-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Key Takeaways:

*Sticky inflation hasn’t prevented markets from pricing in aggressive Fed easing, with political risks eroding the greenback’s safe-haven premium.

*Surging ETF inflows and falling U.S. real yields are powering bullion toward $3,500 as investors hedge against Fed credibility risks.

*Friday’s jobs report is pivotal: a weak print could cement September cuts and lift gold, while a strong reading risks delaying Fed action but won’t fully erase political headwinds.

Market Summary:

The U.S. Dollar Index (DXY) continued to edge lower this week as markets weighed firmer inflation data against weakening growth signals and mounting political uncertainty. July’s core PCE inflation climbed to 2.9% year-on-year, underscoring sticky price pressures. Yet, investors chose to emphasize evidence of economic cooling, from the Chicago PMI’s plunge to 41.5—the weakest since May—to subdued trade flows weighed down by tariffs and global supply chain disruptions. With Fed funds futures now pricing an 87% probability of a 25bps September cut, the greenback remains under pressure as investors anticipate pre-emptive easing to cushion growth.

Political risk has compounded the dollar’s woes. President Trump’s dismissal of Fed Governor Lisa Cook rekindled concerns about central bank independence, while an appeals court ruling against large portions of the administration’s tariff framework cast fresh doubt on policy continuity. These developments have shifted the narrative away from data resilience toward structural risks around U.S. governance, undermining institutional credibility and eroding the dollar’s safe-haven premium.

Gold, in contrast, has thrived on the same backdrop. Prices surged toward $3,440 per ounce as investors rotated into bullion, with falling U.S. real yields and dovish Fed expectations reducing the opportunity cost of holding non-yielding assets. Institutional demand has accelerated, highlighted by ETF inflows of nearly 15 tons in just two sessions—the strongest in months. Beyond inflation hedging, gold is increasingly viewed as a strategic shield against policy missteps and institutional fragility, with the Fed’s credibility under question.

Looking ahead, all eyes are on Friday’s U.S. Non-Farm Payrolls report. A downside surprise would likely cement September rate cut expectations, fueling further dollar weakness and clearing the path for gold to retest the $3,500 record high. Conversely, a strong print could delay the Fed’s hand and cap bullion’s near-term rally, though political headwinds may continue to undermine dollar sentiment regardless of economic resilience. In this environment, the dollar’s trajectory hinges not just on inflation and growth, but also on confidence in U.S. institutions while gold benefits directly from any cracks in that confidence.

U.S. Dollar Index (DXY) is trading near 97.75 after retreating from the 98.10 zone, holding just above immediate support at 97.65. The index is hovering slightly below the 20-period moving average, while the 50-period MA around 98.00 is acting as a key pivot level.

Momentum signals remain cautious. The Relative Strength Index (RSI) is at 39, reflecting a mild downside bias but not yet oversold. The MACD stays in negative territory, hovering below the zero line, indicating persistent bearish momentum though without strong acceleration.

On the upside, a decisive move above 98.10 would shift focus back to 98.75 and open the door toward 99.50 if buying interest builds. On the downside, a clear break below 97.65 would further weaken, potentially dragging the index toward the 97.10 zone.

Resistance levels: 98.10, 98.75

Support levels: 97.65, 97.10

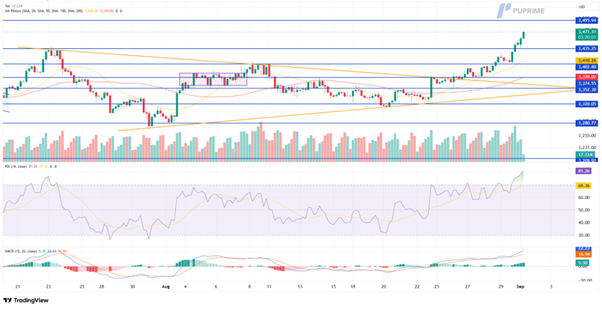

Gold (XAU/USD) is trading near $3,471 after extending its rally above the $3,435 and $3,460 resistance zones, with price momentum accelerating toward the next key barrier at $3,495. Immediate support now lies at $3,435, followed by $3,400, as prior resistance levels begin to act as floors in the short term.

Momentum indicators remain strongly bullish but are flashing early signs of exhaustion. The RSI has surged to 81, deep in overbought territory, highlighting the risk of a corrective pullback if buyers lose steam. Meanwhile, the MACD is firmly in positive territory, with widening histogram bars confirming strong buying pressure, though momentum may be stretched.

Overall, XAU/USD stays in a powerful uptrend above $3,435, with bulls eyeing a push toward $3,495 and potentially $3,520 if momentum persists. However, the overbought RSI suggests near-term consolidation or a dip back toward $3,435 cannot be ruled out before the next leg higher.

Resistance levels: 3495.00, 3520.00

Support levels: 3435.00, 3400.00

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!