-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*Nasdaq leads losses, down 2.3%, as technology shares face sharp declines.

*Dow Jones falls 798 points (1.7%), dragged lower by Disney’s disappointing revenue.

*Concerns over Fed’s December rate decision weigh on market sentiment despite the resolved shutdown.

Market Summary:

The U.S. equity market retreated sharply, with technology stocks driving the decline. The Nasdaq Composite fell 2.3%, led by major chip names such as Nvidia and Broadcom, while Tesla and data-center operator CoreWeave tumbled 6.6% and 8.3%, respectively. The broader Dow Jones Industrial Average lost 798 points (1.7%), accelerated in the afternoon, with Disney shares falling 7.7% after reporting lower-than-expected revenue.

Despite the U.S. government reopening after a record-long shutdown, which would normally be expected to boost risk appetite, the equity market remained under pressure. Investors appear cautious due to mixed signals from the Federal Reserve, particularly regarding the potential for holding interest rates steady in December. Recent sharp gains in equities have also prompted some to question whether the market’s rally reflects sustainable economic fundamentals or signals a short-term bubble.

Looking ahead, upcoming U.S. economic data releases will provide greater clarity on the state of growth and corporate earnings. While short-term volatility and retracements are likely to persist, these fluctuations do not necessarily alter the long-term trend. Market participants will be closely monitoring policy signals and economic indicators to assess potential catalysts for the next leg of the market’s movement.

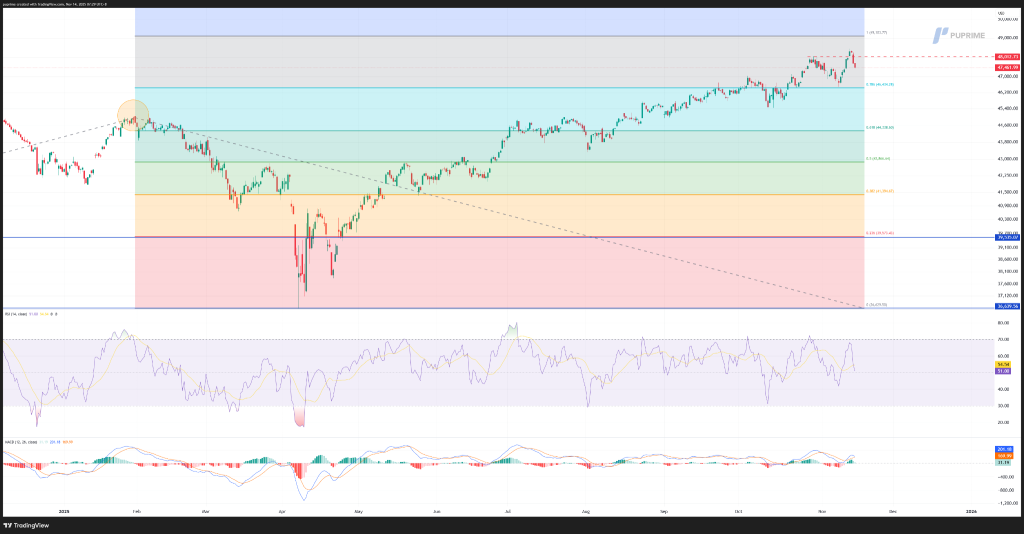

Technical Analysis

The Dow Jones Industrial Average (DJI) chart shows the index easing off from the 48,010 resistance zone after an extended climb throughout early November. The recent price action signals a short-term correction unfolding within a broader bullish trend, as the index pulls back toward the key 46,435 support area, which aligns closely with the 78.6% Fibonacci retracement of the prior upswing.

The strong bullish momentum that lifted the Dow from below 44,500 has started to moderate, with sellers stepping in near the recent high and forming a rounded-top structure. Price is now consolidating around the 46,435 level, creating an important decision point for market direction.

Momentum readings also point toward continued corrective pressure. The RSI has slipped toward mid-range levels near 45, reflecting cooling bullish strength but not yet signaling oversold conditions. Meanwhile, the MACD shows a bearish crossover with expanding negative histogram bars, indicating that short-term downside momentum is still in play.

Overall, the Dow remains in a controlled pullback phase after reaching a multi-week high, with the 46,435 support acting as the immediate pivot zone. Holding above this threshold may preserve the broader bullish structure, while a breakdown could trigger a more extended correction.

Resistance level: 48,010.00, 49,105.00

Support level:46,435.00, 44,340.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!