-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*Bitcoin’s deep correction intensifies, breaking below the crucial $80,000 level and extending losses to over 36% from its October peak.

*Institutional retreat accelerates, as ETF data shows sustained outflows while the Fed’s persistent pushback against a December rate cut tightens liquidity conditions and deepens pressure on speculative assets.

*Wednesday’s U.S. PCE report becomes the key catalyst, with a softer print likely offering short-term relief, while hotter inflation risks fueling another downward leg in an already fragile and volatile market.

The cryptocurrency market is experiencing a pronounced corrective phase, with Bitcoin breaching the critical $80,000 support level to establish its lowest valuation since April. The flagship digital asset has now declined over 36% from its October peak, with elevated trading volume accompanying the descent—a technical configuration that suggests panic selling and capitulation among market participants.

The fundamental backdrop has deteriorated significantly. ETF flow data reveals substantial net outflows in recent sessions, providing concrete evidence of institutional capital retreating from the sector. This exodus has been exacerbated by consistently hawkish commentary from Federal Reserve officials, who have pushed back against market expectations for a December rate cut. This monetary policy stance continues to constrain liquidity conditions for speculative assets, creating persistent headwinds for digital markets.

All eyes now turn to Wednesday’s U.S. PCE inflation report, which will serve as a crucial input for the FOMC’s December policy decision. A cooler-than-expected reading could provide temporary relief for battered crypto assets, while elevated inflation figures would likely reinforce the Fed’s hawkish stance and potentially trigger another leg lower in this corrective cycle. Market participants should prepare for elevated volatility around this key economic release as the crypto market’s near-term trajectory remains heavily dependent on monetary policy developments.

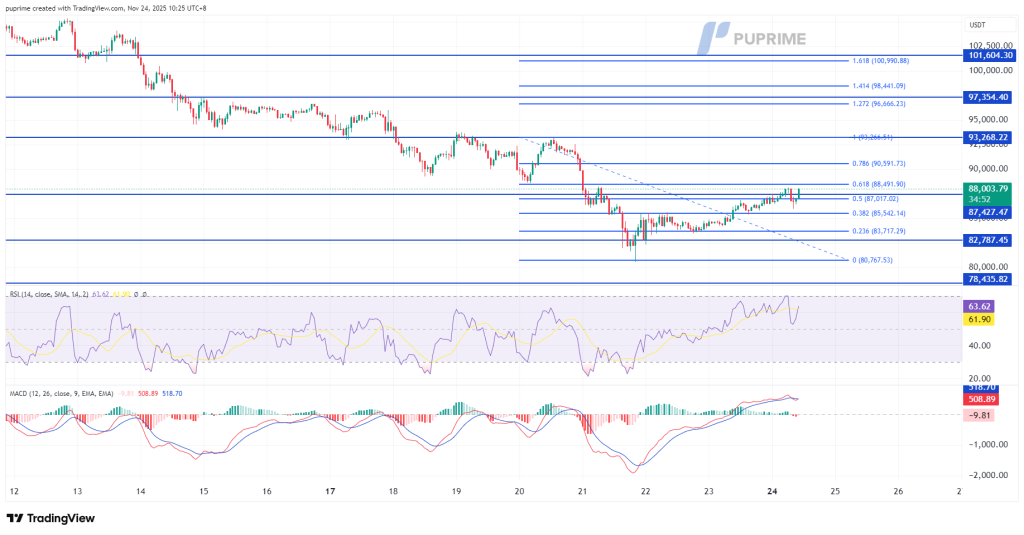

Bitcoin has staged a robust technical recovery from its April lows near the critical $80,000 support level, with the cryptocurrency now testing a significant technical barrier at the 61.8% Fibonacci retracement level of $88,500. This price action represents a notable shift in near-term momentum following the prolonged corrective phase.

The $88,500 Fibonacci level now serves as the primary technical hurdle for Bitcoin. A decisive breakout above this resistance would signal a potential short-term bullish reversal and could trigger accelerated buying momentum toward the next resistance zone near $92,000.

Momentum indicators strongly support the constructive near-term outlook. The Relative Strength Index (RSI) has advanced into overbought territory, reflecting intense buying pressure, while the Moving Average Convergence Divergence (MACD) has completed a bullish crossover above its zero line and continues to trend higher. This configuration suggests bullish momentum is indeed accelerating.

The $80,000 level now establishes a critical support foundation. For the bullish scenario to remain valid, Bitcoin must maintain footing above $85,000 on any retracement. A successful breach of the $88,500 Fibonacci resistance would confirm the reversal pattern and potentially establish a new near-term uptrend framework.

Resistance Levels: 93,270.00, 97,355.00

Support Levels: 82,800.00, 78,435.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!