-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*Major digital assets tumbled, wiping nearly 5% from total market capitalization as Bitcoin and Ethereum led a broad-based decline.

*A wave of forced liquidations and weak trading volumes deepened the downturn, signaling fragile short-term sentiment.

*Despite a brief rebound on improved risk appetite, technical structures remain damaged, with a 52% probability of Bitcoin dropping below $100,000.

Market Summary:

The cryptocurrency market faced a significant downturn last Friday, with major digital assets like Bitcoin (BTC) and Ethereum (ETH) leading a broad-based decline that erased nearly 5% from the total market capitalization. The top five cryptocurrencies all registered weekly losses exceeding 5%, underscoring the intensity of the selling pressure.

This sharp decline appears to be a continuation of a sell-off that began two weeks prior, which critically harmed market liquidity and triggered a wave of forced liquidations. This created a cascading effect, severely damaging short-term sentiment and contributing to depressed trading volumes.

A tentative recovery emerged in the post-Friday session, fine-tuned by an improvement in broader risk appetite following conciliatory trade rhetoric from former President Trump regarding China. However, entering the new week, the technical outlook remains fragile. The previous bullish structure for many assets has been broken, and with analysts assigning a high probability—52%—of Bitcoin falling below the critical $100,000 psychological level, sentiment is tilting bearish. This suggests the market remains vulnerable to further downside pressure, with its trajectory likely tied to broader risk trends and key U.S. economic data releases.

Technical Analysis

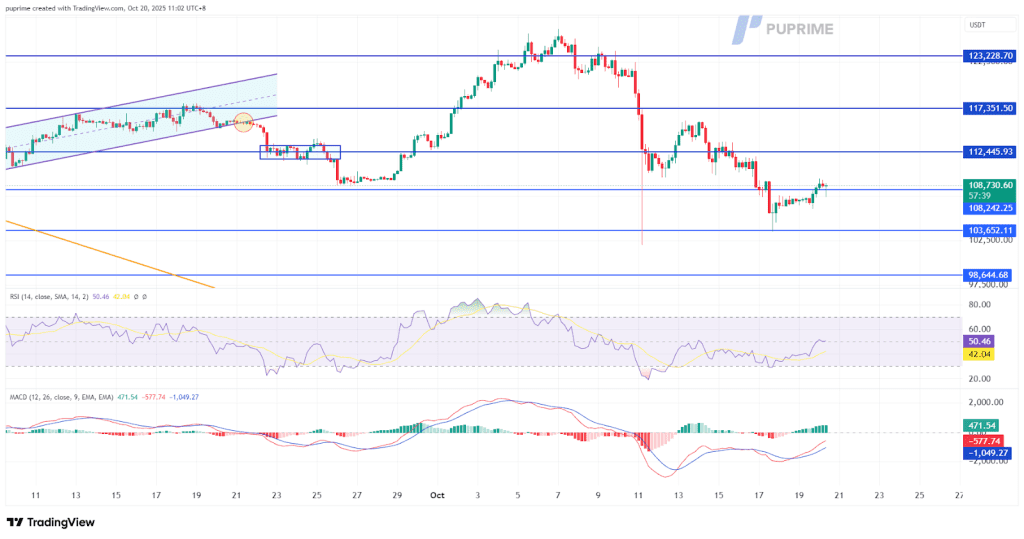

BTC has staged a minor technical rebound from its weekly low near the $104,000 support level. However, the recovery now faces a critical test as it approaches a significant resistance zone around the $109,550 mark, a previous high that has become a formidable barrier.

The price action at this juncture is pivotal. A failure to break decisively above $109,550, followed by a bearish rejection and a subsequent decline, would signal that sellers remain in control and could reactivate strong bearish momentum, potentially leading to a re-test of the $104,000 support.

This key resistance test is set against a backdrop of improving but still cautious momentum. The Relative Strength Index (RSI) has rebounded from oversold conditions, and the Moving Average Convergence Divergence (MACD) has triggered a bullish crossover, albeit while trading below its zero line. This suggests that while the most intense bearish pressure has eased, the overall momentum has not yet fully shifted to bullish. The conflict between the overhead resistance and the improving indicators creates a tension that will be resolved by BTC’s ability to either conquer the $109,550 level or be repelled by it.

Resistance Levels: 112,450.00, 117350.00

Support Levels: 103650.00, 98,6450.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!