-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*Oil prices held near recent lows as weak U.S. growth prospects and political gridlock clouded demand outlooks.

*Easing Middle East tensions and expectations of an OPEC+ output hike further weighed on sentiment.

*Low distillate inventories offer limited support, but the near-term bias remains tilted to the downside.

Crude oil markets remain trapped in a delicate balance, with traders weighing growing macroeconomic headwinds against ongoing supply-side constraints. The bearish narrative has gained traction in recent weeks, as weaker U.S. growth prospects and the prolonged government shutdown threaten to dampen energy demand. Futures markets have reflected this shift, with both Brent and WTI spreads flipping into contango—a clear signal that traders expect near-term oversupply. The expectation of an OPEC+ output increase in November and rising U.S. production have reinforced this cautious sentiment.

Still, physical market tightness continues to provide an important counterweight. Distillate fuel oil inventories across North America remain at multi-year lows, particularly for diesel, sustaining a degree of fundamental support. This tightness is rooted in refining bottlenecks, maintenance disruptions, and elevated export demand, which together have limited downside pressure on prices. Analysts suggest that this supply imbalance may cap losses even if demand weakens further.

Geopolitically, the situation remains fluid. A fragile ceasefire between Israel and Hamas has temporarily eased regional risk premiums, but the broader Middle East remains unstable. Meanwhile, escalating U.S.–China tensions—marked by Beijing’s new export controls on key industrial minerals—pose additional uncertainty for global supply chains. These frictions could amplify volatility in energy and commodity markets in the months ahead.

Overall, crude oil is likely to remain range-bound in the near term, oscillating between macroeconomic weakness and structural supply tightness. Traders are closely watching OPEC+ policy guidance, U.S. inventory data, and broader risk sentiment for cues on direction. While downside risks persist amid slowing demand, any renewed supply disruption or geopolitical flare-up could quickly reprice the market higher.

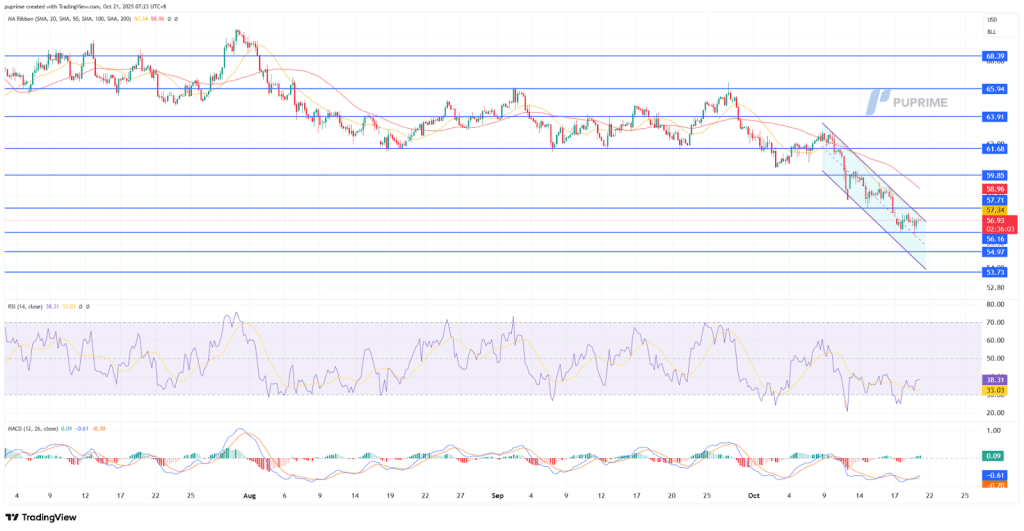

Crude oil remains under sustained pressure, extending its decline within a well-defined descending channel as sellers maintain firm control below the $58.00 handle. The broader downtrend structure remains intact, with price consistently trading beneath the 20- and 50-period moving averages both sharply sloping downward, reinforcing persistent bearish momentum.

From a momentum perspective, the RSI hovers around 38, reflecting limited buying strength and continued downside bias after repeated failed recovery attempts. Meanwhile, the MACD remains in negative territory, though the narrowing histogram hints at early signs of momentum flattening suggesting possible short-term consolidation before the next directional move.

Overall, the technical outlook remains bearish while oil trades below $58.00–$59.00. A sustained break above this zone could trigger a corrective rebound toward $61.70, but failure to reclaim it would likely keep the commodity vulnerable to further declines toward $56.15 and $55.00 amid weak risk sentiment and ongoing supply concerns.

Resistance Levels: 57.70, 59.85

Support Levels: 56.15, 55.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!