-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

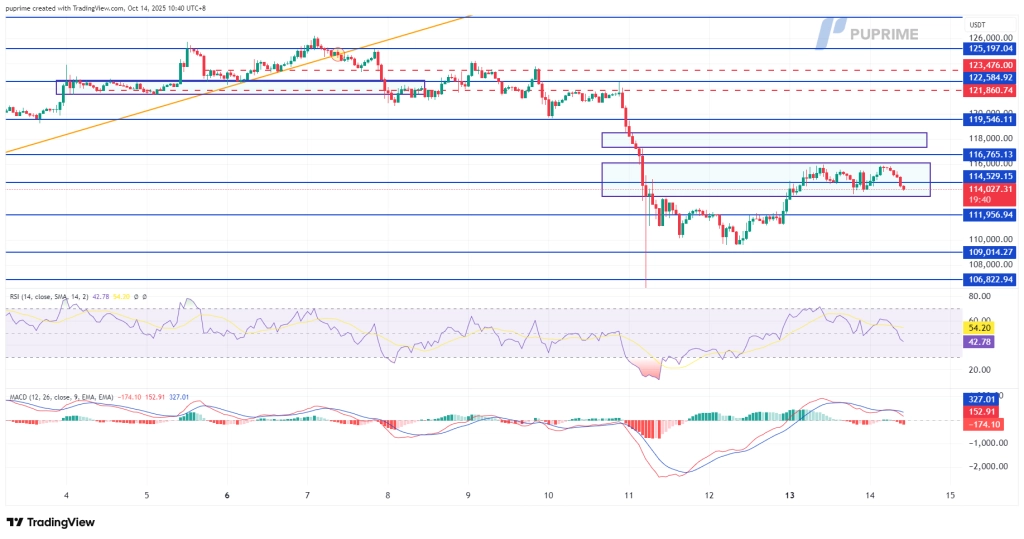

BTC, H4:

BTC staged a robust rebound of over 10% from its recent low near the $102,173 level, but the upward momentum has since stalled as the price consolidates within a key Fair Value Gap (FVG). This pause within the FGV suggests the initial recovery may be concluding, often a precursor to a resumption of the prior trend once the price imbalance is filled.

The case for a bearish near-term bias is strengthening. A decisive drop below the current FVG would signal that sellers have regained control and could trigger the next leg down. This potential breakdown is supported by weakening momentum indicators. The Relative Strength Index (RSI) has been rejected from approaching overbought territory and is now trending lower. Concurrently, the Moving Average Convergence Divergence (MACD) has completed a bearish crossover at an elevated level, a classic signal that downward momentum is overwhelming. The convergence of these factors points to a high risk of a renewed sell-off.

Resistance Levels: 116,765.00, 119,550.00

Support Levels: 111,956.00, 109,015.00

NZDUSD, H4

The NZDUSD pair remains entrenched within a defined bearish trajectory, having consistently failed to reclaim a critical foothold above the 0.5850 liquidity zone. The subsequent development of a lower-high price pattern has reinforced the prevailing downward bias, signaling sustained selling pressure.

The pair is now testing a significant support level at the 0.5720 mark. A decisive break below this threshold is critical, as it would open a path toward the April low and provide further confirmation of the bearish structural bias.

Momentum indicators align with this pessimistic outlook. The Relative Strength Index (RSI) is hovering near oversold territory, reflecting persistent selling momentum, while the Moving Average Convergence Divergence (MACD) continues to flow flatly below its zero line, indicating a lack of any significant bullish impetus. The convergence of price action and momentum signals suggests the path of least resistance remains to the downside.

Resistance Levels: 0.5750, 0.5800

Support Levels:0.5700, 0.5650

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!