-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*The U.S. Dollar remains near multi-week highs, supported by hawkish Fed signals and resilient labor market data, with December rate-cut expectations collapsing to around 30–40%.

*Rising Treasury yields and a firm dollar are putting pressure on equities, particularly tech and valuation-sensitive sectors, despite strong corporate earnings like Nvidia.

*Wall Street experienced sharp volatility and a tech-led reversal, signaling that even stellar earnings cannot fully offset macro headwinds and market anxiety over a “higher-for-longer” Fed.

Market Summary:

The U.S. Dollar Index (DXY) held firm near multi-week highs as markets digested a hawkish repricing of Federal Reserve expectations and sharply reduced December rate-cut probabilities to around 30–40%. Stronger-than-expected September payrolls (119k) and FOMC minutes showing that “many” participants favored holding rates have supported elevated Treasury yields, keeping the greenback particularly strong against the Japanese yen amid Japan’s large fiscal stimulus.

Fed officials, including Beth Hammack, Barr, and Cook, have cautioned that premature easing risks entrenching inflation and encouraging financial instability, reinforcing the dollar’s strength. While the unemployment rate ticked up to 4.4%, the overall message of labor market resilience gives hawkish Fed participants the upper hand, limiting expectations for near-term policy cuts.

Wall Street grappled with a sharp tech-led reversal despite robust corporate earnings. Nvidia’s blockbuster results briefly lifted the Nasdaq by over 2% at the open, but optimism quickly faded, with the Philadelphia Semiconductor Index plunging 4.8% and both the S&P 500 and Nasdaq closing at their lowest levels since September. The VIX spiked, reflecting heightened market anxiety over stretched AI valuations and a “higher-for-longer” Fed stance.

The dollar’s firm footing and rising Treasury yields have amplified pressure on equities, particularly valuation-sensitive tech names. Investors are rotating into defensives and selective cyclicals while monitoring policy signals and upcoming macro data. The combined effect of hawkish monetary expectations and fragile market sentiment suggests that near-term equity performance will remain highly sensitive to shifts in Fed guidance and risk appetite.

Technical Analysis

DXY is trading higher after a strong rebound from the rising trendline, with the price now holding above the 100.25 breakout level. Momentum remains bullish in the short term, but the index is struggling to gain further traction as it approaches the heavy resistance zone around 100.25 – 101.10. This area has capped upside several times before and may trigger another pause or pullback if buyers cannot push through with conviction.

RSI is elevated near 66, showing strong bullish momentum but also signaling that the index is approaching overbought conditions. MACD remains above the signal line with green histogram bars, confirming ongoing strength, though the histogram is starting to flatten, suggesting the move may be slowing.Overall, the trend remains bullish above the rising trendline, but upside progress is becoming more constrained as price nears a major resistance area.

Resistance level: 100.25, 101.10

Support level:99.60, 98.70

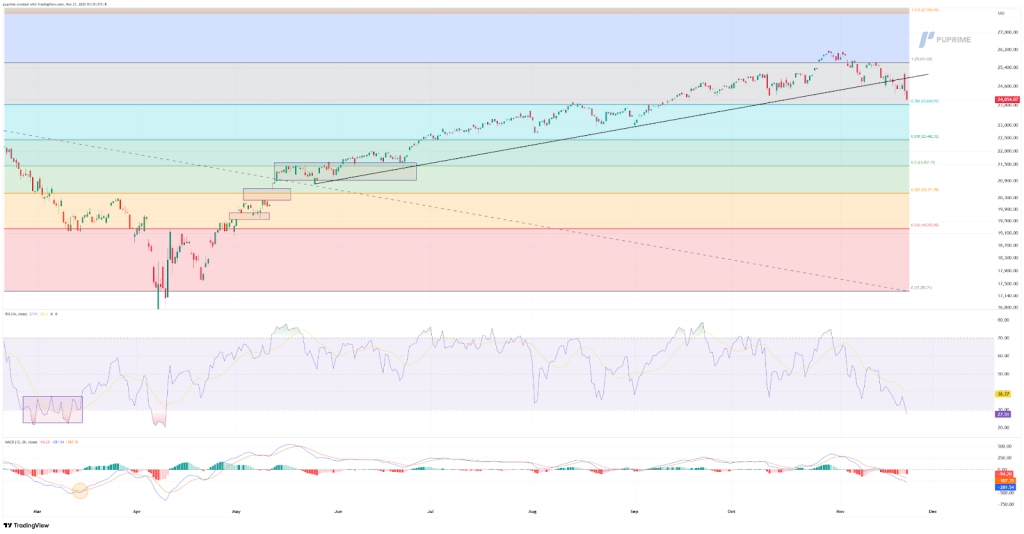

NASDAQ is showing sustained weakness on the chart after breaking below the rising trendline that supported price throughout the previous rally. The index is now trading beneath both the trendline and the 0.786 Fibonacci retracement zone, indicating that bullish momentum has faded and sellers are beginning to take control. This breakdown shifts market structure from a steady uptrend into a corrective phase, with lower highs beginning to develop.

Momentum indicators reinforce the current downward pressure. RSI is falling toward the oversold region, signaling consistent selling strength without signs of a reversal yet. Meanwhile, the MACD remains below the signal line with expanding negative histogram bars, confirming bearish momentum and a lack of bullish participation.

Resistance level: 25,630.00, 27,900.00

Support level: 23,845.00, 22,440.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!