PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

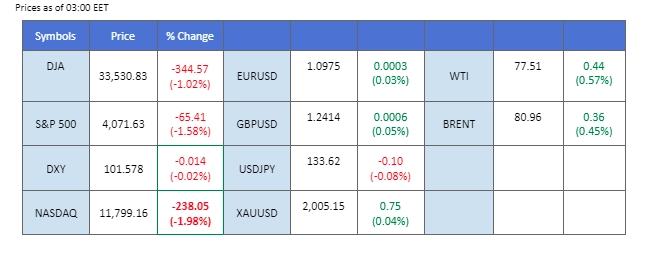

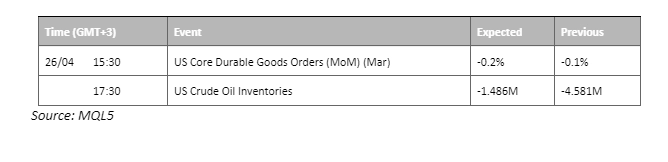

First Republic Bank’s disappointing first-quarter results with a significant plunge in deposit levels, had raised concerns about the bank’s financial health. This triggered a risk-off sentiment, driving the CBOE Volatility Index to new highs while the US Dollar gained on the back of strong housing data. US Building Permits and New Home Sales outperformed expectations, but the Conference Board’s consumer confidence index dropped to its lowest point since July 2022, which limited the US Dollar’s gains. Oil prices fell due to mounting worries about the economic slowdown and the rate hikes expectations for the major central banks.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

25 bps (23.3%) VS 50 bps (76.7%)

The safe-haven US Dollar gained as robust housing data offered some reprieve, indicating that the rising rates environment in the United States is yet to deliver a crippling blow. Data from the Census Bureau revealed that US Building Permits and New Home Sales outperformed expectations, coming in at 1.430 million and 683,000, respectively, surpassing forecasts of 1.413 million and 630,000. Despite the positive data, the Conference Board’s consumer confidence index took a hit, plunging to 101.3, its lowest point since July 2022. This tepid consumer sentiment weighed on the US Dollar, limiting its gains in the market.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 102.25, 103.00

Support level: 101.45, 100.85

A slew of lacklustre financial reports from corporate America had stoked a shift in sentiment toward safe-haven assets, gold prices continuing to stand on its ground. Investors’ anxiety in the banking sector was reignited by First Republic Bank’s dismal first-quarter results, which saw the lender’s deposit level plummet by a staggering $104 billion from the previous year, significantly exceeding the anticipated $40 billion decline. The hefty drop in deposits is poised to deal a severe blow to the bank’s financial health and operational capacity.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2000.00, 2025.00

Support level: 1975.00, 1945.00

On Tuesday, the Euro experienced a significant drop of 0.75% against the U.S. dollar, reaching $1.0975. This decline was driven by investors’ increasing preference for safe-haven assets, causing a shift in money away from riskier investments. Renewed concerns over the stability of the U.S. banking sector and economy also impacted the market sentiment. These factors led investors to turn towards the U.S. dollar, which was seen as a more secure currency.

Traders may be taking profits on their long positions in EUR/USD, contributing to the downward movement in the pair. Furthermore, the MACD has shown a decline in bullish momentum, suggesting a possible reversal in the trend. The RSI is currently at 45, indicating a diminishing bullish momentum ahead.

Resistance level: 1.1075, 1.1168

Support level: 1.0924, 1.0790

The New Zealand Dollar has been grappling with a series of bearish headwinds in the wake of the latest economic data release. According to figures from New Zealand Statistics, the headline Trade Balance plummeted to a disappointing $-1,273M MoM in March, representing a significant drop from the previous reading of $-796M, compounding concerns about the country’s economic outlook. Adding to the Kiwi’s woes is the escalating risk-off sentiment sweeping the global financial markets. Fears of the banking crisis were further stoked by the announcement from First Republic Bank, which revealed a pessimistic financial report that caused the share price to plummet by almost 50%.

NZDUSD is trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 38, suggesting the pair might extend its losses after successfully breakout since the RSI stays below the midline.

Resistance level: 0.6180, 0.6280

Support level: 0.6130, 0.6095

The pound fell on Tuesday as nervousness over the global economy gave the dollar an edge. The U.K. recorded a budget deficit of £21.53bn in March, above economists’ expectation of £20bn, and the fourth-highest borrowing for a financial year since records started. On Tuesday, sterling was trading down 0.58% against the dollar at $1.2414. Despite being one of the strongest performing major currencies against the dollar this year, investors might have overestimated the further tightening the Bank of England may have to do. Money market rates show traders believe there is a 99% chance the BoE will raise interest rates by a quarter of a point in May to 4.5%.

The MACD is trading at the zero line, which suggests that the trend may be reversing or consolidating. The RSI is at 43, indicating diminishing bullish momentum ahead.

Resistance level: 1.2455, 1.2545

Support level: 1.2370, 1.2262

The Dow Jones Industrial Average plummeted on Tuesday amid many lacklustre financial reports from corporate America that have eroded risk appetite in the US equity market. Investor anxieties in the banking sector were reignited by First Republic Bank’s dismal first-quarter results. The lender’s deposit level was found to have plummeted by an astonishing $104 billion from the previous year, significantly exceeding the anticipated $40 billion decline. Consequently, First Republic Bank shares nosedived by a staggering 50%, hitting an all-time low and precipitating a ripple effect throughout the equity market.

The Dow is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the pair might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 34263, 35520

Support level: 33233, 32238

Oil prices took a nosedive, plunging 2% to hit their lowest point this month, putting an end to two consecutive sessions of gains. This slump was caused by mounting concerns over a possible economic slowdown, coupled with a resurgent US Dollar. Despite hopes of China’s oil demand picking up, a stronger US Dollar has made the commodity more expensive for buyers holding other currencies, thereby exerting downward pressure on demand.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the commodity might extend its losses after it successfully breakout below since the RSI stays below the midline.

Resistance level: 79.70, 82.55

Support level: 76.95, 73.75

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!