to inflation, particularly from geopolitical events, suggesting a continued higher interest rate environment until inflation stabilises. Despite the short-term retracement in gold prices due to the Fed’s stance, the long-term outlook remains uncertain amid signs of a slowing US economy. Investors are advised to monitor upcoming US economic data and Fed policies for further trading cues.

Gold prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the commodity might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 2395.00, 2420.00

Support level: 2365.00, 2335.00

The GBP/USD pair has managed to resist the strength of the dollar and is currently trading at its highest levels in a month. The recent UK inflation data exceeded market expectations, boosting the strength of the sterling. Traders are now focused on today’s PMI reading, which could provide the momentum needed for the pair to break above its current resistance level at 1.2760.

GBP/USD has been trading at a high level recently, but the bullish momentum is gradually declining. The RSI hovering near the overbought zone while the MACD declining toward the zero line suggests the bullish momentum is vanishing.

Resistance level: 1.2760, 1.2850

Support level: 1.2660, 1.2600

The euro was hammered by the strengthening dollar, with the EUR/USD pair sliding nearly 0.3% in the last session. The release of the FOMC meeting minutes revealed a hawkish tone, with some members suggesting that interest rates should be higher to curb persistent inflation in the U.S., which has bolstered the previously lacklustre dollar. Euro traders are now looking to the Eurozone PMI readings, scheduled for release later today, to gauge the strength of the euro.

EUR/USD is sliding by nearly 0.4% this week after recording a gain for five weeks straight. The RSI is approaching the oversold zone from above, while the MACD has broken below the zero line, suggesting that bearish momentum is forming.

Resistance level: 1.0865, 1.0920

Support level: 1.0805, 1.0730

The Japanese yen continues to be fragile against its peers, particularly due to recent economic data failing to meet expectations. Following last week’s downbeat GDP figures, yesterday’s trade balance data also came in below expectations. Although today’s PMI reading reached 50.5, the highest level in a year, the strengthening of the dollar has overshadowed this upbeat indicator. Consequently, the yen remains under pressure, highlighting the ongoing challenges facing Japan’s economy.

USD/JPY is trading at its highest level in May due to a lacklustre Yen. The RSI is on the brink of breaking into the overbought zone, while the MACD continues to edge higher, suggesting that bullish momentum is gaining.

Resistance level: 157.90, 159.50

Support level: 156.45, 155.00

US equity markets dropped as investors digested the minutes from the Federal Reserve’s most recent meeting. However, enthusiasm for Artificial Intelligence (AI) stocks remains high, bolstered by better-than-expected earnings reports. Nvidia’s first-quarter results surpassed sky-high expectations, causing its shares to rise by about 6%. Investors are keenly focused on whether the outsized rally in AI-related stocks can be sustained amid broader market volatility.

Dow Jones is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the index might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 39900.00, 40525.00

Support level: 39135.00, 38565.00

Crude oil prices extended their losses on concerns that rising US borrowing costs could hurt demand if inflation surges again. The hawkish tone from the Federal Reserve, following the release of the FOMC meeting minutes, has led to an increase in US Treasury yields. A stronger Dollar and higher borrowing costs are expected to slow economic growth, diminishing oil demand. Additionally, the Energy Information Administration reported an unexpected rise in US crude stocks by 1.8 million barrels last week, further weighing on prices.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 30, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 79.85, 82.00

Support level: 76.90, 75.55

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!