-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Topic Summary:

If you’ve ever wondered why the price of oil today isn’t the same as the price a few months from now, you’ve already brushed up against two of the most essential ideas in the futures market: Contango and Backwardation.

They sound complicated, but the concept is simple: the market values time.

A barrel of oil today isn’t worth quite the same as a barrel next June, and that difference tells you a lot about what traders expect from the economy, demand, and supply in the months ahead.

When futures prices sit above today’s price, that’s called contango.

When they sit below, that’s backwardation.

One point to plenty of supply and steady demand.

The other signals scarcity, urgency, or even a touch of panic.

Understanding these two curves helps you read what’s happening beneath the surface of commodity markets, whether you’re trading oil, gold, or natural gas CFDs.

Every futures contract is a bet on what something will cost later.

The spot price is what you’d pay today. The futures price is what buyers and sellers agree it’ll cost at a specific date in the future.

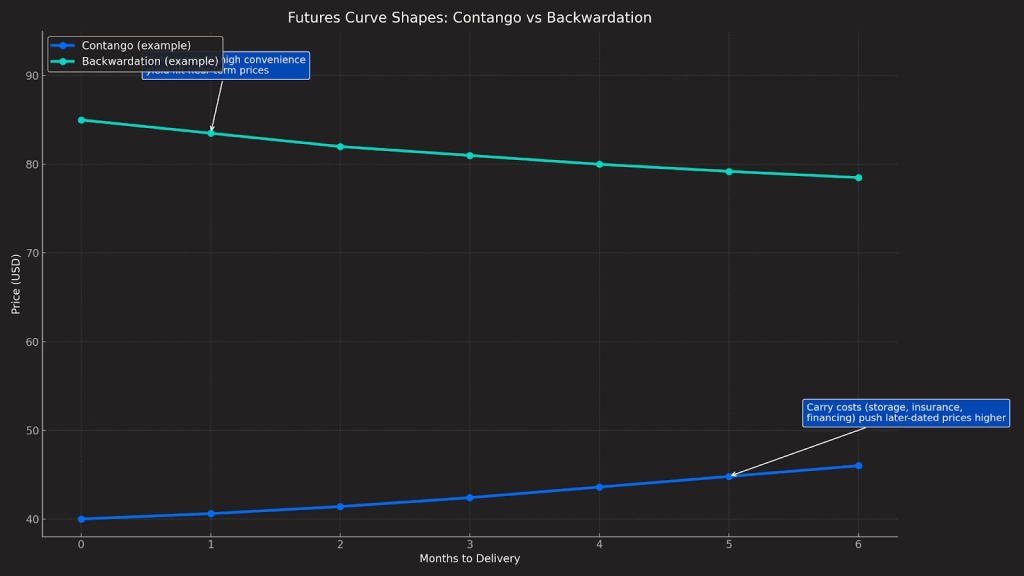

When you connect all those futures prices across different months, you get a futures curve: a line that shows how the market values time.

It’s like looking at a weather forecast for prices. A snapshot of expectations built from thousands of individual trades.

In contango, futures prices sit above the current spot price.

It’s the market’s way of pricing the cost of carry.

Everything that comes with holding a physical commodity for later delivery.

Think of oil in storage tanks or copper sitting in warehouses.

Holding it costs money: storage fees, insurance, financing, and even the interest you could’ve earned somewhere else.

Add all that up, and it makes sense that future contracts cost a bit more.

Oil is the textbook case.

When inventories are complete and refineries are relaxed, oil prices rise. The same goes for metals like copper or aluminium.

When production is steady and demand is soft, the market stays in contango.

In 2020, during the pandemic slump, oil demand dropped while storage filled up.

Futures prices for later delivery soared above spot, creating one of the steepest contango curves ever seen.

Backwardation is the opposite. Futures prices fall below today’s spot price.

That usually means buyers are willing to pay more to get the commodity right now rather than wait.

Backwardation often shows up in perishable or seasonal commodities.

Agricultural markets like wheat or coffee can flip into backwardation if bad weather damages crops.

In energy, it happens when demand spikes or refineries run short of supply.

