-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*DXY remains near multi-week highs, supported by hawkish Fed commentary, elevated Treasury yields, and safe-haven demand amid fiscal and geopolitical uncertainties.

*U.S. equities, particularly tech-heavy Nasdaq, remain sensitive to earnings and macro signals, with early gains often reversed amid rising yields and tighter financial conditions.

Market Summary:

The U.S. Dollar Index (DXY) remains near multi-week highs as markets scale back expectations for a December rate cut to roughly 30–40%. Mixed U.S. labor data—including stronger-than-expected payrolls but modest wage growth—have created a nuanced backdrop, leaving investors cautious about the Federal Reserve’s next move. Hawkish Fed commentary warning against premature easing has kept short-term yields elevated, supporting the greenback against risk-sensitive currencies such as the yen and euro. Broader economic concerns, including ballooning U.S. public debt and fiscal sustainability, have reinforced the dollar’s safe-haven appeal, offsetting temporary swings from risk-on sentiment.

U.S. equities have displayed heightened sensitivity to both earnings results and macroeconomic signals. Strong earnings, particularly in technology and AI sectors, initially boosted sentiment, but rising yields and fading near-term rate-cut expectations tempered broader market gains. The Nasdaq, heavily weighted toward tech, has been especially reactive, with early gains reversing into a tech-led pullback. Investors are increasingly rotating toward defensive sectors and selective cyclicals, reflecting caution amid tighter financial conditions, as solid corporate results alone prove insufficient to drive sustained equity gains.

Underlying macro and fiscal considerations continue to influence both FX and equity markets. Concerns over U.S. debt, fiscal sustainability, and global trade tensions are contributing to cautious positioning. Even with positive corporate earnings, volatility persists in high-beta and rate-sensitive sectors, while safe-haven flows support the dollar. Geopolitical developments remain a secondary driver, with easing tensions occasionally encouraging risk-on rotation but headline risks keeping investors wary.

Looking ahead, market direction will hinge on upcoming inflation indicators, Fed communications, and broader macroeconomic developments. For equities, earnings releases, sector-specific news, and Fed guidance will remain key near-term catalysts, while the dollar will continue to react to shifts in risk sentiment, fiscal policy discussions, and headline events. Investors are likely to maintain tactical positioning, balancing growth optimism against policy and valuation risks across asset classes.

Technical Analysis

DXY is trading higher after a strong rebound from the rising trendline, with price now holding firmly above the 100.30 breakout level. The short-term outlook remains bullish, but upward momentum is slowing as the index tests the key resistance level at 101.10. This region has repeatedly acted as a ceiling in previous swings, and unless buyers show stronger follow-through, DXY may face another rejection or consolidation beneath this barrier.

RSI is elevated around 66, reflecting sustained bullish momentum but also indicating that the index is nearing overbought territory. Meanwhile, the MACD continues to print green histogram bars above the signal line, confirming that momentum is still positive though the flattening histogram suggests the recent acceleration is beginning to moderate.

Resistance level: 101.10, 101.80

Support level: 100.25, 99.60

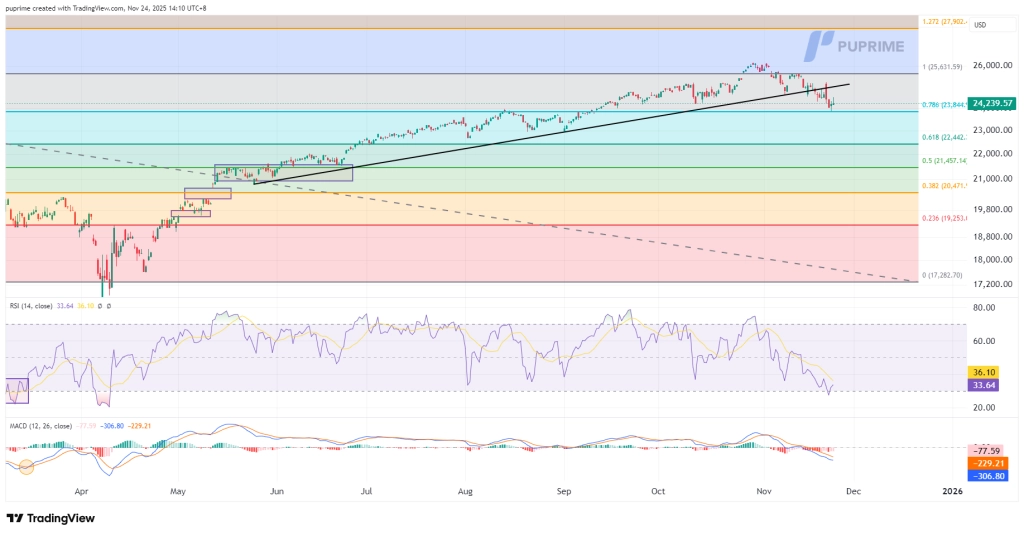

NASDAQ is showing sustained weakness on the chart after breaking below the rising trendline that NASDAQ continues to show weakness on the chart after breaking decisively below the rising trendline that supported the entire prior uptrend. Price is now trading beneath both the trendline and the 0.786 Fibonacci level, confirming a shift from bullish structure into a corrective phase. Sellers remain in control, with lower highs forming and momentum favoring the downside.

RSI is hovering around the mid-30s after a persistent decline, reflecting strong selling pressure while still not deeply oversold. MACD remains bearish with widening negative histogram bars, showing momentum is still favoring the downside. Unless buyers step in at the 0.618 zone, the index risks extending the correction further.

Resistance level: 25,630.00, 27,900.00

Support level: 23,845.00, 22,440.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!