-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Key Takeaways:

*The Dollar Index (DXY) slipped below 98.65, pressured by dovish expectations after softer U.S. inflation data and falling Treasury yields.

*Markets are bracing for a potential policy shift on Wednesday, with investors expecting signals of a more accommodative stance to sustain the easing narrative.

*Despite dollar weakness, gold plunged below $4,000, sliding over 8% from its peak as easing geopolitical tensions sap safe-haven demand.

Market Summary:

The U.S. dollar is showing signs of vulnerability ahead of the Federal Reserve’s pivotal rate decision on Wednesday, with the Dollar Index (DXY) trading below the 98.65 level. The greenback’s weakness is primarily driven by firmly entrenched dovish market expectations, which were significantly fueled by last Friday’s softer-than-anticipated U.S. CPI reading for September. While the currency found temporary support from positive developments in U.S.-China trade talks, it remains fragile as traders await the Fed’s guidance.

The prevailing speculation of an accommodative shift from the Fed has also catalyzed a rally in long-term U.S. Treasuries, driving their yields lower and further diminishing the interest rate appeal of the dollar.

In a notable divergence from typical market correlations, gold has failed to capitalize on the dollar’s softness. The precious metal has decisively broken below the critical psychological support of $4,000, suggesting that bearish momentum is overwhelming its traditional drivers. This breakdown reflects a broad-based retreat from safe-haven assets, triggered by a significant alleviation of global geopolitical risks. The resolution of trade tensions, a ceasefire in the Middle East, and diminished political upheaval in both France and Japan have collectively eroded the demand for havens, leading gold to decline more than 8% from its record peak established just weeks ago. The combined pressure from a less fearful geopolitical landscape and a potentially dovish Fed is creating a uniquely challenging environment for the yellow metal.

Technical Analysis

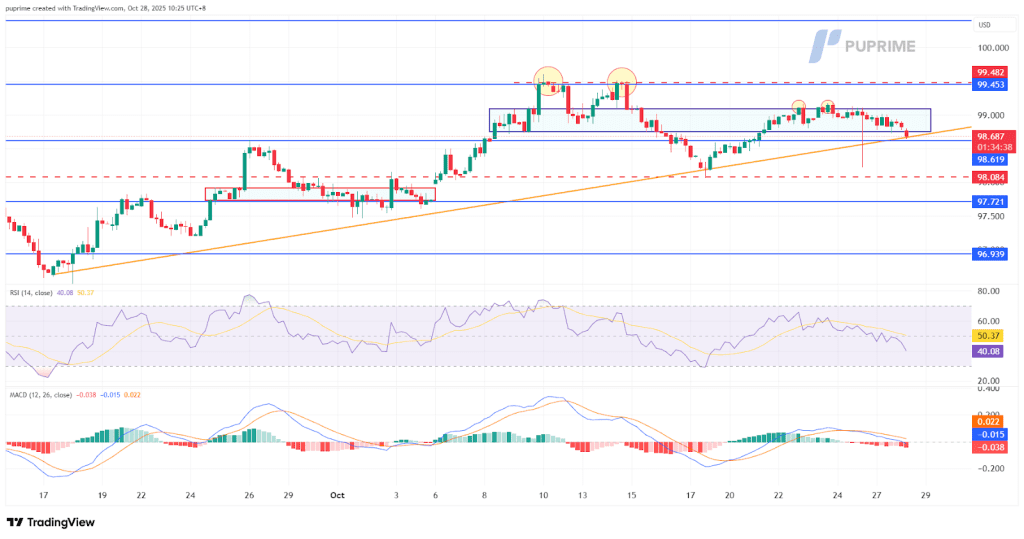

The U.S. Dollar Index has confirmed a bearish technical development, breaking decisively below its recent sideways range and now struggling to maintain a foothold above its foundational uptrend support line. The convergence of these two technical elements creates a critical juncture at the $98.60 level, representing the lower boundary of the former range and the ascending trendline.

This level now serves as the definitive line in the sand for the index’s near-term direction. A failure to defend and sustain a position above $98.60 would constitute a solid bearish signal, likely triggering a deeper corrective phase.

The bearish bias is substantiated by a pronounced deterioration in momentum. The Relative Strength Index (RSI) has slid from higher levels to its mid-point, reflecting a clear loss of upward momentum. More significantly, the Moving Average Convergence Divergence (MACD) is poised for a bearish crossover below its zero line, a strong indication that the prior bullish momentum has not only vanished but is being replaced by building selling pressure. The alignment of this breakdown in price structure with the shift in momentum indicators presents a compelling case for a bearish resolution, with the $98.60 level poised to determine the next directional move.

Resistance Levels: 99.45, 100.40

Support Levels: 97.70, 96.95

Gold has confirmed a significant technical deterioration, decisively breaking below its critical support zone above $4,010 and subsequently slicing through the crucial psychological barrier at the $4,000 level. This breakdown signals a strong bearish shift in market structure, indicating that the previous consolidation has resolved in favor of the sellers.

The importance of this breakdown is underscored by the fact that the $4,010 zone had provided reliable support, successfully repelling sell-offs on three separate occasions in the recent past. Its ultimate failure suggests that underlying selling pressure has become overwhelming, effectively breaking the back of the market and opening a clear path for a move toward lower support levels.

The bearish price action is compounded by weakening momentum indicators. The Relative Strength Index (RSI) is now hovering near oversold territory, reflecting persistent and intensifying selling pressure. Concurrently, the Moving Average Convergence Divergence (MACD) continues to trend lower, confirming that bearish momentum is accelerating. The convergence of this definitive structural break with bearish momentum signals presents a compelling case for further downside, with the breached $4,000-$4,010 zone now likely to act as a new resistance area.

Resistance Levels: 4155.75, 4248.60

Support Levels: 4053.75, 3950.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!