Crude oil swung into backwardation in 2022 as supply disruptions and strong post-pandemic demand pushed near-term prices several dollars above later contracts.

| Feature | Contango | Backwardation |

| Futures vs Spot | Futures > Spot | Futures < Spot |

| Market Signal | Ample supply, low urgency | Tight supply, strong demand |

| Common Causes | Storage and financing costs | Scarcity, production issues |

| Typical Commodities | Oil, metals, gold | Energy, grains, perishable goods |

| Roll Yield Effect | Negative for longs | Positive for longs |

| Trader Implication | Costly to hold long positions | Favors short-term longs |

| Market Mood | Calm, well-supplied | Pressured, urgent |

Markets rarely stay in one state for long. Curves twist and reshape as conditions change.

A few significant forces drive those shifts:

For active traders, the shape of the curve directly affects returns.

When a futures contract nears expiry, traders either close it or roll it into the next month. The price difference between the two creates a roll yield, a significant performance factor.

Over time, these slight differences can add up.

There’s one reason two traders with the same idea can see very different results depending on how long they hold.

Understanding curve shape also helps with timing.

Either way, knowing where the curve sits gives traders context before committing capital.

Contango and backwardation don’t just affect active traders but also influence the performance of commodity ETFs.

Funds that roll futures each month face the same roll yield effect.

In prolonged contango, that drag can slowly erode returns.

It’s why some oil ETFs lag behind headline price gains: they keep buying more expensive contracts.

In backwardated markets, ETFs can benefit. Rolling into cheaper contracts adds incremental gains over time.

The takeaway? Even for passive investors, the curve is essential.

It shapes how closely an ETF tracks the commodity it represents.

Whenever prices drift too far apart, arbitrageurs step in.

They’re the traders who buy in one market and sell in another to lock in small, almost risk-free profits.

If a futures contract trades too high relative to spot, they can buy the commodity now, store it, and sell the futures, bringing prices back into alignment.

If futures trade too low, they trade in the opposite direction.

This process is what keeps futures and spot markets in sync.

It’s not perfect, but it’s a key reason prices eventually converge as contracts near expiry.

Arbitrage also plays a significant role in maintaining market efficiency.

Without it, futures prices could wander far from reality.

Instead, competition between traders constantly forces alignment.

When global demand collapsed and storage tanks overflowed, oil futures went into extreme contango.

On 20 April 2020, the WTI front-month even flipped negative as limited available storage and thin liquidity forced traders to unwind into expiry.

This showed how physical constraints can dominate pricing. (U.S. Energy Information Administration)

During drought years, crops like corn and soybeans often enter backwardation.

After the 2012 U.S. drought, the Corn Belt saw an “inverted” structure in which spot cash prices for corn and soybeans traded above nearby futures, as buyers paid up for immediate supply. (farmdoc daily)

Gold and silver rarely see backwardation, but when they do (usually during financial stress), it signals investors are willing to pay extra for immediate access rather than wait for delivery.

Contango and backwardation might sound technical, but once you see them on a chart, they make intuitive sense.

For traders, they’re part of the rhythm of the futures market.

Learning to read that rhythm helps you understand what’s really driving price moves and how to position yourself accordingly.

If you want to see these dynamics play out in real time, try PU Prime for yourself.

PU Prime gives you access to live market data, price charts, and analysis tools that make it easier to track curve movements as they happen.

Start exploring different trading accounts with PU Prime today.

What’s the simplest way to remember contango vs backwardation?

Contango means futures prices are higher than today’s spot price, usually due to storage or financing costs.

Backwardation is the opposite: futures are cheaper because demand for immediate delivery is strong.

Do these patterns predict price direction?

Not directly. Contango and backwardation show how the market is pricing time, not necessarily where prices are headed.

They’re more about sentiment and supply-demand balance than forecasts.

Why do oil and gas markets switch between the two so often?

Energy markets react quickly to changes in supply, storage, and demand.

A mild winter or production surge can create contango, while a cold snap or refinery outage can flip it into backwardation.

How does this affect CFD trading?

Since CFDs mirror futures prices, the curve shape affects holding costs and roll yield.

In contango, rolling forward can reduce returns; in backwardation, it can boost them.

How can I see if a market’s in contango or backwardation right now?

Most trading platforms, including PU Prime, show real-time price charts across contract months.

An upward slope means contango; a downward one means backwardation.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!